In this digital era, we are surrounded by trillions of devices. They are enhancing our way of living through advanced measures. From IoT-based devices to cloud-based platforms, we have seen a steep rise in the development of new technologies.

Updated 23 January 2024

VP – Pre Sales at Appventurez

In this post, we are going to talk about top digital wallet trends that are going to embrace the way of doing secure transactions.

Nowadays users carry cash in both physical and digital forms. And with the increase in mobile apps, the preference to select digital wallets is also increasing rapidly. Utilizing these resources has laid a secure platform for users to experience convenient payment options.

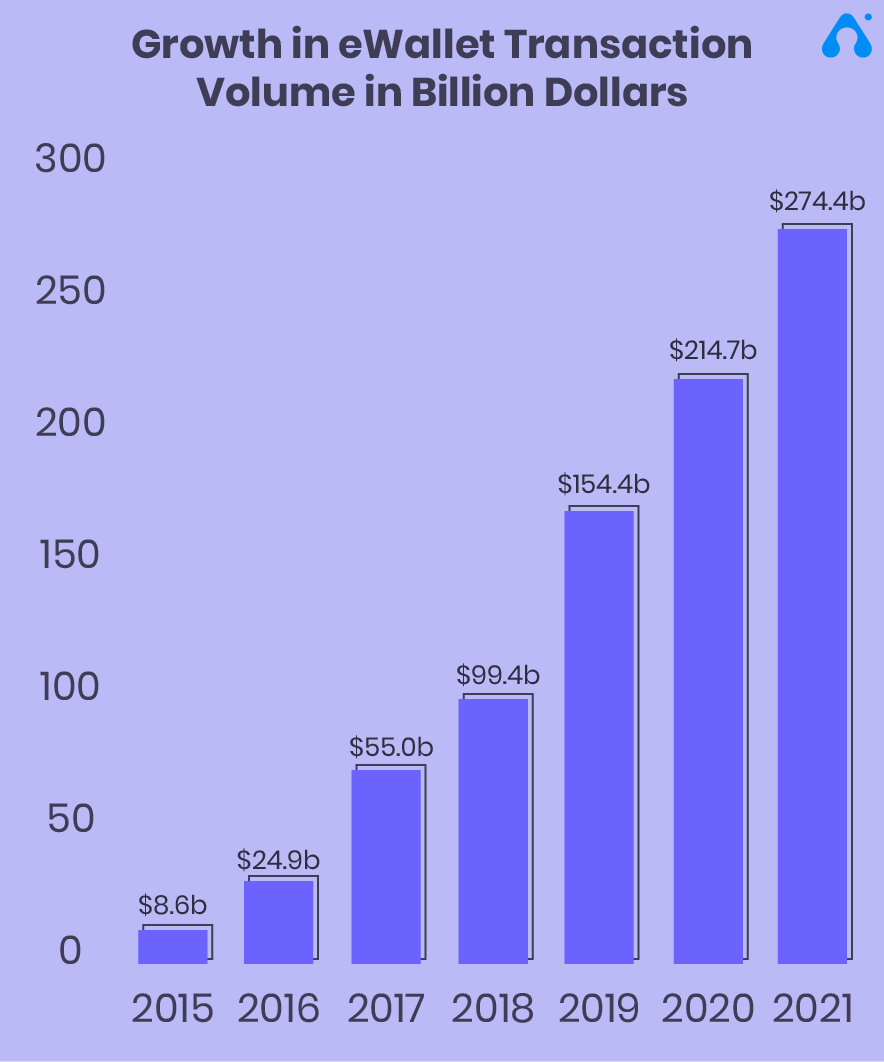

In the past 5 years, the utilization of digital wallets has increased and the results are profitably in the favor of consumers as well as businesses who are opting for advanced fintech app development services. In addition, they will be more than just a digital wallet in 2024 and years coming.

Before we start with the top digital wallet trends, let’s dive deeper into understanding the concept of a digital wallet.

A digital wallet (or e-wallet) is a product-based framework that safely stores users’ transaction data and passwords for various transaction techniques and sites. By utilizing these wallets, users can buy anything effectively and rapidly with instant and responsive apps. They can likewise make more secure passwords without stressing over whether they will have the option to recollect them later.

Digital wallets can be utilized related to mobile transaction frameworks, which permit users to pay merchants with their smartphones. A digital wallet can likewise be utilized to store credit/debit card data and online coupons.

Digital wallets to a great extent put away the entirety of a buyer’s transaction data safely and minimally. Likewise, digital wallets are an expected aid to organizations that gather purchaser information.

To build the best digital wallet, companies are opting to follow the latest digital wallet trends while also utilizing every possible mobile app development framework. The more organizations think about their users’ buying propensities, the more successfully they can market to them. The drawback of purchasers’ security will no longer be considered.

Here are the best highlights of digital wallet apps that make your users fulfilled, and faithful, and help your organization stick out.

Instant transactions and payments imply the transfers of money between different wallets can be done in no time. A mobile wallet, also one of the most secure digital wallets, permits consistent money transfers to any ledger, including your account with a similar bank along with someone else’s financial accounts.

Digital wallet users ought to have an assortment of choices for sending and accepting money with only a couple of taps anytime, from any place. In our cashless society, instant payments and transfers are more than a convenient feature.

Even if the businesses want to earn money through apps they familiarize themselves with the digital wallet trends to develop the wallets and utilize bank transfers using these platforms.

This is one of the key digital wallet features since individuals look for better options for instant payments. Electricity bills, mobile recharges, rents, loans, etc. are preferred choices by users for online transactions.

With the help of digital wallet features, individuals can easily pay their bills anytime. Moreover, these wallets have a feature to produce bill alerts and auto-payment options to avoid any surcharge for late payments. From prepaid recharges to postpaid transactions, every option is available in these wallets.

As the latest advances are being adopted rapidly across the world, retailers, distributors, and merchants realize the urge for digital payments and to also follow the latest digital wallet trends. They are establishing platforms that accept payments from digital wallet apps through QR scan codes and contactless methods like NFC.

These features are enhancing the way of transferring money and making payments without needing a person to visit again and again and receive cash by himself. Having a QR scan code or NFC has become a must-have feature for merchants and other retailers nowadays. It is also considered one of the rising trends in the future of payment industry.

Creating an account without any additional fees or hidden charges is another beneficial feature for individuals. Almost every digital wallet possesses this feature along with the secure login with OTP (one-time-password) functionality.

Users just need to follow these easy steps:

Moreover, the registration is a one-time process, as the digital wallet apps remember your details and will only ask for your contact number or email address at the time of login. This feature is generally tested during mobile app onboarding so that users can rely on the app once it becomes available.

This feature is generally considered the best advantage of digital wallet apps. They provide rewards, discount coupons, and cashback offers to the users on specific payments and utilities. They provide fascinating deals on particular payment options.

Moreover, these additional features provide an extra edge to the digital wallet apps, making users download them more. From loyalty points to discount tickets, several factors help these wallets stand out in the market.

For merchants as well as individuals, digital wallet apps have a user-friendly interface and dashboard. They can manage and track all the payments and activities held through the wallet or other features.

Moreover, they can check their balance, add money to their wallet, access other in-app features, and save reports of their finances anytime. This dashboard feature can help them track their expenses and control the spending of the consumers by setting up limits on monthly spending.

A chatbot is one of the best user-friendly features of digital wallet apps, which helps merchants as well as consumers to ask queries or get support anytime. Generally, companies implement artificial intelligence in chatbot development solutions.

There is a big role of chatbots in enterprises dealing with digital payments. Integrating them will help to upgrade the functionalities for better outcomes.

Implementing chatbot support helps merchants and other businesses to keep in touch with their customers 24/7. This feature offers a cutting-edge advantage to the digital wallet apps and consumers feel reliable when opting for these apps.

Digital wallets can store a user’s credit/check card information, which can be utilized to bring in cash exchanges whenever. Thus the e-wallet rearranges the user’s accounts helpfully accumulating every one of their cards in a single focal space.

Besides, a digital wallet in your mobile is more secure than conveying every one of your cards with you, since it doesn’t store card numbers. Rather, the card information is scrambled with high-grade security.

Individuals today have a scope of credit and dedication cards. That is the reason your mobile wallet app should be prepared to deal with numerous card tasks, for example, square/unblock, change pins, change limits, apply for new cards, and so on.

Banks, financial organizations, telcos, and online businesses can’t stand to disregard the digital wallet solutions upheaval anymore, particularly the mobile wallet opportunity.

Digitization of transactions was an immense bounce toward the objective of accomplishing a simple, advantageous, quick, and secure transaction strategy.

Digital payment technologies saw huge improvements in the past five years and we are going to see many more changes in the coming future. What’s more, presently in 2021, we have the latest digital wallet trends to follow:

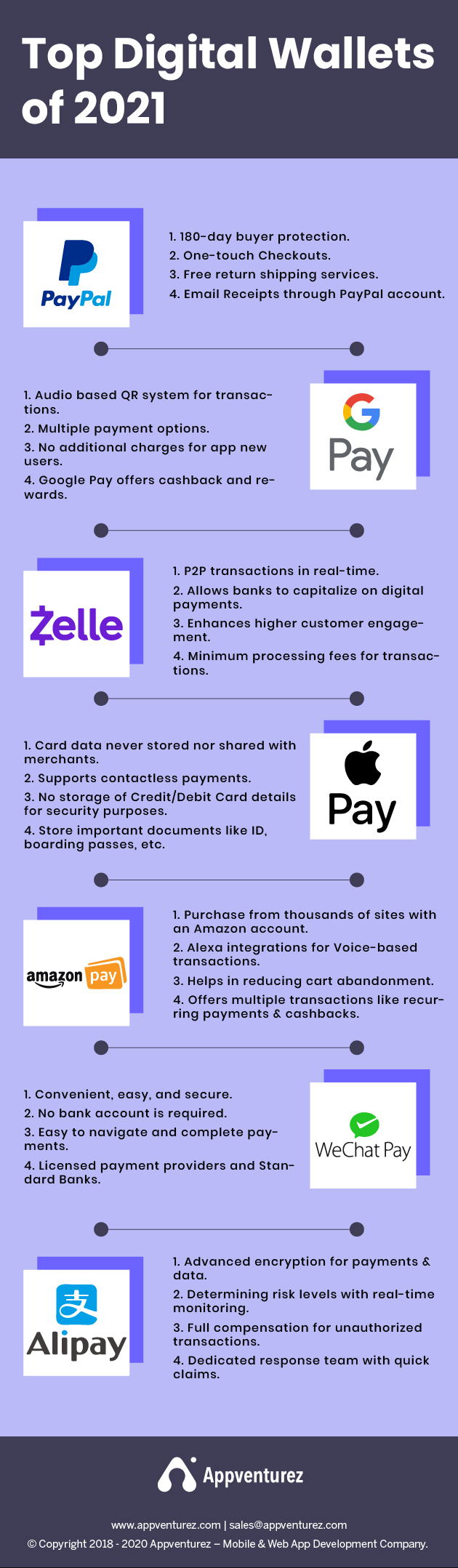

Take a look at some of the top digital wallets and their unique features that make them part of the latest digital wallet trends.

Artificial Intelligence tops the list of the latest digital wallet trends. AI is much the same as the NFC innovation which has quickly digitized toward being one of the advances that are rising. AI & ML development has additionally improved definitely over the range of the most recent five years.

Several online businesses these days have utilized ChatBots for their user’s interests in transactions. To the extent digital wallets or mobile transactions are concerned, AI chatbots have become truly skilled to be utilized in executing and robotizing essential exchanges with the endorsement of the users.

Presently, AI can likewise deal with voice-based interactions and execute transactions about routine undertakings, for example, number checks.

Cryptographic money is not held for multi-million dollar brands or select financial specialists. It has been generally embraced by new companies to small-medium organizations who are aware of the advanced digital wallet trends. In actuality, there are a great many digital wallet apps but some of them can combine cryptographic elements.

Despite the high points and low points in the market, the number of digital wallet users has expanded over time, providing more relevance to the digital wallet trends. Till now (start of 2024), more than 40 million cryptographic money-based e-wallets are existing. And more companies are following tactics on how to develop bitcoin wallet app on the same cryptographic platform.

Statista reports show that cryptocurrency wallet users were raised to 34.6 million in the first quarter of 2019 from 6.7 million in the first quarter of 2016.

Although, it is said that buying digital currencies utilizing e-wallets is an advantageous method, to begin with cryptographic money speculations. Clearly, you would require a digital wallet to store the digital money you’ve purchased. The amateurs need simple to utilize and comprehend e-wallets to store their digital cash.

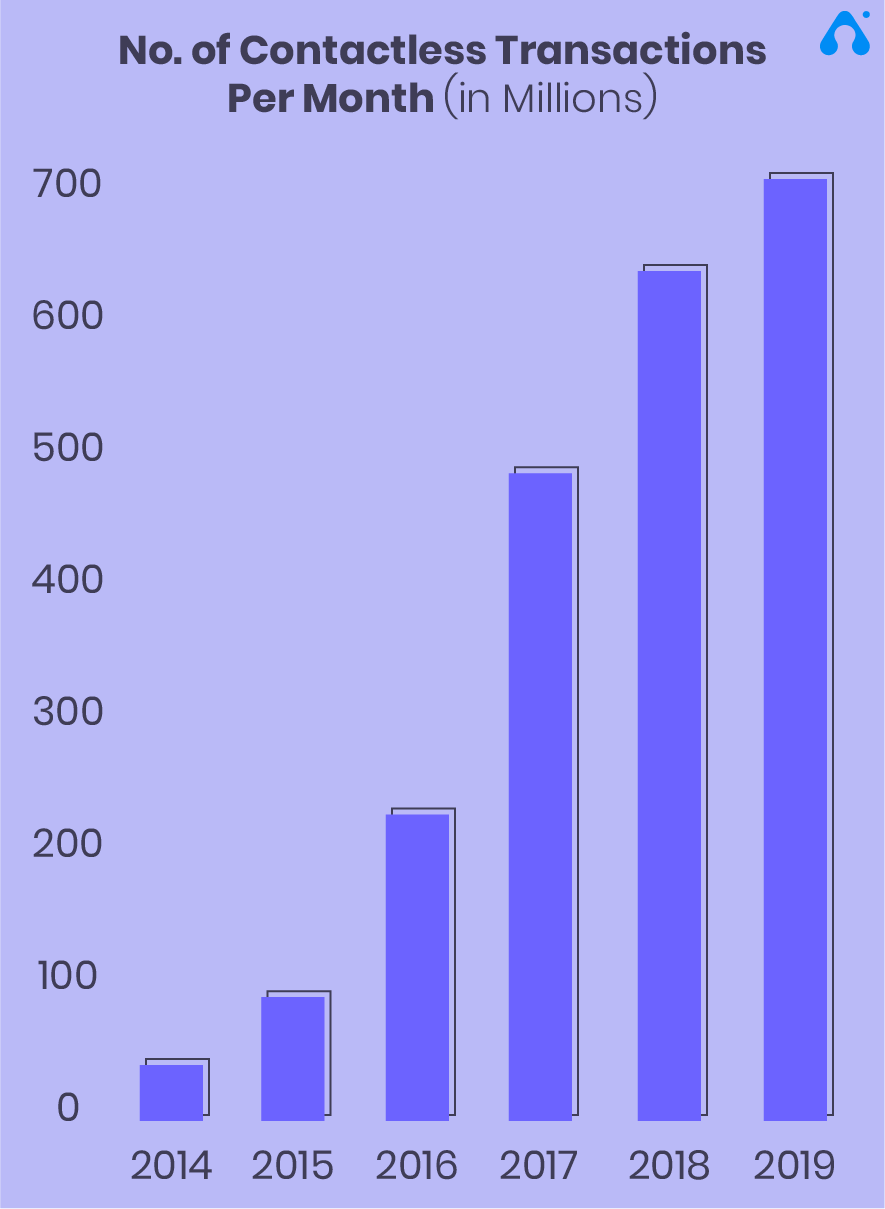

Contactless transactions are likewise quicker and more secure than the PIN innovation as it moves the scrambled information to the retail location gadget promptly. Contactless transactions are conceivable with the NFC feature.

These digital payment techniques are developing quickly over the globe. The beneath outlines this reality well. Here you can perceive how the use of contactless card exchanges has experienced a precarious advancement over the most recent five years.

Moreover, NFC -NFC-based wallet, which is also one of the most popular digital wallets, is better than the PIN innovation since it momentarily moves the scrambled information to the retail location gadget. While the PIN innovation takes a more drawn-out time.

The year 2023 saw the rise of biometric confirmation as a check strategy for monetary exchanges. It depends on the natural and basic qualities of the user. It includes

The purpose of utilizing biometric recognition features is to limit the existence of data fraud and extortion. Biometric verification, one of the crucial digital wallet trends, comes as a protected and solid answer for digital payment transactions.

Smart voice wallet development has been growing since Amazon became the principal of this platform followed by Google and Apple. Smart voice solutions have today become very standard and are famous in family units too. Google Assistant development and other options are being adopted across the globe.

28% of individuals make transactions through smart voice and send and get cash with their assistance. The quantity of digital wallet transactions utilizing a brilliant voice is rising step by step.

Accordingly, the number is going to rise soon as smart voice technology turns out to be increasingly helpful and secure to utilize.

The world is turning out to be progressively digital wallet transactions are on the up. Accordingly, customary transaction strategies are changing to oblige the present digital period. One major change has been in the ascent of virtual cards.

Virtual cards are electronically created and conveyed. When you have one, you can utilize it to make transactions for any continuous exchanges.

Before you pay with the card, you should add assets to it. When supported, the cards work a lot equivalent to a plastic card; you enter the 16-digit card number, its security code (CVV), and expiry date to make a transaction.

An exchange of cash from a remote laborer to their family, companions, or others in their nation of origin is known as a worldwide settlement. In numerous nations, global settlement comprises a noteworthy bit of a nation’s GDP.

The purpose of the rising development of foreign remittance apps is the reception of digital wallet solutions and the development in the utilization of mobile phones. Subsequently, smartphones and app development have immediately changed the finance management industry.

Digital payment technologies and mobile app development have changed the perception of financial transactions. They have promoted digital money to help individuals lower the risk of cash loss. They have provided several online modes of payment for hassle-free transactions.

Here are examples of top digital payment technologies as mobile apps that are currently dominating the market.

From the last few years, and for upcoming years as well, digital wallet apps have been and are going to dominate the industries. Almost every business and individual will get their finances linked with these technologies by opting for digital wallet app development services.

With the essence of AI and voice-based systems, digital wallet trends will take a level up in the future, as people will get reliable on these smart technologies. Appventurez is also helping businesses establish digital wallet apps for easier transactions with their customers and clients.

Hopefully, you will get one for your enterprise as the competition is building strongly among digital payment providers.

Q. Why are digital wallets beneficial for transactions?

Digital wallet apps are one of the best and most secure platforms to do transactions. Moreover, they are convenient and efficient for the consumers as they don’t need to carry cash every time. With cloud security, users can easily store data, shop online, and manage their banking transactions as well.

Q. How digital wallets trends can change the way of handling finances?

With the help of mobile app development, these wallet apps are becoming easier to manage banking transactions, paying bills, shop online, and handle the budget. The rise of digital wallet apps is transforming the methods of managing the finances of individuals as well as businesses.

Elevate your journey and empower your choices with our insightful guidance.

VP – Pre Sales at Appventurez

Anand specializes in sales and business development as its VP - Sales and Presales. He supervises the pre-sales process by upscaling on establishing client relationships. He skillfully deploys instruments such as cloud computing, automation, data centers, information storage, and analytics to evaluate clients’ business activities.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.