In times when customer experience is the topmost priority for any industry, can cloud computing act as a catalyst to transform the way the banking sector operates?

Updated 25 January 2024

Global Delivery Head at Appventurez

With over 90% of large enterprises already adopting a multi-cloud infrastructure, it won’t be wrong to say that we all are surrounded by the ‘cloud.’ Even 44% of traditional startups and SMEs have also implemented cloud computing technology and hosting services into their systems.

However, at this time when almost the entire market is relying on cloud services to fulfill their data-related needs, the banking sector seems to be lagging. And it might be disappointing but this indecisiveness in adapting to digital transformation can profoundly impact the customer experience in this sphere.

But why is it a matter of concern for the banking and finance sector?

Well, according to a report by Forrester, retail banks that focus on customer experience optimization prosper 3 times faster compared to the ones that don’t. Living in times when consumers want everything at their fingertips, avoiding cloud computing in banking and relying on traditional working models can impact their experience adversely.

It clears one thing; integrating cloud computing in the banking sector has become more important than ever. But how and where to start? Let’s get an idea through this blog.

Do you remember Deep Blue, IBM’s supercomputer with the capability to play chess, that beat Garry Kasparov, then the ruling world champion? It was 26 years ago when this unusual incident took place. Many people couldn’t believe a machine defeating a human in a chess game that is too complex for the former. However, it was also one of those apparent moments that proved how a machine, with the power of AI, big data, and computation, can outsmart humans.

Cloud computing has been there for a very long time. However, now it has become far more than just a technology; it turned out to be a one-stop solution for industries, offering them advanced services to store and access data. Most businesses support cloud-based solutions for the capabilities to process massive amounts of data and provide them with advanced analytical methods.

Despite this potential of cloud services, the benefits of cloud computing in banking sector is still lagging. Most banks and financial institutions find it extremely challenging to stop using their on-premise apps. However, there are still a few exceptions, such as Capital One, which shifted to the cloud and closed all of its on-premise data centers. Moreover, by overcoming security concerns, the day isn’t far when cloud adoption in banking will become the new normal.

Being a kind of on-demand service, cloud computing, in general, provides users with access to shared applications and resources over the Internet. With this technology, banks and other financial institutions can store and manage data on remote servers instead of local storage.

Currently, most financial companies that leverage cloud computing rely on external cloud service providers or outsourcing solutions. However, according to Gartner, this trend is changing as several large banks are about to shift (or have already shifted) to multi-cloud.

By understanding the value of cloud computing capabilities, leading firms in the banking sector have now started considering the cloud as their data storage and processing partner. They realize how leveraging cloud computing in banking can help them accomplish their business goals while meeting their customers’ expectations simultaneously.

Here are some benefits of cloud computing in banking sector that improve the performance of financial institutions in several ways:

Like any other industry, the banking sector also needs advanced analytics methods to get insights into trends related to customer behavior. These insights provide banks with crucial information regarding how their customers usually interact with financial services and products.

By leveraging cloud computing in banking, the financial sector can also make changes in their processes and provide their customers with the services that they expect. Moreover, with cloud solutions, users can access major banking services from anywhere, anytime, improving the customer experience to an optimum level.

Data security has always been the primary concern for the entire banking industry. It is also one of the prominent reasons why the financial sector felt (and still feels) reluctant to use the cloud over on-premise applications.

However, technological advancements have optimized cloud computing services, making it a security-first approach. With enhanced integration of cloud computing in banking sector, the user data stays safe under multiple layers of protection against cyber attacks and breaches. Moreover, the state-of-the-art technology used in cloud computing today can analyze a big pile of data from numerous sources to detect fraud and suspicious activities before they cause any harm.

Still, to ensure that the purpose is served, it is essential to pick a cloud computing service that offers:

Besides storing and processing data, cloud computing in banking help them in improving their overall operational performance and efficiency. Once you integrate the right solutions, you can avail of the following cloud computing benefits for banks:

Cloud computing in banking sector follows the pay-as-you-go approach, which means paying only for the specific services financial and banking institutions want. It makes the operational expenses more manageable.

Moreover, since you are not required to install heavy software or hardware equipment, the cloud computing cost for banks is relatively low and affordable. In addition to this, when the banking portals are hosted on the cloud, financial institutions can enhance their uptime while lowering their fixed and variable investments.

As per a survey conducted by Unitrends, almost 84% of businesses use cloud solutions to store and back up their data. But do you know why?

Well, with cloud computing, banking, and financial institutions get

Furthermore, incorporating cloud computing in banking also helps the financial sector to understand and overcome the major challenges in business. And that’s not it. It also assists companies and banks in recovering and backing up data at the minimal costs possible. In a nutshell, the role of cloud computing in the financial sector is eminent in making it future-ready.

By replacing physical IT infrastructure setup with cloud computing, energy consumption and greenhouse gas emission levels can be lowered. Moreover, using the cloud for computing services reduces idle time, making it more productive for businesses.

Cloud services offer companies with flexible business models that increase working efficiency while minimizing operational costs. However, when it comes to the banking sector, finding the right cloud computing model for financial services can vary according to the needs of a particular organization.

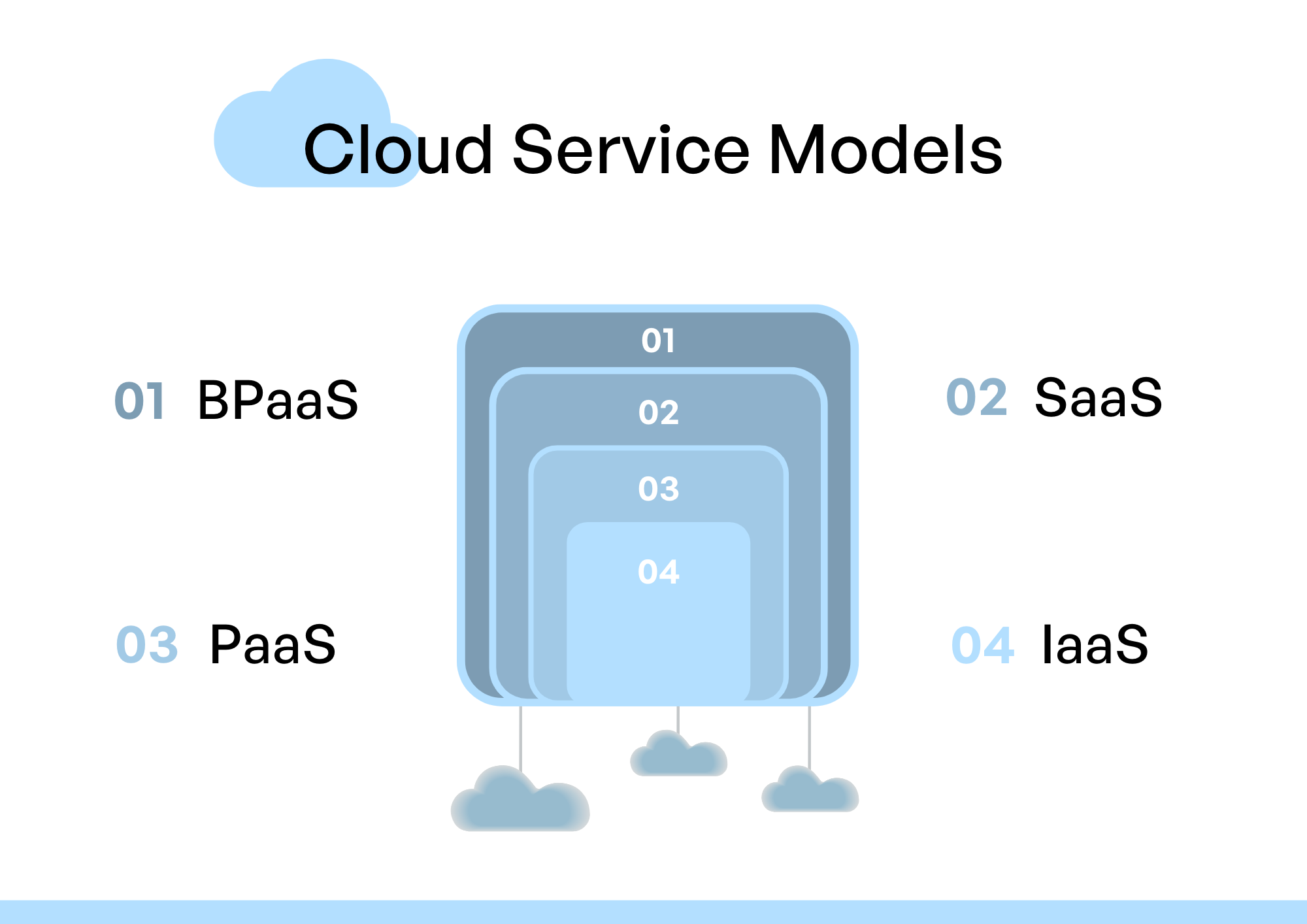

Specifically, to choose the right cloud computing model, cloud services offer three major options to banking organizations:

The following section highlights all three of them along with their subcategories.

BPaaS is primarily used for standard business operations, like managing payroll, billing, or human resources. With proper process expertise, you can also combine other cloud services in this model.

SaaS is one of the most popular cloud computing models used in various industries to accelerate productivity. It mainly consists of business software developed as per the requirements of a specific enterprise with its related data that is easily accessible by the users on their browsers. Here are some of the SaaS-based products and services include:

This type of cloud service model offers users a platform to develop apps, interfaces, databases, storage areas, and testing units. The primary objective of this model is to streamline the development process and provide them with complete maintenance and support services while minimizing the costs and usage of resources.

This cloud computing model for financial services allows business owners to incorporate a fully featured outsourcing service structure offering various resources, such as software, data centers, servers, network tools, etc., instead of purchasing them.

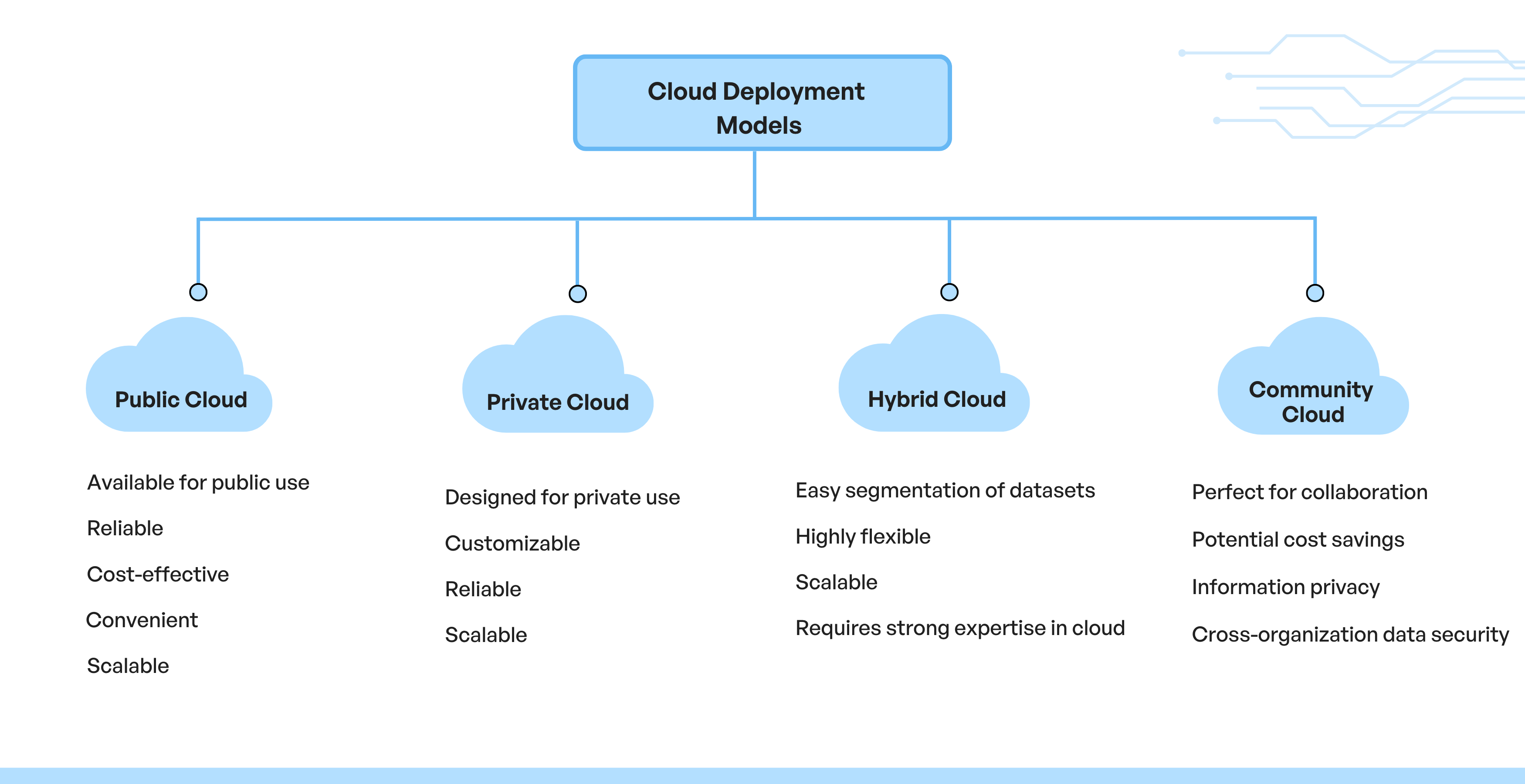

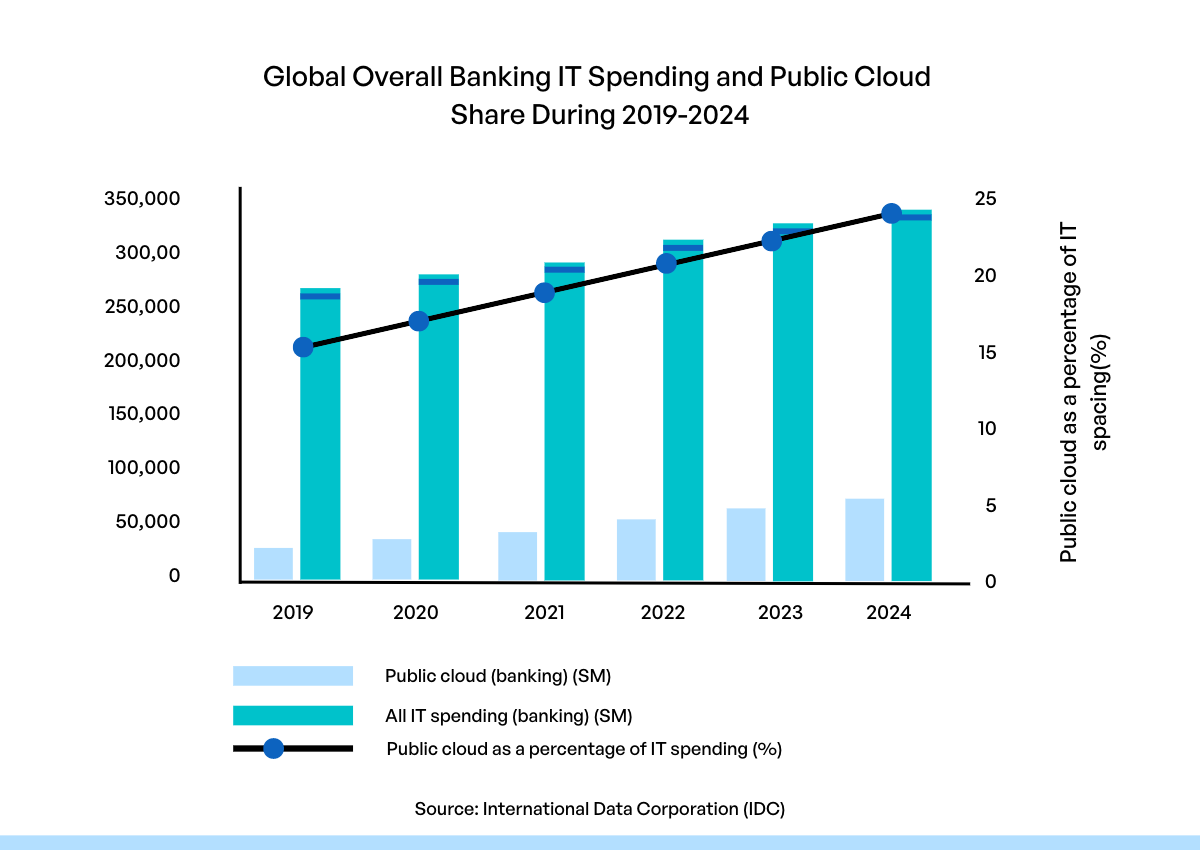

This kind of cloud infrastructure is owned by the companies offering cloud services and is accessible by the entire banking sector and the general public. If banks are seeking economies of scale, this can be a preferable option. The following illustration describes global banking IT spending and public cloud share during the forecast period of five years (2019-2024).

The most popular public cloud service providers include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and IBM Cloud.

As the name suggests, this type of cloud deployment model is developed solely for a specific bank and is primarily managed by the bank itself or a third-party organization working from premises. Mostly, banks and other financial institutions are recommended to use this type of cloud infrastructure as it gives them more authority and flexibility.

Since this cloud computing model for financial services is deployed within the organization’s boundaries, it mitigates the risks of data breaches and fraud. This cloud deployment model is further divided into two subcategories:

A hybrid cloud is a combination of both private and public clouds which is generally used for a single specific business. It is a single IT ecosystem built from several other environments linked via virtual private networks (VPNs), local area networks (LANs), and wide area networks (WANs) or APIs.

The characteristics of a hybrid cloud can vary from business to business. Typically, hybrid clouds can include:

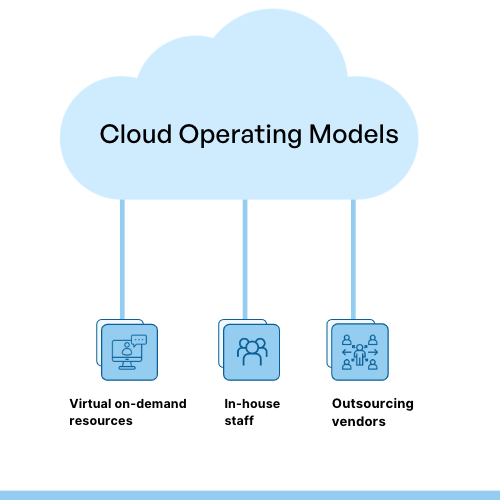

This model includes a dedicated group of on-demand resources and support centers that help financial institutions with their cloud operations.

In this model, banks and financial institutions hire people with expertise in cloud computing as an in-house team. All the operations are managed internally which offers greater flexibility, especially while fulfilling demands in real time.

In this model, banks leverage off-shore services and outsource most of their operations. The resources hired in this model mostly cater to multiple financial institutions simultaneously.

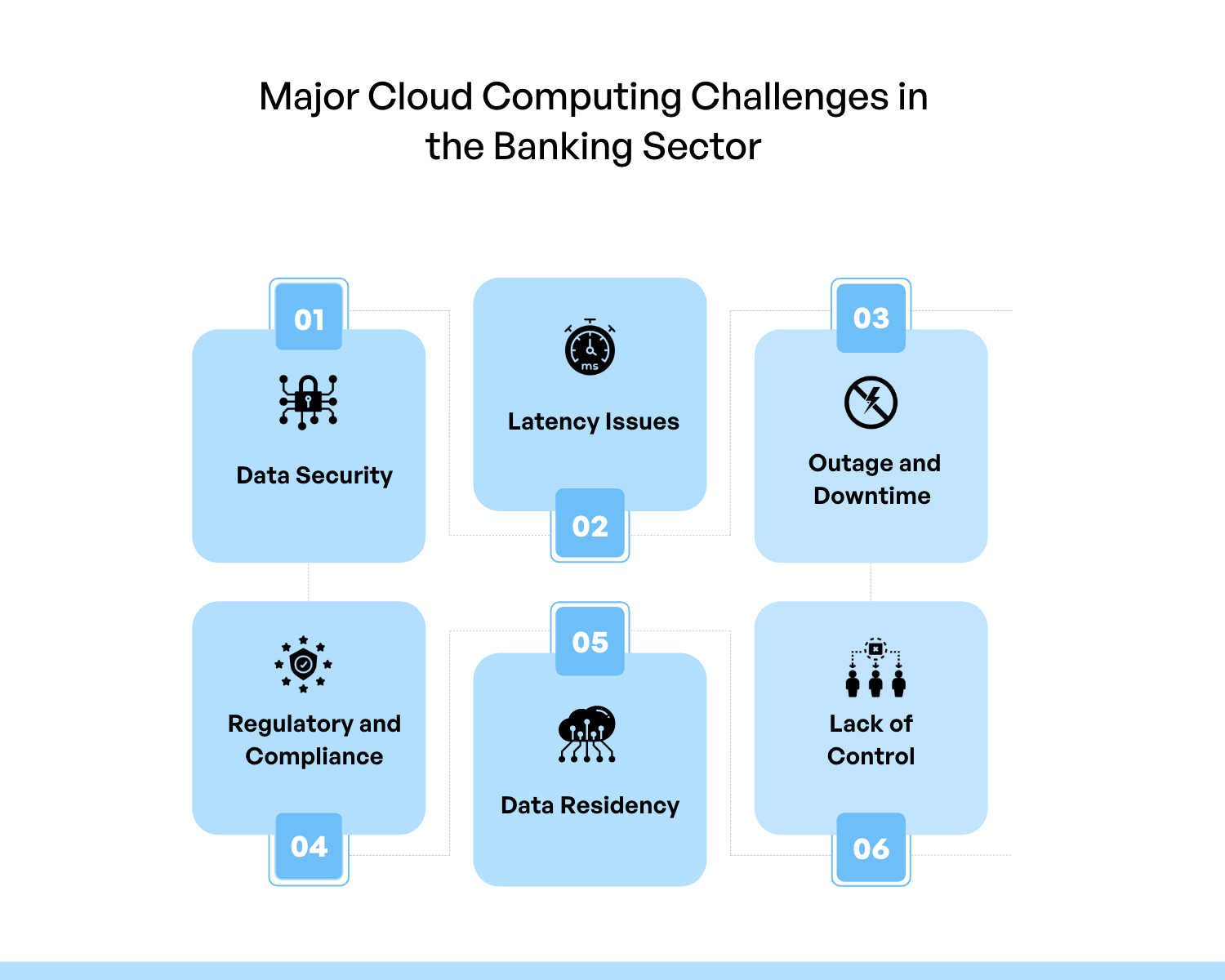

Although the future of cloud computing in banking seems bright, shifting to the cloud isn’t a walk in the park for banks and other financial institutions. There are a plethora of roadblocks that obstruct them from integrating cloud computing services into their systems. The following section will highlight the major cloud computing challenges.

Everything comes with its good and bad, and cloud adoption in banking is no different. Although cloud computing in banking enhances the operational efficiency of financial institutions, data stored on cloud servers is easily prone to cybercriminal activities. If advanced and robust security measures are not taken, intruders can easily cause impactful damage.

Latency is one of the most common issues that can be exasperating for anyone. In the cloud-based banking sector, the physical distance between the cloud service provider and the data center can be the major reason for latency. Any delay in banking operations, such as card authorization or payment transfer can impact the performance of the entire system. Consequently, it can hurt customer experience and satisfaction.

Although the instances of data outage and downtime in cloud-based systems are relatively less compared to conventional IT infrastructure, they still happen. The bigger problem is that the impact of such situations is comparatively high in cloud outages, as the systems become vulnerable to cyber-attacks. Moreover, longer downtime can throw the banking sector in dire straits.

There is a certain set of protocols and regulations in the financial industry that banks need to comply with. These regulations include specific procedures to manage customer data. However, when banks host their systems in the cloud, it becomes quite challenging to meet all the compliance requirements.

The issue of data ownership is another common challenge that financial institutions often face when they host data on cloud servers. Regulatory compliances added by the government make banks face limitations on where the data could be stored.

There is always a fear among banking and financial institutions of losing some degree of control over their systems when data and services are linked to cloud servers.

To cope with the challenges of cloud computing in banking industry, banks must choose the right and desirable cloud models that are compliant with data security concerns.

Risk management is crucial for all kinds of businesses, and the banking industry needs to be extra careful as they are easily prone to risks. In one of their insightful reports, McKinsey has specifically mentioned that banks should always be prepared for the risks to function efficiently. Here are some of the risks that the banking industry often faces:

There’s always a risk that financial institutions might violate certain regulatory policies followed in a particular location or jurisdiction while providing services to customers. If such situations happen, the regulatory authorities can impose fines or penalties, or even revoke charters and cancel the license of the particular organization.

Regulatory risks are often common in cloud-based banking systems because in several cases, their operations do not comply with the local rules and regulations followed in a specific jurisdiction or country.

Sometimes, consumers often post negative reviews and criticize the services of financial institutions through traditional media, such as magazines or newspapers. These practices can damage the reputation of banks and financial organizations in the digital medium, as well.

Operational Risks generally lead to financial losses. They could happen from insufficient control over the internal processes within the companies operating in the banking sector. For example, the occurrence of any technical glitch in the cloud while handling customer transactions can result in unauthorized access to intruders, who might steal sensitive user data.

Similarly, technological failures can cause downtime, impacting the customers attempting to access their accounts digitally.

By using cloud computing capabilities efficiently, banks can easily mitigate these risks. However, to do that, it’s crucial to understand the different types of risks and what impact they can have on the operations and performance of financial institutions.

Therefore, banks need to implement a robust risk management system that can identify risks and suggest methods to cope with them. Besides that, the banking sector can:

There’s no doubt that cloud adoption in banking has been slow lately; however, the time is changing. According to a study by Deloitte, in the last few years, a threefold growth in the number of banks and other financial organizations adopting the cloud has been observed. Here are some of the prominent cloud computing banking use cases.

The instances of cloud computing in banking highlighted above indicate a significant shift in the industry’s landscape in the years to come. Given the dynamic nature of the business environment, it’s prudent to stay well-prepared for any challenges that may arise. This foresight is particularly crucial for a finance app development company, as it navigates the evolving terrain of the banking sector.

If you’re considering transitioning from on-premise applications, Appventurez, as a dedicated cloud app development company, is poised to assist you. Through our expert cloud app development services and a customer-first approach, we can facilitate the digital transformation of your business, positioning it strategically for long-term success.

Q. Which cloud service provider is most popular among banks?

All cloud service providers have their own merits and demerits. Some banks like Amazon’s cloud service, while others prefer Microsoft’s Azure. Cloud computing services by Google and IBM are also widely popular options. However, several financial institutions still feel reluctant to adopt cloud computing in banking anyway. Therefore, it mostly depends on the requirements of the financial institutions and the features offered by a specific cloud partner that makes the latter popular among others.

Q. What are the different types of cloud computing in banking?

There are primarily four cloud computing types that the banking industry can avail of — Private, Public, Hybrid, and Multi-cloud. When it comes to cloud service models, there are SaaS, PaSS, IaaS, and BPaaS.

Q. What are the advantages of using cloud computing in banking?

Cloud computing in the banking sector can help banks improve scalability and flexibility, reduce operational costs, enhance business continuity, and increase data security.

Elevate your journey and empower your choices with our insightful guidance.

Global Delivery Head at Appventurez

Ashish governs the process of software delivery operations. He ensures the end product attains the highest remarks in qualitative analysis and is streamlined to the clientele’s objectives. He has over a decade of experience as an iOS developer and teams mentorship.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.