The dynamic landscape of FinTech Vs TechFin is shaping the future of finance and technology, further paving the way for innovation and financial inclusion.

Updated 30 April 2024

Global Delivery Head at Appventurez

The finance and banking sectors are experiencing a new wave of technology transformation in the form of FinTech vs TechFin. Fintech and TechFin are the two evolutionary technology terms that cater to the same niche. However, they both are different and utilize technology in different ways.

Notably, FinTech has been running and expanding for many years in the industry with banks and financial companies transforming their financial services with advanced fintech app development services. On the other hand, TechFin is gradually evolving and has started to change the global financial and banking market.

In this comprehensive blog, we will further discuss how FinTech and TechFin are impacting the future of finance and banking. We will also attempt to understand the difference between the two and how FinTech vs TechFin gives business opportunities for startups and entrepreneurs.

FinTech stands for Financial Technology, representing a broader spectrum of companies leveraging technology to disrupt and innovate traditional financial services. FinTech startups and services are dedicated solely to revolutionizing finance through technological advancements.

TechFin, a term coined by Jack Ma, the founder of Alibaba, refers to the technology companies leveraging their technological expertise to provide financial services. Unlike traditional financial institutions, TechFin companies are primarily rooted in technology, using their vast data and digital infrastructure to offer innovative financial solutions.

These companies utilize cutting-edge technologies such as artificial intelligence development services, big data analytics, and blockchain development services to streamline financial processes and enhance user experience.

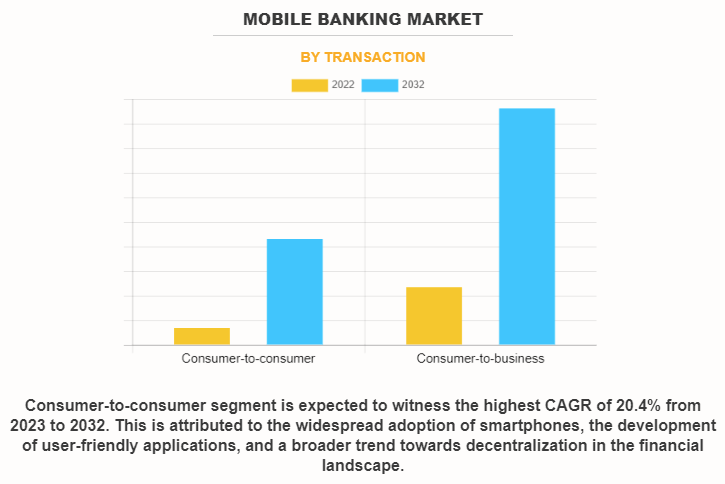

Have a look at some of the current market statistics of both concepts to further understand the debate of FinTech Vs TechFin.

In the debate of FinTech Vs TechFin, it is important to understand how they both operate in the banking and financial sectors. Some of the key differences that set them apart in the landscape of finance in technology are:

To comprehend the debate of TechFin Vs FinTech, you should understand that TechFin companies typically operate within a broader ecosystem of technology-driven services, utilizing financial services as an additional revenue system.

In contrast, FinTech companies often operate independently, focusing solely on disrupting traditional financial services.

TechFin companies prioritize leveraging the existing technology finance solutions, infrastructure, and user data to expand into financial services seamlessly.

On the other hand, FinTech companies concentrate more on developing innovative solutions to address specific pain points within the financial industry.

While diving further into the concept of FinTech vs TechFin, it is important to understand that TechFin companies often face regulatory challenges due to their expansion into the highly regulated financial sectors.

FinTech companies also encounter regulatory hurdles, however, may benefit from the regulatory sandboxes and partnerships with established financial institutions.

Fintech and techfin difference can also be understood from the fact that the TechFin companies innovate by integrating financial services into their existing platforms, further leveraging their extensive user base and data insights and giving an understanding of how financial apps simplify businesses.

FinTech companies, on the other hand, innovate by developing standalone solutions that challenge the traditional financial institutions’ practices and procedures.

TechFin companies target a broad user base across various industries, leveraging their extensive reach and infrastructure.

FinTech companies often target niche markets or specific demographics, offering tailored solutions to meet unique needs by leveraging tech finance.

When it comes to FinTech Vs TechFin, the approach varies for partnerships and collaborations. Notably, TechFin companies may collaborate with traditional financial institutions to offer complementary services or enhance existing products.

FinTech companies frequently partner with other startups or technology firms to leverage expertise and resources.

To understand in detail the concept behind FinTech vs TechFin, it is important to grasp the impact of both technologies on the financial sector. How they drive innovation, enhance efficiency, and reshape the consumer experiences.

TechFin and FinTech companies have challenged the traditional banking landscape and have altered the way developers understand how to make a banking app. They have also prompted the incumbents to adapt and innovate to remain competitive.

Advanced technologies such as big data solutions, artificial intelligence, and blockchain have improved risk assessment and management, further reducing fraud and enhancing security within the financial ecosystem.

It is understood that technologies affecting the future of fintech have facilitated the FinTech and TechFin companies to expand their access to financial services. The impact can particularly be seen in underserved communities and developing economies.

Before discussing FinTech vs TechFin, it is important to understand that TechFin and FinTech solutions prioritize user-centric design, offering seamless and personalized experiences across various financial products and services further leveraging tech financing.

Both the TechFin and FinTech companies grapple with the evolving regulatory frameworks, balancing innovation with compliance requirements.

The competitive tussle of FinTech vs TechFin affects global banking and tech financial services significantly. They both have brought dramatic changes and substantial improvements in the efficiency and delivery of financial services.

In the current digital-first stage, consumers are more interested in using banking and financial services on their mobile devices. This shift in consumer behavior has compelled banks and fintech firms to develop customer-oriented financial solutions like fintech apps, super app development, digital-only banking apps, mobile payment apps, and more.

Digital payments and mobile payments have disrupted the whole market scenario. Because of an increased demand for more efficient and feature-rich payment facilities, companies are now developing innovative digital and mobile payment solutions for consumers.

They are also utilizing advanced technologies such as machine learning development services, artificial intelligence, and cryptocurrency to develop advanced digital payment solutions.

Security is one of the top concerns for consumers and while understanding the debate of FinTech vs TechFin, it should be understood that one of the reasons why in some cases TechFin takes an edge over FinTech is security.

It is also important that the Fintech and banking institutions take assistance from the top mobile app development services for creating high-end security features.

Data is the new power in the age of advanced digital transformation technologies. Whether it is a bank, SME, or enterprise, every organization looks for data analytics to better understand their consumer and derive user business insights.

In the debate of FinTech vs TechFin, we cannot ignore the fact that they both are emerging technology trends in the banking and financial domains. They both leverage different technologies as per their goals and functions.

While FinTech focuses on providing a better consumer experience, TechFin leverages its core technology expertise to build large-scale solutions.

Appventurez, as one of the leading fintech app development companies specializes in creating a wide range of digital solutions for banking and financial services. Our team of experienced app developers, AI specialists, software engineers, and market experts can assist you in developing a future-ready web or mobile app with the use of innovative technologies.

In the landscape where consumers prefer digitally empowered financial products and services, the rivalry between FinTech vs TechFin is expected to create a significant change in financial services.

Q. How much does it cost to build a FinTech application?

The cost of a FinTech app depends on various factors such as app size, number of features, APIs, and more. To get an exact number, you should consult a fintech app development company and get a quote as per your specific requirements.

Q. What is the main difference between FinTech and TechFin?

FinTech is a finance technology where non-technical organizations or businesses use technology to provide financial products or services. TechFin is a technology company that is expanding its services in the financial sector.

Q. What are the advantages and disadvantages of Fintech?

Some of the advantages of Fintech are- improved convenience, inclusivity and accessibility, lower transaction costs, and enhanced security. Some of the disadvantages of FinTech are- downtime and technical difficulties, technology dependence, implementation cost, and compliance with regulations.

Q. FinTech and TechFin which is the future of banking?

The time in the financial landscape is set to move from FinTech to TechFin. The technology-based companies that made an entry into the banking services will make their presence stronger and the financial institutions will start involving the technology at a greater level in their processes.

Elevate your journey and empower your choices with our insightful guidance.

Global Delivery Head at Appventurez

Ashish governs the process of software delivery operations. He ensures the end product attains the highest remarks in qualitative analysis and is streamlined to the clientele’s objectives. He has over a decade of experience as an iOS developer and teams mentorship.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.