Digital banking is one of the fastest-growing areas in the Fintech industry. As a bank & non-bank organization owner, you need a digital solution to stay ahead of the competitors. Smartphone transactions are expected to account for 88% of total banking money transactions by 2022. According to Citi, 91% of users use mobile apps instead […]

Updated 24 January 2024

VP – Pre Sales at Appventurez

Digital banking is one of the fastest-growing areas in the Fintech industry. As a bank & non-bank organization owner, you need a digital solution to stay ahead of the competitors. Smartphone transactions are expected to account for 88% of total banking money transactions by 2022.

According to Citi, 91% of users use mobile apps instead of visiting a branch and 68% of Millennials think their phone could replace their traditional payment method.

The top game-changers in the banking industry are Citibank, Wells Fargo, and Ally Bank. Capital One is the most-used mobile banking app. In this post, we will learn how to experience digital success like Capital One.

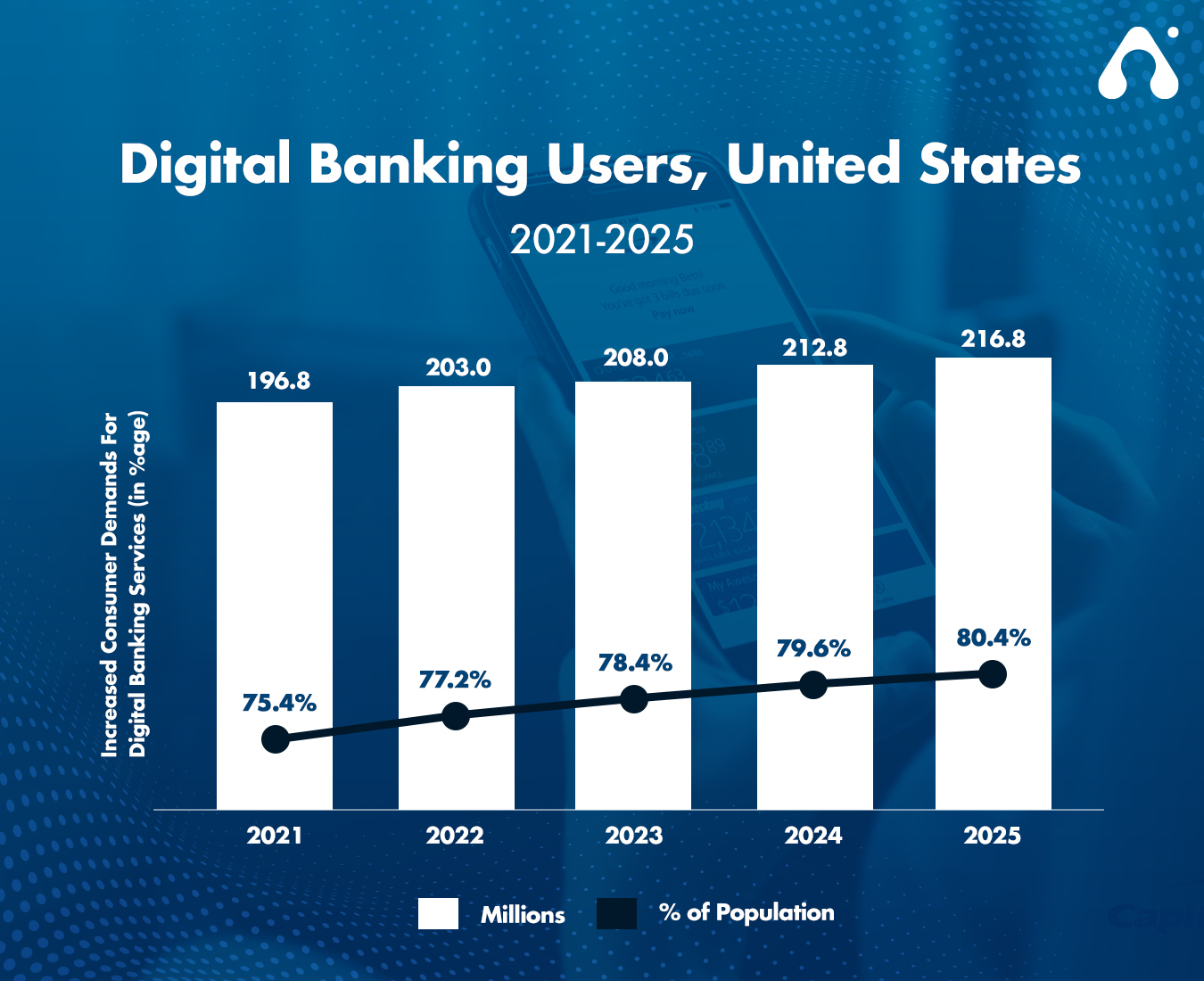

The market for banking apps is versatile, and there is still several room for Startups & acquiring new players. What’s more, there are some finance app ideas for startups. Here are some reports:

Above mentioned stats show that different technologies are affecting the future of fintech. If you want to take your financial business to the next level, you need a digital banking solution like Capital One.

Capital One banking app has earned a high rating thanks to excellent customer support and several saving tools. Available for both Android & iOS platforms, this app uses almost 100 technologies such as Java, HTML5 & JQuery.

Whether you need a banking app for any platform, make sure you get in touch with a company that has experienced iOS and Android app developers.

Banking app development requires a lot of time, effort, and cost. Despite this, many banks and startups are investing in such solutions. The reason is several benefits for both owner and clients.

The use of AI in the Fintech industry is growing rapidly thanks to providing several automating benefits. Here are some pros for users to use digital banking like Capital One:

Banks & financial institutions can minimize operating costs and the number of staff while maintaining customer service thanks to digital banking solutions like Capital One. As per statistics, it is estimated that the revenues of mobile banking apps will reach $935 billion by 2023. Here are some other benefits for owners of mobile banking apps:

The future of mobile banking app development looks like under the mobile-first Millennials’ rule. According to them, the shift towards digital solutions will bring a more customer-centered approach, a connected world, frictionless operations, and a smart move for utilities.

Knowing top banking apps & trends and development steps is an essential starting point. But when it comes to experiencing digital banking success like Capital One, you need to head over to more serious steps. Start thinking about the most important features like Capital One you should use for cardholders, deposit account holders, and anyone.

The Capital One app offers credit card users complete access to their account data such as card numbers & security codes. It also allows you to make an online purchase via phone without any card. It includes a Card Lock feature that allows you to quickly disable the card use if it is stolen.

Other credit card features such as the ability to pay your bills or configure autopay for your payments. Of course, you can use a banking app to view your statement & transaction history.

For those who want a deposit account, mobile banking apps also offer the ability to view your statement & transaction history. You can also use this digital banking solution to deposit a check. Plus, this app lets account holders send money securely to people in the U.S. by using the Zelle service.

CreditWise feature is perfect for anyone whether you are a digital bank owner or using a banking app. You can receive alerts whenever your score changes due to events such as recent information, new accounts, and missed payments.

Here are some must-have features for digital banking solutions like Capital One:

Multi-factor authentication is a secure sign-in option. It is the next step for login, solving what users can check in your app. To deliver an excellent user experience, apply biometric authentication, covering physical metrics such as fingerprints and voice.

Account management features help users see bank balances, track transactions, and record and analyze habits. You can set saving goals, create investing plans, and automate regular payments. It is the future of the payment industry.

Make sure your clients can reach out to 24/7 customer support to resolve issues. In addition, you can increase your user experience by adopting an artificial intelligence-integrated chatbot development solution.

All in-app payments and transactions should be secure and 24/7 available regardless of location. You can also add QR code payments for the best solution.

The mobile banking app includes user information about each transaction and changes in the account status if there are fraudulent calls or spam. Push notifications can also contain information about discounts, bonuses, and rewards.

Here are some innovative features of digital banking apps like Capital One:

Having your money condition under control is always a good idea. Expense tracker helps people stick to their budget and save more money.

Mobile eCommerce is predicted to reach $3.5 trillion and make 72.9% of sales by 2021. It encourages bank users to make in-app payments. Plus, cashback comes in handy as a strong background for your loyalty program.

On-demand mobile app development solutions cover other non-obvious offerings too. It includes purchasing tickets online, car booking, reserving tables, ordering delivery & many more.

Wearable app development solutions can improve the way people live & bank. It’s worth considering the given potential to show banking information, deliver notifications & enable transactions using wearable technology.

For both information & transaction purposes, voice-based digital banking chatbots are blooming on the top to provide an advanced & conversational user experience. You can also need to know about how to make a banking app by following easy steps.

So, these are important features that will help you experience digital banking success like Capital One. If you want a reliable and unique banking app like Capital One, get in touch with a reliable mobile app development company such as Appventurez.

If you’re considering taking your business to the digital realm, look no further than Appventurez—the go-to destination for transforming your concepts into intelligent and secure digital banking solutions. As a prominent finance app development company, we specialize in delivering distinctive fintech services tailored to various business requirements. With a committed team well-versed in both Android and iOS platforms, we offer comprehensive hybrid and cross-platform app development solutions.

We value our client’s reputation & guarantee that our services use encryption, security protocols, and anti-fraud tools to protect customer privacy and financial assets.

We have many years of experience in delivering 700 successful projects for companies. We have gained vast experience in mobile banking app development to make your project successful.

We build apps with great UX design that helps people easily reach their goals. We pay attention to small details to deliver the best experience.

We care about delivering an intuitive digital experience that matches all customer expectations and requirements. Our dedicated team always pays attention to target user research as a basic step to creating a user-oriented design.

Q. What tech stacks are used to develop apps like Capital One?

Here are some examples of tech stacks for banking apps such as Capital One: 1. Native for iOS: Swift or Objective-C, Apple XCode, and iOS SDK 2. Native for Android: Java, Kotlin, Android Studio Developer tools, and Android SDK 3. Hybrid: JavaScript, HTML, Xamarin, Ionic, or PhoneGap frameworks; and 4. Cross-platform: C#, APIs, and frameworks like JS-based React Native

Q. What are popular banking apps in the market?

There are several types of banking apps available in the market that have gained huge success after shifting towards digital solutions. A few names are Varo, Bank of America, Ally Bank, Wells Fargo, and many more.

Q. What challenges can you face when developing a banking app?

If you are planning to develop a mobile banking app, make sure you are prepared for the challenges. The most important challenges are data, transactions, client money security, crime prevention, personal data protection, and many more. Most financial organizations consider security a vital concern. To protect information and client’s money, you need to: 1. Think about the cloud data storage 2. Provide for digital signatures and multifactor authentication for login 3. Enable an in-app timer for system usage sessions and strong encryption

Elevate your journey and empower your choices with our insightful guidance.

VP – Pre Sales at Appventurez

Anand specializes in sales and business development as its VP - Sales and Presales. He supervises the pre-sales process by upscaling on establishing client relationships. He skillfully deploys instruments such as cloud computing, automation, data centers, information storage, and analytics to evaluate clients’ business activities.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.