In today’s world, the banking and finance sectors with RPA in finance, becoming the leaders in technological innovation.

Updated 23 May 2024

CEO at Appventurez

The continuous process of efficiency, accuracy, and effective cost has led the financial intuition to explore the new age of cutting-edge technologies.

Among several latest innovations, Robotic Process Automation (RPA) has come out as a transformative technique, leading the industry with rapidly changing demands and challenges.

RPA in Finance and banking industry holds a strong potential for optimizing diverse processes, enhancing the efficiency of operations, and ensuring compliance with regulatory and financial institution standards.

With the power of AI development, constant changes, progressive customer expectations, and rigid regulatory requirements govern the dynamic world of banking and finance app development services.

In these circumstances, the implementation of RPA plays an important role in fulfilling all these requirements and staying ahead in the whole process.

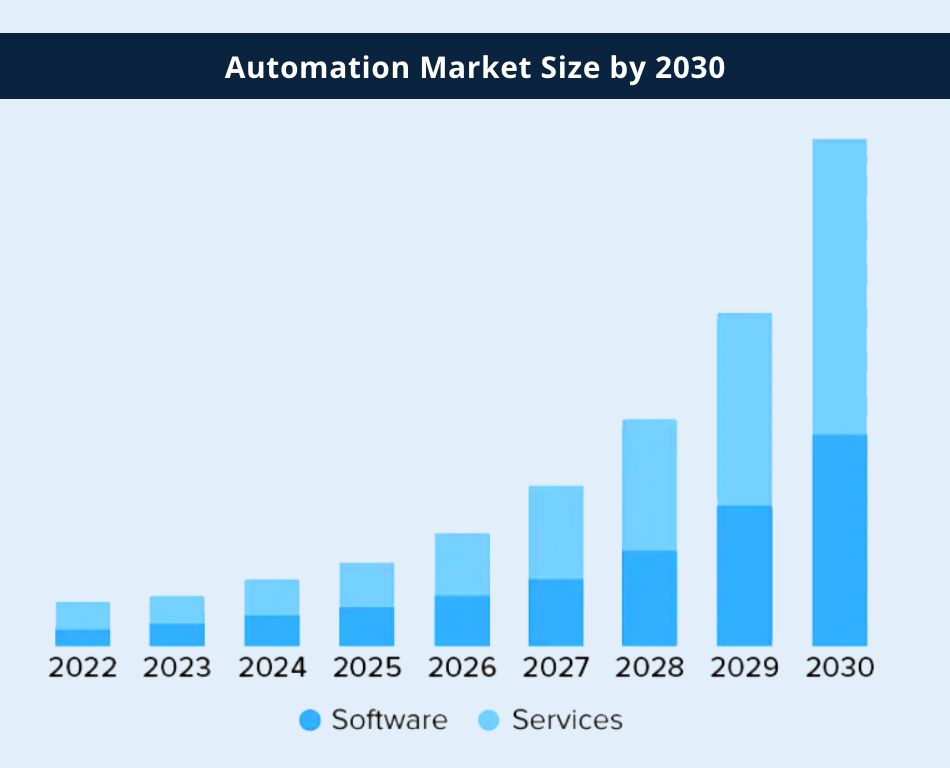

From the reports of Grand View Research, the market size of RPA was valued at $2,322.9 million and it is expected to reach 39.9% CAGR by 2030.

Robotic Process Automation in financial services has helped organizations and human resources to focus on more analytic work. Here are some common RPA use cases in finance automation and accounting that are valuable for your organization’s investment.

Financial organizations are always involved in the heavy inflow and outflow of cash. These repetitive tasks consume a lot of time and effort the purchase requisition or purchase order, making communication, and getting the approval is monotonous as well as heavy mistakes if not done carefully.

Purchase Orders through the robotic process automation in finance reduce error and get the smart handling of data. This system can minimize the cost, with the RPA in finance and accounting.

Processing invoices is also repetitive and monotonous work that requires extra effort, especially when the invoices are generated in different formats.

RPA in finance industry helps to manage all the invoice processing tasks with super efficiency and effectiveness along with the approvals of financial authorities.

Applying for travel reimbursement, verifying the category of expense, required steps of approval, submission of essential and supporting documents, these all step-by-step processes take a lot of time for the accounting team which causes delays in the processing.

In this scenario, RPA in financial services can solve these challenges, like creating monthly expense reports and ensuring the record is according to the company policies making the whole process convenient and effective.

Reconciliation of accounts is a critical process that consumes long hours of business hours for the accounting team, to be accurate and valid balance comparison it also takes effort as well.

Implementation of finance robotics process automation can bring great relaxation to the organization.

With the RPA Automation Collection of various data for preparing reports on a tax basis made it much easier to operate. It reduces the work repetition on the same task, reducing errors and inaccuracy.

Already many businesses run their process through traditional tax processing software but still a lot of specific work needs human effort. RPA bots can easily do most of the manual work which can effectively reduce the cost as well as the accuracy, ensuring the best accuracy and defensive parameters.

Maintaining accurate and detailed track of profit and loss information keeps the business updated and ready for future challenges. Keeping a track record of all financial data helps in proactively managing and handling the issue which keeps you away from any kind of loss.

Financial institutions and banks need to generate various reports that show the performance, insights, and trend inputs from the huge database. Performing this manually with that database is very tedious and time-consuming, However robotic process automation in finance facilitates the collection and analysis of data in a very efficient manner.

Budget planning and budget forecasting are one of the important benefits of rpa in finance.

Getting proper details with implementation of RPA for the finance and banking sector helps create various reports, providing different perspectives to view and analyze data.

With the reference of very old data and new data, comparison can be easily done to find the trend that can be helpful in planning your successful business forecast.

KYC is the most important as well as the most time-consuming process that the banking and finance industry has to perform with every customer. KYC costs too much for the banks, implementing RPA in finance to automate the KYC process will reduce the cost with greater margins.

Robotic process automation in financial services will help reduce cost, time, and other resources. It helps a lot to smoothen the whole process.

Processing of Payroll is one of the most significant processes for any organization. Punctual and accurate operation of payroll brings a positive and professional feel to the organization, it also builds a happy and satisfied customer base and a very promising business.

Implementing PRA in finance captures multiple benefits across the globe, it accelerates productivity growth, and ease of the process.

After so much advanced treasury management, there is a lot of human effort involved in doing the process. RPA in Finance and banking can easily fill the gap with the formation of raw data to final data from different sources.

RPA in finance helps in analyzing and organizing the financial data, keeps the treasury management updated with the latest trends, and maintains the ledger and books of accounts.

The use of RPA in finance industry has been slightly growing because of its effectiveness in repetitive handling, in monotonous back-office work.

RPA bots are capable of handling the most important activities and tasks like payroll, record keeping, accounts payable, and accounts receivable.

The benefits of RPA in finance operations help in

According to statistics from Garter Research, around 80% of financial companies are implementing the RPA process in their operations or they are about to implement it.

Robotics Process Automation in Finance and banking industry holds a strong potential for optimizing diverse processes, enhancing the efficiency of operations, and ensuring compliance with regulatory and financial institution standards.

With the Fintech trends and RPA trends in Finance, here are some of the key benefits of RPA in Finance.

Most of the financial and banking bodies are implementing the RPA in their work to run the processes very smoothly and effectively. Below are some real-life examples of RPA in finance and digital banking industry.

One of the World’s largest insurance firm, Zurich has implemented the RPA in the workforce for performing day-to-day tasks and managing boilerplate policies.

These RPA solutions help Zurich to more focus on easing complex insurance aspects and maintain standardization in work.

Keybank, one of the leading names in commercial banks, started working with RPA very early to increase efficiency and accuracy in realistic banking matters. Keybank has automation in invoice management, Purchase orders and bills receivable, helping to make payment methods smoother and error-free from every step.

Leader in financial services, Societe Generale Bank has adopted the RPA in their process to manage the tedious and time-consuming task. RPA bots help them to provide excellent customer service and transform the business model.

Nowadays, Generative AI dominates almost every industry, including banking and finance. RPA in finance and banking has almost changed how businesses perform tasks and leverage AI solutions to deliver smooth and better experiences. Financial apps and AI in banking and finance simplify the whole process.Appventurez as a seasoned financial software development services company, possesses years of expertise and provides global AI financial solutions. We have delivered a ‘myriad’ of successful AI banking solutions with an impactful approach.It helps in improving the revenue. Reduced the operating costs and mitigating risk in different departments.

Q. What is RPA in Finance?

Robotic Process Automation (RPA) is a software technology(robotic bot) that automates repetitive and rule-based work in the Finance industry. Adding more accuracy than human involvement and reduction of cost.

Q. What are the benefits of RPA in Finance?

RPA in Finance is beneficial in several factors such as an increase in efficiency, reduction in cost, improvement in data management, and great customer satisfaction.

Q. What is the difference between RPA and AI in finance?

AI in finance helps in the analysis of data, making predictions, and providing references to improve decision-making whereas RPA automates repetitive and rule-based tasks without any human involvement in a very effective way.

Elevate your journey and empower your choices with our insightful guidance.

CEO at Appventurez

Ajay Kumar has 15+ years of experience in entrepreneurship, project management, and team handling. He has technical expertise in software development and database management. He currently directs the company’s day-to-day functioning and administration.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.