Biometrics in banking enables financial institutions to deliver an effortless user experience and maximize security.

Updated 2 May 2024

Global Delivery Head at Appventurez

In today’s rapidly evolving digital landscape, ensuring robust security measures is paramount for the banking industry. Traditional authentication methods, such as PINs and passwords are increasingly susceptible to cyber threats and identity theft. To address these challenges, biometrics in banking has emerged as a more secure and reliable solution.

In the banking industry, biometric authentication has gained traction as a means to strengthen security measures and streamline the user experience through advanced fintech app development services.

Whether it is a fingerprint scan on a mobile device or facial recognition at an ATM, biometric authentication offers a seamless way for consumers to interact with their banking services.

In this comprehensive blog, we will further explore the role of biometrics in banking sector, the benefits of biometric technology in banking, and use cases of biometrics in banking, among others.

Biometrics in banking is a piece of software that scans the physical characteristics of a user for identification and authorization. The main approaches include facial scan, voice check, fingerprint mapping, and retina recognition since they are easiest to implement and use.

To log into an application or perform some operation with the help of biometrics in banking, an individual has to use their biometrical data to verify their identity. The system will scan the data with scanners suitable for the given data type.

Biometrics in banking ensures solutions to two challenges. It makes it more difficult for fraudsters to gain unauthorized access to accounts, and at the same time, provides a more convenient identity verification process.

Biometric security systems have hardware scanners that are powered by custom software that processes the collected data. The look of the system depends on the type of data collected and greatly varies as it can be a tiny scanner in a phone or a separate professional device.

Once a scanner is activated, it captures the biometric data for identity verification. The connected software then automatically converts the scans into digital format and matches them against an existing database.

If the data samples coincide, it allows access to the system, if not, then the user is denied access or a system operator sees a corresponding message. This way, biometric data replaces other identification methods like passwords further improving the future of payment industry.

Biometrics in banking systems work through a three-stage process source:

A customer’s biometric data, such as fingerprint, facial features, or others, is captured in a form that would depend on a relevant biometric security tape.

The collected biometric data is encrypted and protected from unauthorized access. The system converts the taken image, video, audio recording, etc, into a code language graph.

The customers’ input biometric data is compared with the data that is already stored in the system to verify their identity.

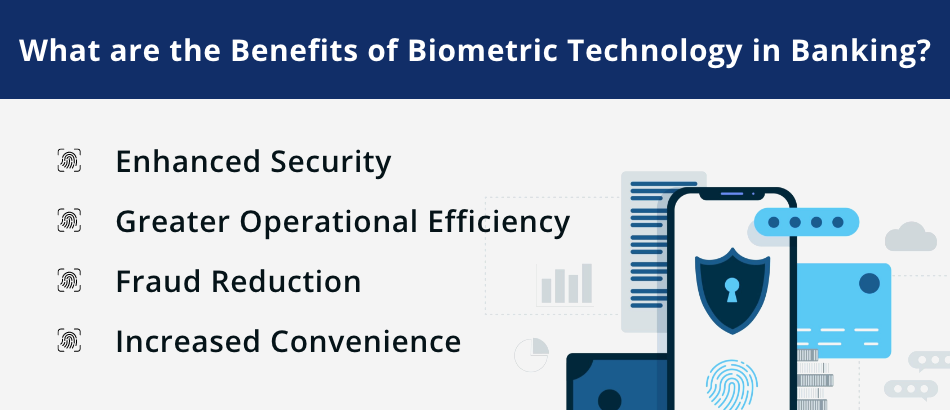

Biometrics for banks offers various benefits as the popularity of biometric authentication for banking continues to grow. Some of the prominent advantages of biometrics in banking are:

Bank biometric verification eliminates the customers’ need to remember complex passwords or worry about losing their physical security keys. Instead, consumers can seamlessly access their accounts using their fingerprints, facial recognition, or voice.

Biometrics in banking provides a high level of mobile banking security and mitigates fraud and error risks. It can be used to either replace or enhance traditional authentication methods like passwords or PINs.

Biometrics traits are also unique to each individual, and generally cannot be transferred or shared digitally.

Biometric banking has specific benefits in detecting and preventing fraudulent activities, such as identity theft or account takeover.

Biometric authentication technology detects anomalies in user behavior or biometric patterns, which may indicate fraudulent behavior. In such a case, the bank is alerted in real-time and can take action immediately.

Traditional banking processes often require consumers to fill out multiple forms of identification. However, with the latest disruption in traditional processes where developers attempt to understand how to build a banking app, biometric authentication in banking does not imply this step and allows consumers to save time.

Besides, banks using biometric technology improve operational efficiency by reducing the need for manual reviews and investigations.

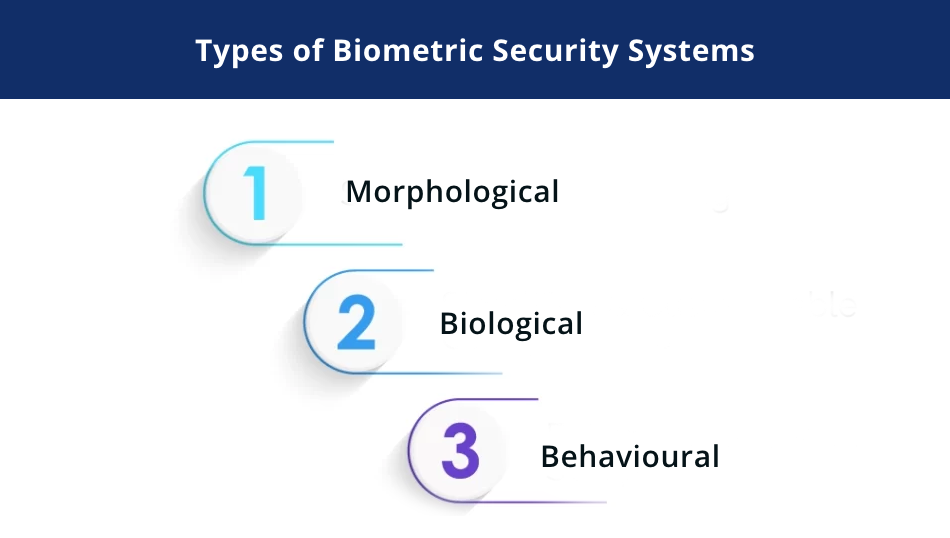

While implementing the banking biometrics, you will most likely use the following mentioned below. Overall, biometric data falls into three groups:

Notably, biometric security in the banking sector is usually based on morphological characteristics. The two primary biometric modalities are fingerprints and facial recognition. Along with them, financial institutions can also use finger or palm veins or iris scans.

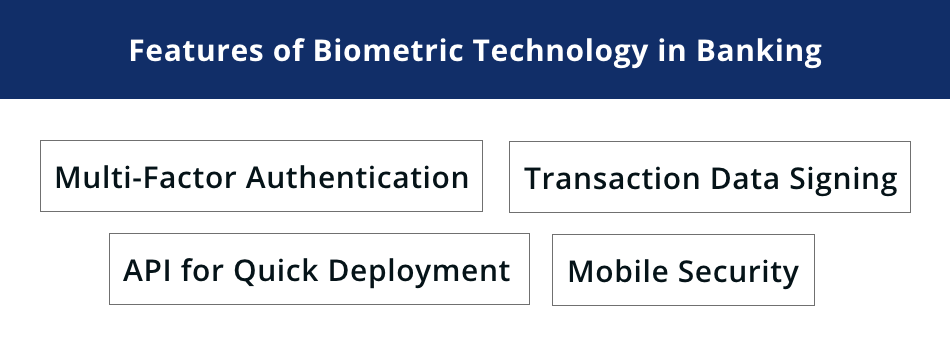

To implement comprehensive biometrics in banking systems, it is important to embed some standard features. Here is the core functionality for reliable biometric identification:

This feature of biometrics in banking verifies transaction credentials by generating a one-time confirmation code. It is crucial for large monetary transfers, online personal detail changes, or other high-risk transactions.

The registration procedure cannot include biometric scanning only since it increases the vulnerability. Therefore, it is important to request additional verification steps like a phone number, DoB, or, password check.

Before identifying the prominent features of biometric security for digital banking, it is significant to comprehend the role of API in fintech and banking. API for fintech and banking can be defined as a set of protocols for seamless and effective communication between the bank’s server and the client’s devices.

If you develop a custom biometric bank security system to supply it to third-party organizations, build an API. It would further simplify the implementation, allowing other banks to deploy biometric scanning quickly.

Before opting for biometrics in financial services, it is important to follow the essential steps to enhance mobile security. It is essential to implement must-have mobile security precautions like advanced obfuscation, anti-hooking, anti-debug, jailbreak, and rot detection. Since neobanks are largely used on mobile devices, fighting off potential threats is essential.

To integrate biometrics in banking system, you must first decide what data to collect. Since not all biometric identifiers are equally easy to capture and process, there are a few considerations when making this decision:

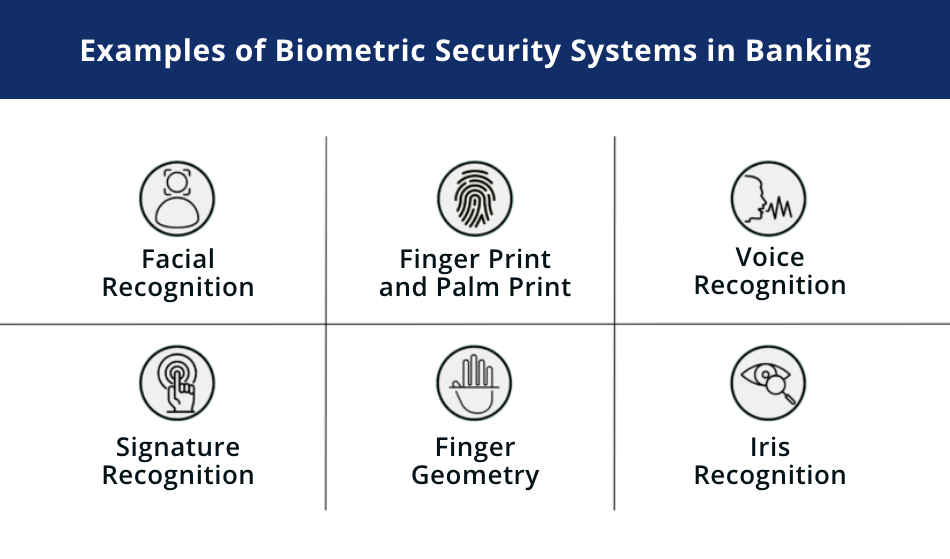

How a person sounds depends on a combination of distinctive physical characteristics like the length of vocal cords and throat shape.

Artificial intelligence development services and machine learning services help measure speech modulation, accent, tones, and frequencies to create a reference template known as the voice print. The voice model enables the software to identify the person during subsequent interactions.

Face algorithms capture the appearance of facial features like the nose or eyes to generate a face template with convolutional neural network technology.

Facial recognition is among the most popular types of biometric verification systems of biometrics in banking sector. A face image can be captured by a standard smartphone or camera, making this method convenient and affordable.

Biometric recognition systems scan and digitize an orientation of ridges on human fingerprints to create biometric templates. They store the templates on datasets for comparison or quick search. A person being identified needs to either put the finger on a platen or hold it over a scanner for contactless reading.

As the advanced technologies affect the future of fintech, Iris recognition for biometrics in banking is one of the most preferable options. This subtype of eye recognition is based on reading the iris and runs on biometric security software. The iris has unique patterns of colored tissue that allow the scanners to distinguish one person from another.

The biometric scanning captures the surface, shape, length, width, and thickness of each finger as well as the distance between the fingers. The latest finger geometry systems use three-dimensional imaging for maximum accuracy of the generated model.

Signature recognition can be static (offline) or dynamic (online). During static recognition, the algorithm captures the graphic image of a handwritten signature to compare it with the previously saved copy.

The trusted approaches to follow to ensure the secured integration of biometrics in banking and financial landscape.

Biometrics in banking has become more prevalent for the authentication of customers and to secure their assets. Banks are well-served by implementing biometric authentication in banking measures as it helps enhance customer service. The applications of biometrics in banking entail:

Biometrics in banking ATMs has gained traction in multiple developed countries, with the two most popular authentication methods being PINs assisted by biometric traits like facials and fingerprints. Therefore, it is no surprise that more banks embrace biometrics in their ATMs.

The use of mobile banking is increasingly on the rise and shows how the technology has transformed the payments industry. However, there is a lack of security in these platforms because of an increasing number of fraud cases.

To combat this, facial biometric authentication in online banking can be employed to access banking services such as KYC monitoring and transaction identification.

Financial organisations can streamline their customer onboarding process with biometric technologies. The Know Your Customer (KYC) verification that is inherently part of the onboarding processes is often left for the consumers to perform in person.

Biometrics in banking offers reliability and security while allowing banking organizations to cut down on the time spent onboarding customers.

Biometric data is another fintech trend that will shape the banking and financial industry in 2024 and beyond.

It has the potential to change how banks and financial services companies operate in the coming years, offering a path to not just enhance security but also promote sustainable banking practices by streamlining processes.

Appventurez, as a software development services provider specializes in Fintech engineering and providing biometric security services. Our skilled team implements biometric authentication in banking products while also adding new features or developing an app with biometric scanning from scratch.

Q. Which of the following is an advantage to using biometric scanners over hardware tokens?

Biometric scanners are harder to fool than hardware tokens because they rely on the unique biological characteristics of an individual for authentication.

Q. Which of the following security measures is a form of biometrics?

The fingerprint scanner is one of the most prominent security measures implemented for biometrics in banking.

Q. What is the future of biometrics in banking?

Banks and card issues are planning to significantly expand the capabilities of emerging behavioral biometrics tools. These systems can provide continuous authentication by tracking dynamic information about the users and learning more about them over time.

Q. Why do banks use biometrics?

Biometric face authentication ensures that the person trying to access an account is the same person who created an account on an ongoing basis.

Elevate your journey and empower your choices with our insightful guidance.

Global Delivery Head at Appventurez

Ashish governs the process of software delivery operations. He ensures the end product attains the highest remarks in qualitative analysis and is streamlined to the clientele’s objectives. He has over a decade of experience as an iOS developer and teams mentorship.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.