The loan management system is a digital platform that streamlines both lenders’ and borrowers’ experience during the loan processing phase.

Updated 15 May 2024

CEO at Appventurez

Just like any other business, banks have also started to embrace technological advancement in order to stay abreast with the ongoing market trends. From handling finances using traditional approaches to managing loans digitally, the banking industry has indeed come a long way.

Now, lenders no longer have to do manual loan processing or any paperwork as fintech software development services are developing an effective loan management system to ensure the stability and growth of businesses.

Loan Management Systems (LMS) is the backbone of financial institutions, enabling them to streamline processes, reduce risks, and enhance customer experiences. If you are also willing to automate the loan processing or keep a real-time track of your customers, build a robust loan management software.

In this comprehensive blog, we will guide you with essential features, benefits, and a complete process of building an LMS.

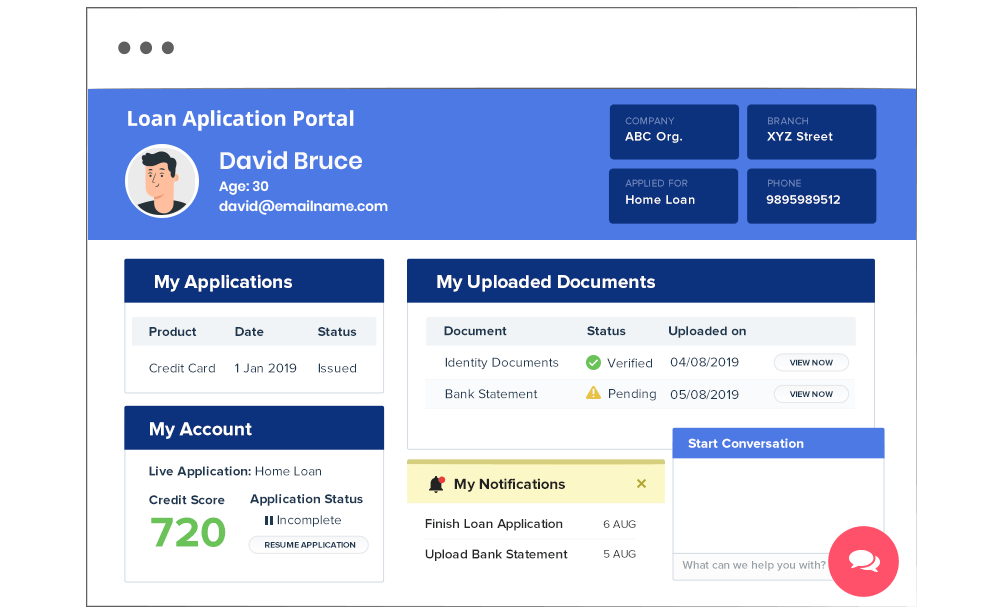

A loan management system is a digital platform used by lenders to manage the whole process of a loan, from monitoring the system to approving disbursement and repayment. The software also manages and collects recurring payments.

The system aims to boost operational efficiency, mitigate risk, and reduce manual errors to deliver a streamlined borrower experience. With the help of a loan management system, banks, mortgage lenders, credit unions, and other financial institutions can easily gather and verify customer data.

Furthermore, the loan management system is integrated with a set of advanced tools and technology solutions to make the lending process for customers easy. It generates detailed reports with profound analytics along with valuable insights to make the whole process easy & efficient.

The loan management system has an increasing market size and a study by Allied Market Research has reported that the value of the loan management software market will reach $29.9 billion by 2031.

The loan application processing system includes the integration of the following features:

Loan origination is a process that ensures the borrower has the suitable financial capability to qualify for a loan. It is a valuable addition to a loan management system as it mitigates the risk of compliance with unverified applications. Consider adding the following elements to the loan origination process:

Another significant feature of a loan management system is loan servicing, which provides efficient tracking, processing, and repayment administrations. It helps lenders to do complex calculations on taxations, and interest rates, generate monthly statements, track repayments, etc. Loan servicing manages escrow accounts, reconciles balances, generates reports, addresses payment issues, and more.

The primary feature of the lending management system is analytical insights along with reporting. These two characteristics determine the overall profit and performance of the products by leveraging data dashboards offered by various systems. The capability of data analytics in loan monitoring systems enables real-time tracking of loan portfolios and detects potential risks.

Debt collection is one of the key elements of credit risk management as it automates the collection process for managing overdue loans effectively. This feature has the potential to negotiate and set up payment plans with borrowers to avoid default. Debt collection has enabled law compliance and regulations, like the Fair Debt Collection Practices Act (FDCPA).

The primary advantage of a loan management system is providing business owners with a competitive edge in the marketplace. A loan processing system can give you a precise understanding of your customers, resulting in a streamlined process with great personalization. The processing system of loan management carried out in the right manner allows lenders to handle more loan applications, and inspect every single loan transaction accurately.

Digital report generation is another core benefit offered by online loan management systems that allow lenders to track valuable metrics, like loan disbursement, repayments, eligible criteria, etc. It gives access to real-time data that helps lenders to make well-informed decisions and focus on areas of improvement. Overall, loan management software handles reports, like invoices, accounting, and taxes.

Providing a user-friendly lending process to customers is essential to making them regular visitors to your loan management system. The users should be able to easily submit loan applications, upload documents, and track the entire process. On the other hand, lenders should also have easy access when it comes to evaluating the borrower’s data, passing the loan amount, and making accurate lending decisions.

The lending space comes with a lot of calculations, ranging from EMI percentage to the amount of loan disbursement based on each customer’s loan duration. Now, doing mathematics manually has a higher chance of making mistakes but not anymore- thanks to the lending management system. The software automates the task and ensures accuracy, consistency, and compliance with lending regulations.

A loan management system saves a lot of time as it can automate the process, resulting in improved efficiency and better productivity. The software not only saves lender’s time but also servers borrowers quickly. Eventually, loan management systems offer comprehensive solutions to companies by easing their profile management, helping them save time and focus on other crucial activities.

In this section, we have mentioned the five steps that are crucial in building a successful loan management system that can drive your business growth.

The first step in a loan management process is defining business objectives or identifying measurable goals. You can start by gathering detailed requirements from stakeholders, including users, managers, and compliance teams. This involves understanding the types of loans, user roles, reporting needs, and regulatory compliance requirements.

After you have identified your business objectives, it’s time to work on in-depth market research and competitive analysis. You must determine your targeted audience’s behavior, and along with it, analyze the ongoing market trends or various dynamics to uncover the opportunities.

Moving forward, avail of UI design services for your loan management system because it is one of the aspects that can help you attract your target audience. You must stay in the loop with your hiring team that your loan management software is not only visually appealing but also engaging and easy to navigate. The end goal should be delivering a streamlined user experience to avoid higher bounce rates.

Once the designing and coding part is done, you must ensure that your loan management software is error-free. That is when rigorous testing will take place to identify any threats or bugs and mitigate the risk of poor user experience. The QA team must follow the latest software testing trends as it optimizes the development cost and money, resulting in the app’s enhanced stability.

Don’t forget to provide post-launch maintenance services to loan management software to ensure that your end solution is up-to-date and functioning smoothly. It guarantees that LMS is operational and delivers customers a streamlined experience.

Developing a loan management system can be a game-changer for your business as it will transform lending operations, resulting in better efficiency and productivity. If you want to be at the forefront, you need to ensure that your idea is competitive and development is unique.

In such a scenario, you must consult experts. Here at Appventurez, we have a team of experienced professionals, who are well-versed with the latest technologies and trends. Our developers have built effective loan management solutions like EFL Clik based on the client’s requirements and demands.

We focus on delivering an excellent solution to our clients, and that is why, we leverage AI and custom blockchain development services that are already merging to make LMS more efficient. With our expertise, transform your project idea into reality and harness the power of automation loan processing.

Q. Is the loan management system easy to use?

Yes. Loan management systems aim to provide a user-friendly experience by designing an interactive interface with simplified navigation and workflows. The system strives to deliver a smooth user experience, so administrators, borrowers, and lenders can easily access the system, gather relevant information, and perform tasks accordingly.

Q. How much does it cost to develop a loan management software?

There is no definite cost to build loan management software as it depends on various factors, like app complexity, design, tech stack, feature integration, and more. However, on average, the cost of creating loan management systems can vary from $40,000 to $2,50,000.

Q. How long does it take to build an online loan management system?

The complete duration to develop the loan management system is never defined properly. Just like the cost, it also varies on various factors, like the project’s size, complexity, desired features & functionality, and the team’s expertise. However, the development can take a few months or even more.

Q. Can I build a customized loan management solution for my business?

Of course yes. You can consult a professional fintech team to develop a custom-made loan management platform that will meet your business requirements. The entire process includes the addition or modification of features, adaptation of easy workflows, integration with existing systems, and more.

Q. Does data security come along with loan management solutions?

If you’ve hired a reputed app development company like Appventurez, you can expect the implementation of robust security measures in your loan management system. The security practices maintain confidentiality, brand integrity, and more. The data security further includes user authentication, regular security audits, compliance with industry standards, etc.

Elevate your journey and empower your choices with our insightful guidance.

CEO at Appventurez

Ajay Kumar has 15+ years of experience in entrepreneurship, project management, and team handling. He has technical expertise in software development and database management. He currently directs the company’s day-to-day functioning and administration.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.