Machine learning in the financial sector may work magic, while there is no magic behind it. Still, ML project success depends on building efficient infrastructure, gathering the right datasets and applying the right algorithms.

Updated 11 March 2024

Director at Appventurez

Machine learning in the financial sector may work magic, while there is no magic behind it. Still, ML project success depends on building efficient infrastructure, gathering the right datasets and applying the right algorithms.

Cleo is the best example of AI & ML-powered finance apps. It is an AI-powered messenger-based financial assistant that helps users in handling their financial transactions.

Machine learning is making significant progress in the financial industry. Let’s know about the role of ML in the rise of finance automation.

Machine learning in the finance sector is bringing the potential for high-complexity solutions that provide positive ROI across business segments. Here are some surprising facts about ML in the financial & banking industries:

It is also noticed that ML technology is rapidly implemented in the banking sector. 75% of respondents at banks with over $100bn in assets say that they are currently deploying AI & ML technologies. AI apps offer the most significant cost savings chances across digital banking.

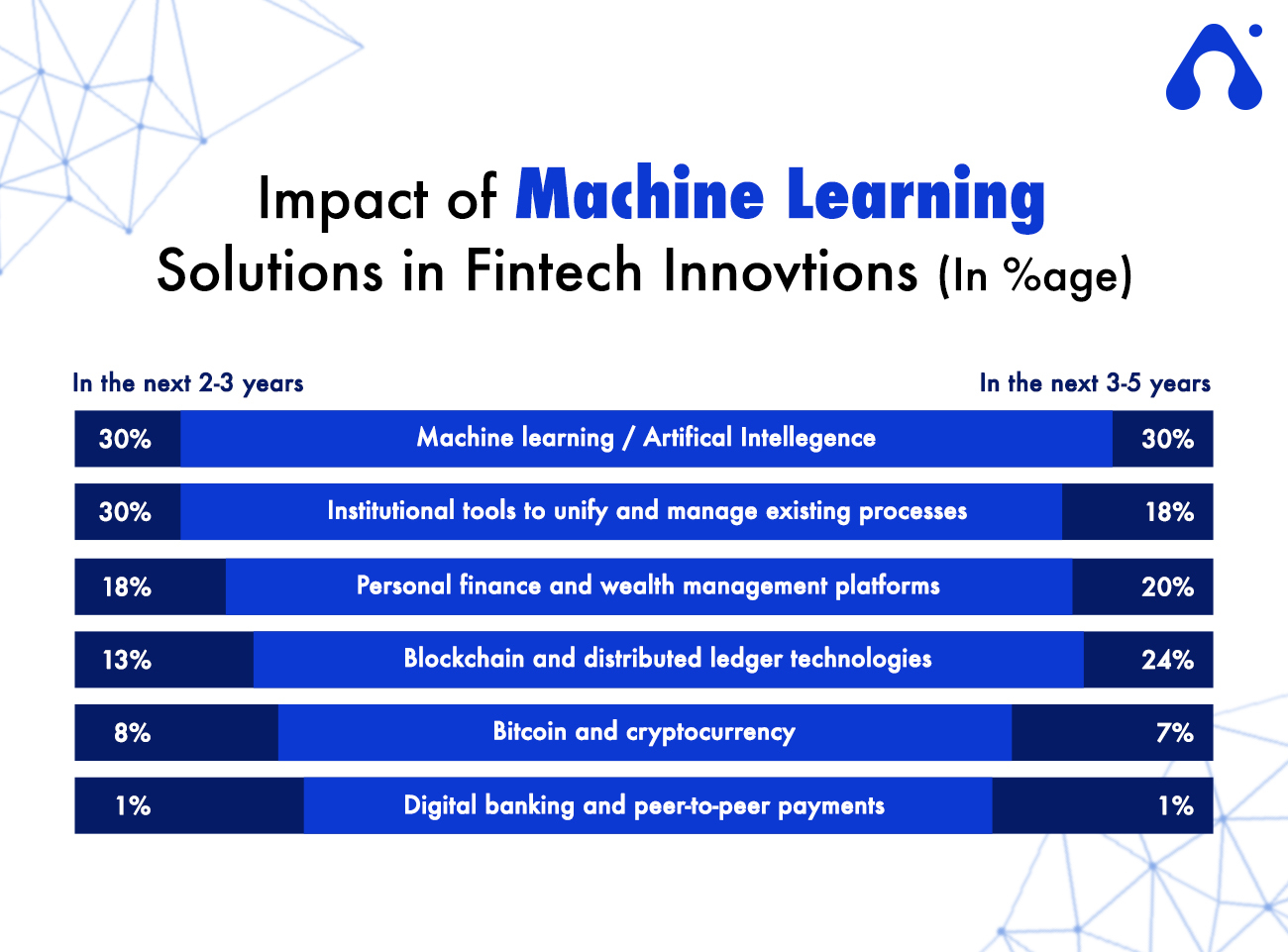

The advantages of ML are ideal for the finance sector as the industry is built on big data. With a proper ML algorithm & a dataset, the financial & banking sector can tap into several opportunities shown by AI & ML technologies. Here are the impacts of ML solutions on the finance industry:

Those days are gone when paper workflows were effective. Now, intelligent ML-based models that allow quick sharing & editing as well as storage and management of information. It can dramatically decrease the time & cost of dealing with documents.

Artificial Intelligence excels at dull & repetitive work taking reportedly up to 60% of employees’ time. On the other hand, ML algorithms take over the dull work, employees can focus on high-value tasks & core business goals.

Minimizing the cost of human errors by outsourcing specific tasks to machines is another ML impact on financial performance.

With proper adherence to safety protocols, AI allows for increased security and improved compliance.

Losing a single customer might not seem like a big deal. But, if it happens daily due to poor communication, insufficient issue resolution, it might threaten a large portion of your customer base.

AI & ML decreases the time spent looking for information and resolving customer issues from several days to numerous minutes. Smooth 24/7 customer service shows that a business cares for its customers. AI-based virtual assistants are the biggest example of this statement.

With the help of ML algorithms, AI can analyze large amounts of data as per the customers’ specific interests and needs. If your customer purchases a property, you can provide them insurance. When they plan for a startup, you can offer them a new bank account. In addition, assessing the financial health of accounts & offering customized data for investment goes an extra mile for your customers and business. You can use Python for AI & ML development services.

So, these are a few impacts of machine learning-as-a-service on the financial services industry. In robotic process automation, machine learning can advance robots beyond automatically process execution & allow them to take on tasks that traditionally required human decision-making. They can be applied in different ways to improve data integrity, enhance business insights or improve automation execution.

Let’s have a look at different ways machine learning is being applied in automation:

Unstructured data accounts for roughly 80% of the data that businesses process daily. Examples of structured or unstructured data consist of images, audios, text files, PDFs, or customer service emails. Machine learning and other cognitive capabilities such as optical character recognition (OCR) & natural language processing (NLP), can be applied to this data to extract & structure it for automation use.

OCR engines are ideal for identifying, extracting, and categorizing data from scanned images. NLP can be trained to understand emotions in free-form text such as customer service emails, chats, and voice inputs.

ML algorithms can also improve automation delivery services. For example, they can be used in computer vision to train robots how to interact with on-screen components. Repetitive often decreases code complexity & optimizes runtime.

Task assignment is another emerging ML app development solution in the automation process. For example, robots are trained to identify regular task information collected from employees to produce process maps and suggest processes for automation as per the highest ROI.

Organized automation is often referred to as remote desktop automation. In this process, robots work with humans to improve their work or help in making better decisions. ML can be used to absorb data from several sources in real-time which allows machines to help humans find the next best step in their workflow process.

You can also combine machine learning with other cognitive capabilities such as NLP to help robots to replicate the simple decision-making within a human’s workflow to get end-to-end automation.

There are several benefits of using automated machine learning for security. Some of the are listed below:

Here are some startups that use ML to help businesses innovative hackers & financial criminals:

It is a Prague-based ML-powered startup that protects AI systems from targeted manipulation and advanced fraud detection.

It uses ML algorithms to provide payment data that enable businesses to accept or reject transactions.

It is a startup that uses ML to build risk management tools to prevent fraud in transactions.

Machine learning is ideal for customer retention purposes. But, if you are looking for speed, personalization and data, you need a chatbot development solution.

Here are some notable chatbot machine learning use cases in the banking sector:

It was the first US bank to build an ML-integrated customer assistant for Facebook Messenger. It was used to build machine learning apps in the banking sector.

It was one of the first banks to provide a virtual ML-enabled assistant within a mobile application.

Here are some benefits of ML for stock prediction:

Here are some ML use cases for stock prediction:

It is a startup that received AI and ML finance solutions for investment management.

It utilizes the latest deep learning technology to identify & forecast the financial markets. The company also built a mobile application.

Here are some benefits of ML for matching the rules & regulations requirements:

Here are several use cases of this benefit:

It helps bankers make better decisions & better loan management, enhancing revenue, minimizing risk & automating compliance.

It is a startup company that resolves the gaps between policies and workflows.

Uncover fresh avenues, enhance operational effectiveness, and attain remarkable business results through tailor-made machine learning solutions crafted by a dedicated Machine Learning App Development Company. At Appventurez, As an experienced ML and finance app development company, our professionals create futuristic ml-integrated solutions that help businesses in:

We are a recognized ML development company that helps businesses get new heights by improving workflow efficiency & devastating high operational costs. Here are other reasons why you should go with Appventurez for AI & ML development solutions.

Closely assess your project necessities and arrange a service with a great number of certified ML developers to achieve the task.

Our ML-powered apps are designed to deliver result-oriented services in a quick turnaround time.

State-of-the-art data encryption with high-security plugins to protect it against malware & threats.

Our cross-functional dedicated team follows the collaborative approach of agile software development.

Q. What challenges are faced by finance companies when implementing machine learning solutions?

ML helps organizations make sense of their data, automate business processes and enhance productivity. When companies want to adopt machine learning algorithms, they often find themselves struggling to start the journey. Here are some issues which companies face during the machine learning adoption process. * Inaccessible data security * Infrastructure requirements for testing & experimentation * Rigid business models * Lack of talent * Time-consuming implementation

Q. Why Should You Use A Machine Learning System With A Robotic Automation Process?

The limitless quantity of available data, affordable data storage & more powerful processing has driven ML growth. Many companies are building more robust models capable of identifying big & complicated data when delivering faster & more accurate results on a huge scale. Machine learning enables companies to identify profitable chances & potential risks quickly.

Elevate your journey and empower your choices with our insightful guidance.

Director at Appventurez

Director and one of the Co-founders at Appventurez, Chandrapal Singh has 10+ years of experience in iOS app development. He captains client coordination and product delivery management. He also prepares preemptive requisites and guides the team for any possible issues on a given project.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.