Understanding the nuances of custodial vs non custodial wallets is imperative for businesses, especially when one is more secure while the other is more convenient.

Updated 28 March 2024

CTO at Appventurez

The world is rapidly evolving in terms of how it perceives money. Different ways are available to diversify its capabilities, and one of the most lucrative ones is cryptocurrency.

After purchasing cryptocurrency, choosing between a custodial and non custodial wallet is first and foremost. The two wallets primarily differ based on the control of your private keys. However, businesses can use a specific type of wallet for different purposes and requirements.

Picking one from a custodial vs non custodial wallet can be challenging without appropriate knowledge and expertise. You can consult a professional blockchain app development company specializing in cryptocurrency wallets. Besides, you can also get insights into both types of cryptocurrency wallets.

This blog highlights the benefits, drawbacks, and comparisons of a custodial wallet and a non-custodial wallet, helping you decide the one suitable for your business.

Before delving into custodial and non custodial wallets, let’s first understand what crypto wallets are. So, a crypto (or cryptocurrency) wallet is a software program that helps store and track private and public keys. These wallets facilitate connections between these keys and the blockchain networks, allowing users to access, manage, send, and receive cryptocurrencies.

Whether you obtain your cryptocurrencies by buying, exchanging, or receiving them in the form of payment, it’s crucial to have a secure wallet to manage them. These wallets create a unique address for users that helps them identify on a specific blockchain.

For businesses in the fintech sector using blockchain in banking services, crypto wallets can play a significant role. Moreover, their popularity on the global scale has rapidly increased, as well. It is reported that the global market size of crypto wallets is projected to reach the $13.38 billion mark by 2024, almost double from what it was in 2021.

Also, since the global crypto user base had reached over 576 million users in 2023, there is no doubt that the number of crypto wallets will increase more speedily. To understand these wallets more comprehensively, let’s take a deeper look at custodial vs non custodial wallets.

As the name suggests, this type of cryptocurrency wallet requires a ‘custodian’ or a third party that stores the user’s private keys. These third parties have complete control and rights over your crypto assets. It means they can perform functions, such as authorizing transactions, managing wallet keys, and securing your digital assets.

An individual can obtain a custodial wallet through crypto exchanges or a well-built NFT marketplace. Additionally, designated providers well-versed in blockchain solutions and the NFT marketplace development process can also help you get a custodial crypto wallet. Some of the popular custodial wallet examples include Freewallet, Coinbase, Binance, etc.

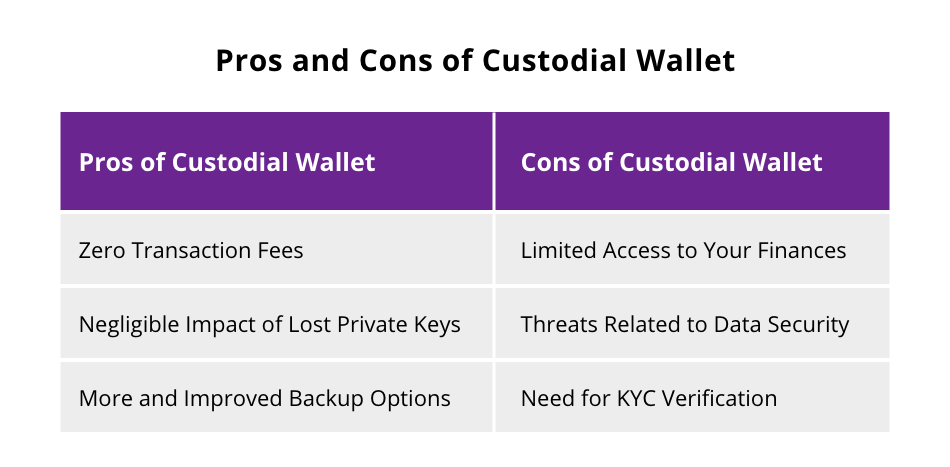

To understand the nuances of a custodial vs non custodial wallet, it’s important to know the benefits and drawbacks of both.

One of the significant benefits of custodial wallets is that they incur zero transaction charges. Unlike other types of wallets, users can easily transact in the system with no additional fees. One of the notable examples is Freewallet, a custodial wallet crypto solution that helped users save around $500K in terms of network fees in 2019.

A third-party services provider manages your private keys. So, if you lose them or forget your mnemonic phrase, regaining access to your custodian wallet and getting a refund wouldn’t be challenging.

One of the best things about custodian wallets is the availability of backup features and options. It means any transaction can be undone and restored to the previous version by requesting the central authority.

The first drawback of using a custodial cryptocurrency wallet is that you have limited access to it. Since they manage your entire account including your funds, there is negligible to no autonomy over your wallet. As a rightful custodian, they can perform tasks such as tracking your assets or freezing your stored amount.

In custodial vs non custodial wallet exchange, the first time you purchase your cryptocurrency using a custodial wallet will possibly end up in the exchange crypto wallet. In such a scenario, the exchange becomes your custodian. Thus, it is important to have a reputed custodial wallet partner so that the exchange stores your funds in cold hardware wallets which are highly secure against data breaches.

Another significant drawback of a custodian wallet is that it asks users to do KYC verification, violating the fundamental principle of anonymity in cryptocurrencies and blockchain for businesses.

A non-custodial wallet is a type of crypto wallet where the crypto owner has complete authorization over their funds. In this case, the user controls their entire crypto portfolio, makes transactions independently, and manages their own private keys.

Various types of non-custodial wallets are available in the market, such as browser-based wallets, hardware wallets, etc. These wallets provide users with a seed phrase — a unique set of 12 randomly generated words serving as a cloud-based recovery mechanism.

These words are crucial as users can use them to generate public and private keys essential to manage transactions. Once lost, this seed phrase cannot be retrieved and users will lose access to their funds permanently. Some popular non custodial wallet examples include Electrum, Exodus, Ledger Nano X, etc.

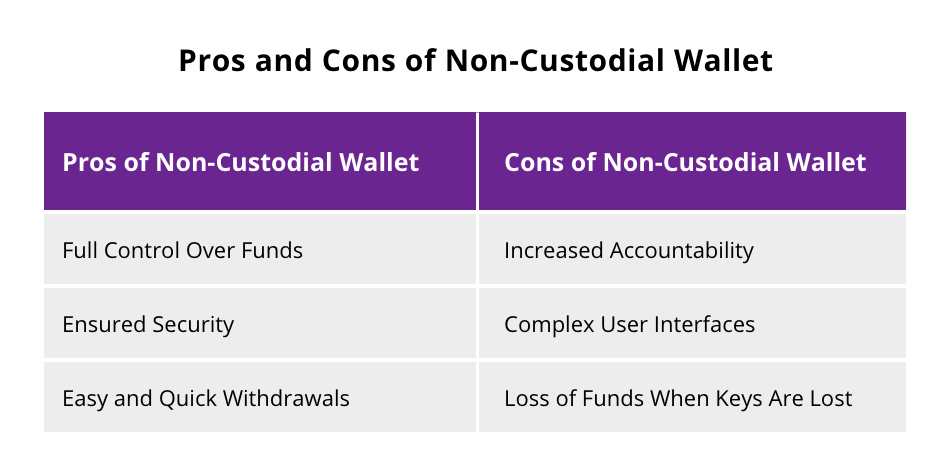

Like custodial wallets, non-custodial ones also have their own set of benefits and drawbacks. Below are the significant pros and cons of a non-custodial wallet.

One of the major benefits of a non-custodial wallet that drives its popularity is its ability to give users complete control over their funds. With this, you no longer need to rely on third-party service providers for managing your finances.

With complete ownership of one’s own crypto wallet and no accessibility to any outside party, the chances of data breaches and cybersecurity challenges are significantly reduced. That’s one of the major reasons why over 66.5% of crypto wallet holders prefer this type of wallet in custodial vs non custodial wallet options.

Non custodial wallets do not require permissions and authorizations from any third party, leading to simpler and instant withdrawals.

Since the users are accountable for their own wallet’s security, it turns out to be a great deal of responsibility for them. Even the slightest of mistakes can result in significant challenging consequences.

In a non custodial wallet, there are a lot of features that are often structured in a cluttered way. These hard-to-navigate user interfaces sometimes become trickier to comprehend.

The biggest challenge with non-custodial wallets is that losing your private key can make you lose access to your account data and stored cryptocurrency forever. There is no way to restore your account in such a case.

Now, since you have got an understanding of both types of crypto wallets, let’s compare them side-by-side. Below is the detailed comparative analysis of custodial vs non custodial wallets.

| Comparative Parameters | Custodial Wallet | Non Custodial Wallet |

|---|---|---|

| Custody of the private key | Third-party service providers manage the private key | Users hold and manage the private key themselves |

| Security | Considered less secure than non custodial wallets | Exclusive control in the hands of users makes them more secure |

| Usability | Typically easier to use since technical requirements are managed by the third party | Using and understanding all the functionalities make them comparatively hard to use |

| Control over wallet | Control over cryptocurrency resides within the third-party | Complete control over funds is in users’ hands |

| Transaction type | Transactions are not reflected on the chain in real-time | Transactions are reflected on the chain in real-time |

| Recovery and Backup | Backup and recovery is possible even when you lose your private key | Since you are the sole authority, once the private key is lost, it can’t be recovered |

| Cost and charges | There are associated costs when it comes to custodial wallets | Non custodial wallets are generally free to use; need to pay only for premium features |

| Offline accessibility | Need internet connectivity to access them | Almost all services can be accessed offline and in real-time |

If you have made it to this point, you might have got an understanding of both custodial and non custodial wallets. Now, when it comes to choosing one from a custodial vs non custodial wallet, the ideal choice will completely depend on individual preferences and end goals.

Want a highly secured crypto wallet? Go for the non-custodial one. Looking for an easy-to-use and convenient option, custodial wallets are the ones you should consider. Both types of wallets have their own pros and cons which we have already discussed in this blog.

However, if you still need assistance with picking the right crypto wallet for your business, Appventurez is here to help. We are a custom software development company that not only provides consultation regarding cryptocurrency but also builds robust blockchain-powered wallets.

Besides, our blockchain developers are also well-versed in delivering seamless NFT development services to tokenize your digital assets. Our immutable blockchain solutions ensure the secured upkeep of your data while enhancing your business productivity.

Q. What is the difference between a custodial and non custodial wallet?

The major difference between the two cryptocurrency wallets is that with a custodial wallet, some other party accesses and manages your private keys. The case is totally opposite when it comes to non-custodial wallets.

Q. What is a custodial wallet example?

Binance is one of the most popular examples of custodial wallets. Besides that, BitMex, Freewallet, and Bitgo are other notable names in this category.

Q. What is an example of a non custodial wallet?

MetaMask is a popular non custodial wallet example. Apart from this, Exodus, Electrum, Trezor One, Ledger Nano X, Zengo, and Wasami are some other prominent examples of non-custodial wallets.

Elevate your journey and empower your choices with our insightful guidance.

CTO at Appventurez

CTO and Co-Founder at Appventurez, Sitaram Sharma has 10+ years of experience in providing world-class digital solutions. As a CTO, he brought his expertise ranging from product enhancements to advanced technological integrations, while focusing on the consistent growth of the team.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.