Several use cases and applications of generative AI in finance have helped businesses in the industry enhance their operational efficiency.

Updated 16 May 2024

CEO at Appventurez

Generative AI in finance and banking has enabled a new scope of notable advancements such as a better understanding of financial literacy and improvisation of foundational frauds.

Earlier traditional artificial intelligence and machine learning were only based on making predictions and classifying the data on their existing inputs. However, with the inception of generative AI services, we can now create novel content by adding the analysis of the behavioral pattern in the existing data.

This generative technology can generate content in the form of a wide range of modalities, including text, images, code, and music, making it ideal for a wide range of use cases.

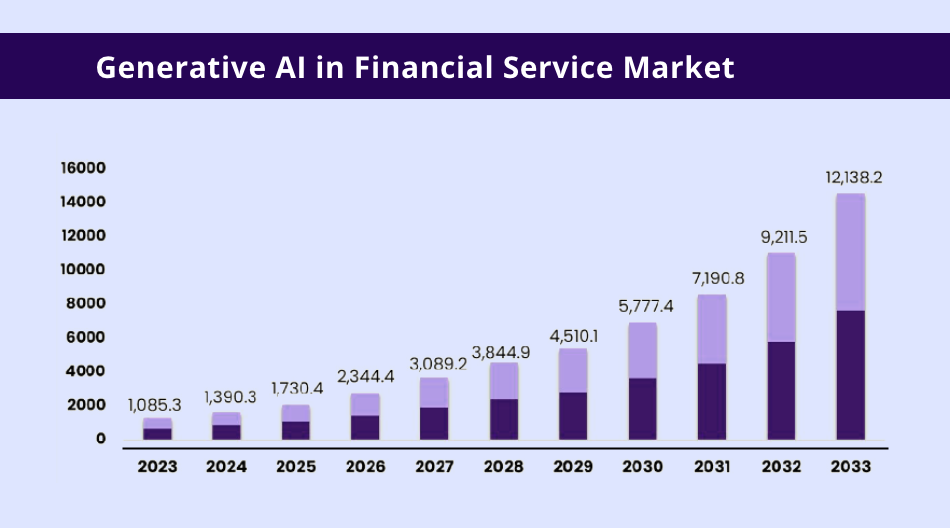

According to statistics, reported by Market Research, the estimated market valuation of AI in financial services is around $1.85 billion in 2023 and is projected to reach $9.48 billion by 2032.

Financial institutions are becoming more aware of the whole potential of generative AI and its wide usage in different processes. To get a clearer picture of the role of this technology in the financial landscape, let’s discuss the potential use cases and the future of generative AI in finance.

Generative artificial intelligence is the most advanced form of AI which has the infinite potential to learn from the huge set of data and generate responses based on the inputs. It can analyze different forms of data and with all patterns and trends, collectively it turns to make the final output for taking close actions.

We will discuss some factors behind the growth rate of using generative AI in banking and Finance.

Leveraging machine learning development services allows the development of algorithms like deep learning and reinforcement learning has the highest acclamation for progress in the world of financial activities. These highly developed algorithms are made up of massive database training, enabling the generation of accurate predictions.

There is a huge challenge in analyzing the data from the finance and banking sector with old-age traditional methods. However, generative artificial intelligence offers the most useful solution to financial institutions for the accurate flow of their data.

Generative AI in finance will enhance productivity and provide new insights and generated predictions with the data science services and data-centric information guide as an essential source in decision-making in the financial world.

Generative AI in finance and banking assists wisely in data analysis and fraud detection by overtaking automation manual processes. It also shows its effectiveness in high efficiency and reducing operational expenses.

Gen AI in finance makes it clear and easy for automation, passing streamlined operations with better resource allocation and significantly reducing costs for financial institutions.

Generative AI in finance will represent a larger picture of transforming standard financial practices with its advanced algorithms.

The use of generative AI use cases in the financial services world brings a diverse range of applications, along with risk management, trading-related algorithms, detection of fraud, automation in customer services, better optimization of portfolios, and forecasting financial data.

Below are the top 10 prominent use cases of generative AI in finance. Let’s explore them in detail.

Let’s explore the multiple forms of generative AI finance use cases.

Generative AI in finance helps in analyzing the vast amount of information and regulatory data to provide every insightful detail to organizations on the change of regularity code changes efficiency. Integration of complex financial regulations helps businesses to stay aware and mitigate regulatory risks on an effective basis.

Generative AI for finance provides personalized business analysis and customized pieces of advice tailored to the individual, based on the existing data and user behavior to provide the best and most insightful personalized recommendations.

This customized approach enhances customer satisfaction and makes them more knowledgeable about investment, savings, budget, and financial planning.

Generative AI in finance easily simplifies the whole procedure of in-depth analysis of financial documentation by applying automatic extraction of relevant details from various sources. It also helps save time for the analysis of financial reports from complete statistics to make accurate decisions.

Generative AI in finance and accounting has proven beneficial in processing automatic routine tasks such as collection of data, entry of updated data, reconciliation of amounts and books, and classification of different financial transactions.

With automation in finance and accounting, manual effort and calculative mistakes can be reduced, whereas efficiency and financial accuracy in bookkeeping can be increased.

Generative AI and finance together can ease the process of creating financial reports by integrating multiple data sources and representing them in a structural format. It empowers the business to produce in an accurate and timely manner reports from stakeholders, financial institutions, regulatory bodies, and investors of the organizations.

Fraud detection is one of the most effective and efficient applications of generative AI in finance and banking. Gen AI in finance detects the patterns of fraudulent activities in financial transactions, mitigating cybersecurity challenges and enhancing data security.

Additionally, generative artificial intelligence ensures data protection by administering robust encryption techniques and continuous monitoring of financial statistics. However, financial institutions must ensure that these gen AI solutions follow CCPA compliance, ensuring complete data privacy in the financial sector.

The use of Generative AI in finance enables the standard optimization of Portfolio and risk management by analyzing the accumulated data, market updates, and latest trends along all types of risk factors. It helps in increasing the returns as well as it also decreases the risk of loss.

Credit risk analysis is one of the most prominent features of generative AI. The generative AI algorithms analyze credit history, statements of every relatable financial document, and economic indicators.

The gen AI in banking enables the creditors to be more specific in the decision-making for loan approvals, changes in interest rates, and fixing the credit limits.

Generative-powered chatbots and virtual assistants provide the topmost and most personalized customer support by addressing the customer’s exact needs.

The major role of chatbots in enterprises is to enhance the user experience through simple and effective interactions between the financial institution and the customer.

Generative artificial intelligence has better capabilities of analyzing customer opinion through various mediums, such as social media platforms, surveys, quick questionnaires, and regular interactions.

Financial institutions can change their strategies to meet customer needs and demands by understanding the exact opinion and choice of the customer with the help of generative AI.

Real-life examples of using generative AI in finance have shown a positive impact on the operational efficiency of banking institutions. Major financial brands use generative AI to enhance customer experience, smooth the banking process, and balance risk assessment. Below are some notable examples of generative AI in finance.

To provide a personalized AI-powered banking experience and tailored guidance, Wells Fargo introduced its Predictive Banking Feature. It allows access to more than 50 prompts related to past and future account activity.

The AI-based trading platform by RBC Capital is a practical application of generative AI in finance. It helps in increasing the quality of trading execution and adapting to a dynamically evolving market.

Goldman Sachs is leveraging the power of generative AI in a dozen of its projects to optimize investment strategies, improve risk management, and align with the latest market trends.

Several Fintech trends are already impacting the future of financial and banking services. Organizations are making their digital presence to generate revenue and sell their products in unique and more personalized ways.

Within this landscape, generative AI in finance can add efficiency to the operational process. This technology helps drive tailored customer experience, facilitate reliable service recommendations, and build trust through its relatable services when the customer needs that. A notable example of generative AI application in finance already used by several banks is automation in financial document monitoring.

Moreover, financial institutions are going to build powerful and unique access-based digital profiles of customers, the data will be safer and more secure. Considering this, incorporating generative AI in banking can improve user interaction and scale customers seamlessly.

Staying ahead is the first step in the process of becoming an expert in the field. With the integration of generative artificial intelligence, lead the finance and banking industry with generative AI financial services.

If you’re looking to excel in the world of finance, Appventurez will help you become the industry leader with its robust generative AI in finance solutions. We shape the idea into the result with our expertise in finance and the banking industry.

As a leading software development company, we ensure to turn your dream projects into reality with a profound passion and skill set. Our generative AI development services are the roadmap to enhance your financial operations in a way you might not have imagined.

Q. How does generative AI in finance and accounting work?

Generative AI in finance and accounting helps in decision-making and decreasing errors by analyzing large sets of data. It also helps in making financial decisions and assessment of risk.

Q. What is an example of generative AI applications in finance?

Generative AI in finance helps in portfolio and risk management, fraud detection, and enhancing customer experience through virtual assistance and customer service.

Q. How banks are using generative AI for day-to-day activities?

Leading banks are using generative AI for operational and customer support functions such as credit approval, debt collection, analyzing different financial statements, and providing personalized customer services.

Elevate your journey and empower your choices with our insightful guidance.

CEO at Appventurez

Ajay Kumar has 15+ years of experience in entrepreneurship, project management, and team handling. He has technical expertise in software development and database management. He currently directs the company’s day-to-day functioning and administration.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.