AI in banking has become a huge buzz because of the technological advancements it offers, resulting in more personalized financial services.

Updated 21 February 2024

VP - Delivery at Appventurez

Artificial intelligence has entered almost every industry vertical, including banking, and transforming the ways people handle their finances.

Some popular brands, like JPMorgan Chase, Capital One, and Goldman Sachs, leveraged the features of AI in banking and became more successful than ever.

| Banks | Use Cases |

|---|---|

| JPMorgan Chase | The first-ever bank that integrated artificial intelligence into its application for virtual assistants. It introduced a brand new financial service called IndexGPT (based on AI) that helps users determine how and where to invest money. |

| Capital One | Capital One utilized a standardized technology for data management, model development, and operationalization. With the help of AI and ML, it is now easy to take care of our customer’s finances by providing the right guidance along with much better spending. |

| Goldman Sachs | The Goldman Sachs Group leveraged the unique & innovative features of AI in banking applications to abstract assets from large datasets like corporations’ public regulatory filings. With the help of AI, our team provides meaningful analysis of comprehensive changes along with the suggestions of investors, companies, and the global economy. |

AI in the banking industry is unstoppable, and its buzz in banking and finance is inevitable. That being said, the AI banking advancement is witnessing a groundbreaking transformation, resulting in the excessive demand for AI development services across the globe.

The integration of AI in banking sector brings substantial benefits that will not only reshape the Finance development services industry but also strengthen competitiveness.

In regard to this matter, we have comprehensively discussed the benefits of AI in banking sector, the prominent use cases, the challenges in adopting AI & ML in banking, and more.

A report by Business Insider shows that applications of AI in banking can save $447 billion by 2023. As a result, artificial intelligence in banking industry has revolutionized and welcomed a whole new world of digitization.

In other words, the impact of AI in banking industry is profound and wide-ranging, transforming this vertical in various ways.

Delivering a streamlined customer experience is the key to a successful banking application development and AI helps in meeting this expectation. Artificial intelligence has effective algorithms that analyze complete customer data to comprehend their preferences.

After extracting valuable insights into customers’ data, business owners of the banking application can accordingly provide recommendations, leading to higher customer satisfaction and loyalty.

Financial organizations are one of the most targeted institutions for scammers because of the immediate fund access, resulting in unauthorized transactions. That is why businesses focus on providing robust security to their financial institutions for prevention purposes.

The integration of AI in banking apps analyzes each transaction in real-time to compare them to the existing patterns and identify any irregularities. As a result, business owners are capable of detecting the chances of any fraudulent activity beforehand.

Regulatory compliance in banking firms is one of the crucial aspects as it ensures that the finance industry abides by all the constitutional laws & regulations. The compliance will build trust in your customers, and as a result, it will secure the integrity and reputation of your industry.

When regulatory compliance gets combined with AI technology, some exciting and safeguarding opportunities come into the picture. Regulatory-based technology exerts artificial intelligence for monitoring continuous transactions and potential compliance issues.

Another benefit of AI in banking industry is risk management, enabling banks to get a brief understanding of everything in order to reduce the chances of any unethical activity. Artificial intelligence in banking services perform crucial tasks, like checking financial status, verifying documents, releasing loans, or other risk-related activities.

Mobile banking applications based on AI handle all kinds of financial transactions, along with in-depth bank data analysis. The integration of artificial intelligence in banking applications further helps bankers identify any fraudulent activity and understand the customer’s behavior.

The primary benefit of AI in banking is excellent customer service and unwavering support, assisting customers in many ways. AI has an interactive and innovative establishment known as ‘Chatbots’ that provides excellent customer services.

Chatbot for enterprises (or virtual assistants) provide customers with instant responses to their queries, assist with transaction details, round-the-clock support, and more. Overall, the role of AI in banking is to entice customers’ attention and give quality services, resulting in increased brand credibility.

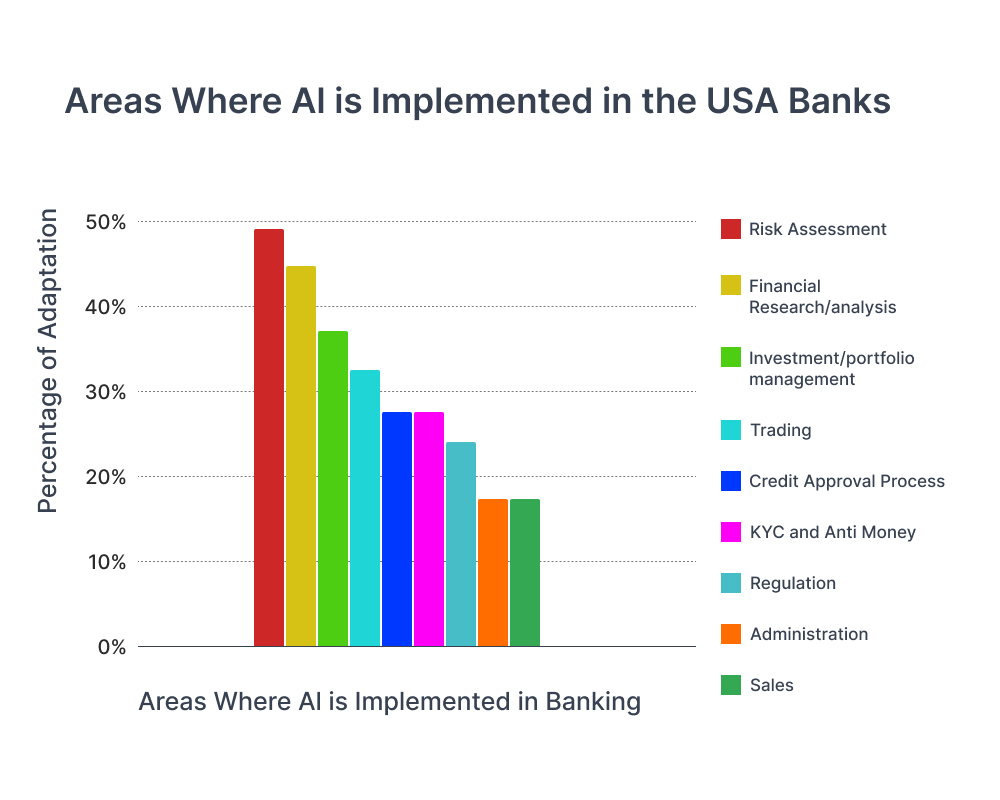

Given below is a list of top use cases of AI in banking sector:

The creation of digital wallets has uplifted the digital money movement to the next level. Customers can now easily buy anything online and make the payment by simply providing their 10-digit number and entering a one-time password. It is one of the unique features of the digital wallet.

Banking applications use an interactive voice response system (IVRS) to interact with their customers. The ultimate goal of this feature is to deliver a streamlined customer experience by responding to their queries on time and giving them accurate responses.

The role of AI in banking help customers make instant and suitable decisions along with the latest information or market trends. Overall, artificial intelligence can easily provide customers with personalized financial advice.

Artificial intelligence is an advanced technology that has indeed benefitted industries on so many levels; however, several challenges come along with it. For instance, lack of data security, quality, explainability, etc.

Let’s have a look at each challenge along with solutions one by one:

Banking applications have a huge data collection of users, from their phone numbers to credit/debit card details, etc. Thus, banking applications require robust security measures in order to protect user’s information from any breach or violation.

Availing of suitable software development services for developing an AI-based solution is vital as the experts will provide adequate security measures for user data protection. They will maintain robust security practices for AI models, gather customer data based on their consent only, and ensure compliance with privacy regulations.

Before developing a fully-scaled AI-based banking application, it is a must for banks to attain structured & quality data for training and validation purposes. Now, the qualitative data ensures that artificial intelligence algorithms are being utilized in real-life scenarios. Also, when the data is not in the readable format by machines, the chances of unforeseen model behavior of AI increase.

Artificial intelligence automates the process of transferring the data into a common format, which further ensures the consistency and improvement of data analysis.

Systems built on artificial intelligence are useful in decision-making processes because they eliminate the chances of errors, which results in time-saving. Also, if there is any minor inconvenience by chance, AI systems quickly get in trouble, leaving the bank’s reputation at stake with all the financial risks.

A bank should avoid the lack of explainability and should properly comprehend, validate, and explain the working criteria of AI models.

The world has completely undergone a digital transformation, resulting in increased customer expectations from the industry. As a result, the banking industry is adopting a new transformative technology, known as Generative AI to provide exemplary services to its customers.

Here are some of the benefits of Generative AI in finance that can surely transform business operations, customer engagement, and more.

Generative-AI-based chatbot is one of the most powerful tools in the banking sector as it not only automates quick responses but also interacts with customers using NLP and ML. Chatbots powered by Generative AI deliver round-the-clock customer support with instant responses, leading to an improved customer experience.

Identifying threats or fraud is crucial for banks to maintain users’ privacy, and this is when Generative AI plays an imperative role. The next-gen technology has algorithms that have the potential to analyze large amounts of transactional-based data, suspect any unusual activity, and more. As a result, the chances of losses get eliminated, and financial interests get automatically saved.

Last but not least, Generative AI services allow banks to provide personalized financial advice to users by analyzing their end goals and patterns. After the in-depth analysis, AI-based systems give saving recommendations, manage finances, etc. It results in customer satisfaction as well as customer loyalty.

The AI-driven world is reshaping the future of work for almost every industry, and talking about banking firms, it has indeed skyrocketed in the past. AI in banking sector aspires to become more successful with the commitment to delivering innovative solutions. As a result, business owners have started to leverage AI solutions in their banking operations to deliver a smooth user experience.

As a seasoned AI app development company, Appventurez possesses years of expertise in delivering exemplary banking solutions. To quote a real-life example, we have built a secured banking platform ‘Ezipay’ that makes money transfers convenient for users.

Our professionals are adept in technology development services and craft intuitive banking applications as per business requirements.

We have successfully delivered a myriad of AI in banking solutions by following an effective approach. Our team has worked with banks and financial institutions on different custom AI and ML-based models. It aids in improving revenue, reducing costs, and mitigating risks in different departments.

Get in touch with our professional team and meet your business goals today!

Q. Does Appventurez provide NDA services?

Yes! We provide NDA services to our clients as we care about their reputation and want to maintain their privacy. We sign a non-disclosure agreement with our clients that helps maintain their competitive edge by keeping their information secure.

Q. How will artificial intelligence change the future of banking?

AI in banking is the future! The implementation of artificial intelligence into financial institutions has the potential to smoothly boost back-office operations and effective decision-making powers. Furthermore, AI in banking and finance provides innovative processes and simultaneously harnesses data to generate intelligent and custom-made experiences.

Q. Does Appventurez offer post-launch app maintenance and support services?

We ensure that after delivering the final project, our clients are not facing any kind of challenge. That is why we deliver post-delivery maintenance and support services that guarantee their banking application is operational, integrated with the latest features, and updated as per the latest market trends.

Q. How is AI used in financial services?

Artificial intelligence is useful in corporate finance since it can better forecast and analyze loan risks. AI technology, like machine learning, may help organizations raise their value by improving loan underwriting and lowering financial risk.

Elevate your journey and empower your choices with our insightful guidance.

VP - Delivery at Appventurez

Expert in the Communications and Enterprise Software Development domain, Omji Mehrotra co-founded Appventurez and took the role of VP of Delivery. He specializes in React Native mobile app development and has worked on end-to-end development platforms for various industry sectors.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.