Technological advancements in the financial sector have transformed the sphere of digital banking. Now, it’s time for mobile banking apps to lead the command.

Updated 31 January 2024

VP – Pre Sales at Appventurez

Until a few years back, consumers used to identify financial services with long queues at banks and service terminals. Even over the on-call support, they had to face extended waiting times with customer representatives which heightened their frustration. This process might have been a humdrum of their lives if advanced and convenient mobile banking solutions had not evolved.

The emergence of mobile applications has burgeoned the banking industry drastically. In fact, over 2.7 billion users were projected to use handy solutions like digital wallets in 2022. Moreover, the continuing practice of contactless payments is another driving factor that urged businesses to build a banking app. This could be the reason why the global mobile banking app market size is estimated to reach the $1.3 billion mark this year.

Since digitalization is reaping benefits to a large extent, creating a personalized mobile banking experience for your customers is undoubtedly a step in the right direction. However, in order to make this work, it is crucial to be self-aware with the appropriate knowledge and facts.

The rising growth in the usage of smartphones has made businesses from all industries focus on mobile app development, and the banking sector is no exception. Moreover, since the pandemic, companies have been looking for digitally-oriented ways to enable business continuity in an optimized manner.

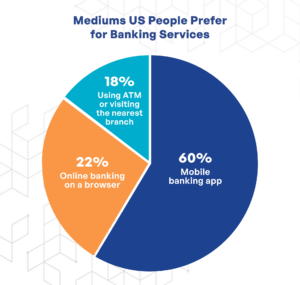

Mobile banking applications have completely changed the way in which customers used to avail financial services. Today, in the United States itself, 60% of consumers prefer to use banking services on a mobile app, compared to 18% – who still rely on traditional banking models.

With the remarkable features users get with mobile banking, there is no doubt why many banks and financial organizations have already invested in banking app development. Wells Fargo, Ally Bank, and Capital One are some notable names in the mobile banking application examples category.

There are mainly two objectives for developing a mobile banking application:

Banks can enhance the quality of their services by providing users with convenience and flexibility. This helps businesses in the financial sector to gain a competitive edge and comprehensively fulfill market demands. By upscaling the standard of services, they can easily retain their existing customers and target potential users to a large extent. Consequently, it also leads to a significant increase in their client base

Here are some notable advantages of mobile banking applications:

Be it an e-commerce company or a financial institution, advertising is crucial for every kind of business. That’s why it becomes important to have omnipresent marketing and promotional channels to reach a wider audience. Since the growth of smartphone users is showing no sign of stopping, it could be productive for businesses to build a banking app in order to advertise their banking services.

With a promising mobile app solution, you can notify your customers about all the latest features, updates regarding interest rates, information about cards, and much more. This way, you can stay more connected with your customers without intimidating them over phone calls or direct sales on the bank premises.

Since a mobile banking app needs to be integrated with hi-tech features for seamless services, the investment incurred in the development process is pretty considerable. However, if implemented accurately, the return on investment will be significantly higher, as well.

This is because when companies go digital and mobile, the cost of building and maintaining physical branches is stamped out, or at least gradually reduced. Moreover, with process automation, the need for a large staff can also be eliminated. Revolut, a British bank is one such popular example. The bank’s primary objective is to completely operate digitally without having any physical branches.

When you offer your users an immersive medium to interact with your business, it is natural that more and more of them will want to connect with your services. This helps in increasing your client base, and not just to the local boundaries but beyond international borders.

In fact, various studies reveal that mobile banking has already become a ubiquitous trend. A survey concluded that almost 89% of respondents are using mobile banking services. This means that with a robust mobile banking platform, companies in the financial sector can easily extend their client base and expand their business operations.

One of the best things about having a mobile banking application is that you get a massive source of valuable insights regarding your customers. These insights provide you with a profound understanding of user behavior, with the analysis of which you can offer more customized experiences to them.

Besides this, you can also learn about the weaker and stronger sections of your app and improve them accordingly to attract more users.

Before you hire a development team to build a banking app, it would be great to know other crucial aspects associated with it, too. As a business owner, you must conduct an in-depth market analysis and make an informed decision based on it. Simply put, before focusing on how to create a mobile banking app, you must have a good understanding of the prerequisites to be taken care of.

If you are new to the banking industry, the first and foremost thing is knowing the market inside out. For this, you have to perform deep research about your competitors and the strategies of the established leaders in the industry. Besides this, you also need to have an idea regarding the prevailing trends of mobile banking, the common pitfalls, and the ways to come out of them.

Another issue is that the mobile banking market is enormous, and growing rapidly every single day. It is often reported that 94% of users in the mobile banking domain access digital banking services every month. To fulfill the needs of such a number of users is not a straightforward task, especially when your competitors are already prepared to do so.

There is one common mantra that goes for all kinds of businesses looking for positive outcomes – the better you know your customers and their expectations, the easier it will be to deliver the relevant services and get results.

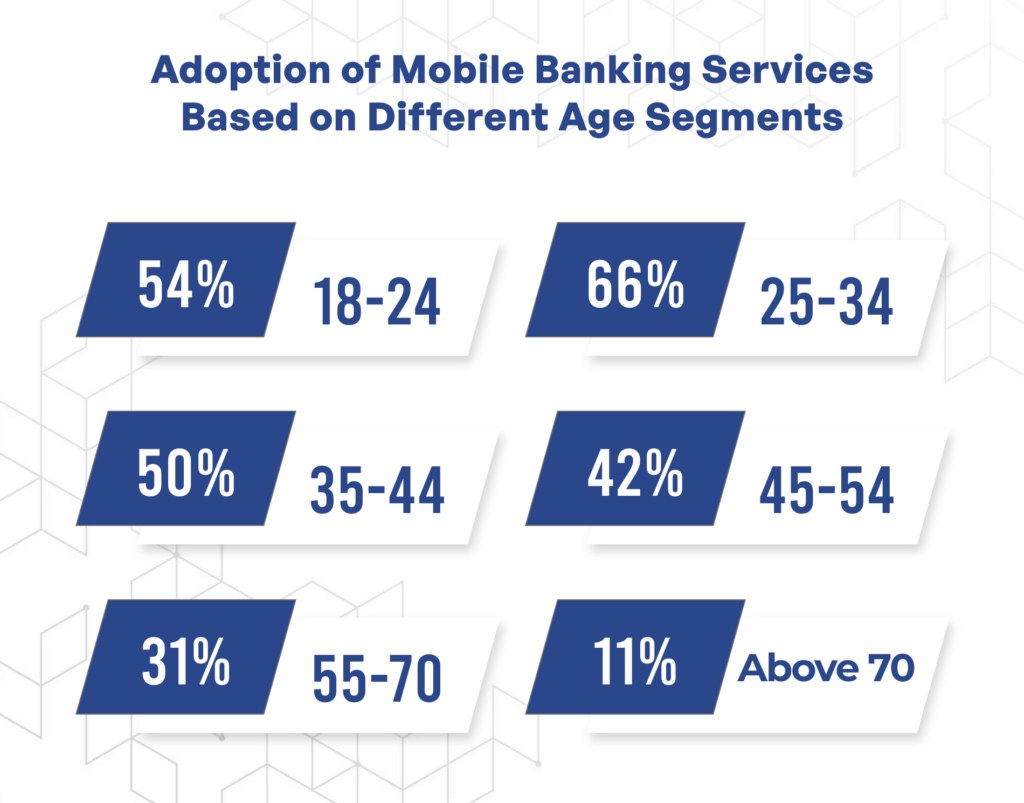

Therefore, businesses must get a comprehensive understanding of their audience and the demographics associated with them. However, in the case of mobile banking, your target audience could be significantly broad, especially when it comes to age groups. Now, these different age groups have varying user behaviors and mobile banking adoption rates.

For instance, users between 25 and 34 years of age are most likely to adopt mobile banking services. The reason is – most people in this age group are working professionals and have access to major digital technologies and devices. On the contrary, people who are 70 years or older are least likely to leverage mobile banking due to their reluctance towards advanced devices and technologies.

Similarly, users between 18 and 24 are most likely to consume mobile banking services for college or university fees, small purchases, etc. However, the age group ranging from 25 to 70 is more mature and focuses on big investments and expenses, such as utility bills, buying or selling property, cash flow management, etc.

Before you build a banking app, it is important to keep yourself updated about the latest trends in the market. Since these trends somehow act as the driving factors, a well-aware and efficient approach to them can offer you a competitive edge. Technological Analysts in the domain of digital banking picked out a few popular trends of mobile banking that can make a difference in 2023.

Developing a voice-enabled UI design can enhance user experience to the ultimate level. With generic voice commands, your customers can access the basic features of your mobile banking app at their own convenience. Eminent financial corporations like USAA and ING Direct Canada have already included this feature in their mobile banking platforms.

Banks and financial institutions can offer a single-channel mobile experience to their customers by providing them with account management tools to avail of basic banking services. Since over 80% of users in the US prefer their smartphones as the primary medium to access their bank accounts, these account management tools can be really helpful.

The role of AI in the banking sector is becoming more significant every day. From automating processes to increasing operational efficiency, AI has reshaped the financial domain extensively. Of all these areas, the one where the impact of this technology has proved to be more impressive is data security. AI in mobile banking can monitor payments and authenticate logins to detect whether there is any sign of unusual activities in a user’s account.

Another important trend in mobile banking is the integration of chatbots. These bots can help users remind them about pending transactions, bank offers, updated policies, and much more. They also resolve the basic customers’ queries with predefined commands. In addition, chatbots can recommend the preferred communication channels to users for better assistance from bank representatives.

It is nothing but the features that make an app more interactive and popular among your users. The more intriguing these features are, the greater the chances of your mobile banking app being downloaded and used by your customers.

Here are some of the prominent features of mobile banking apps that make them more engaging:

Mobile banking users always appreciate it when they can quickly transfer funds between accounts without facing any inconvenience. For this, it is crucial to integrate quick transaction features in your app that allow them to pay or receive money with feasibility. For instance, In the Google Pay app, the UI shows some of the recent users you have made a transaction with on the home screen as shortcuts to allow quick transactions.

Besides this, users can also add people to their favorite lists to skip searching for their names or numbers every time they need to transfer funds.

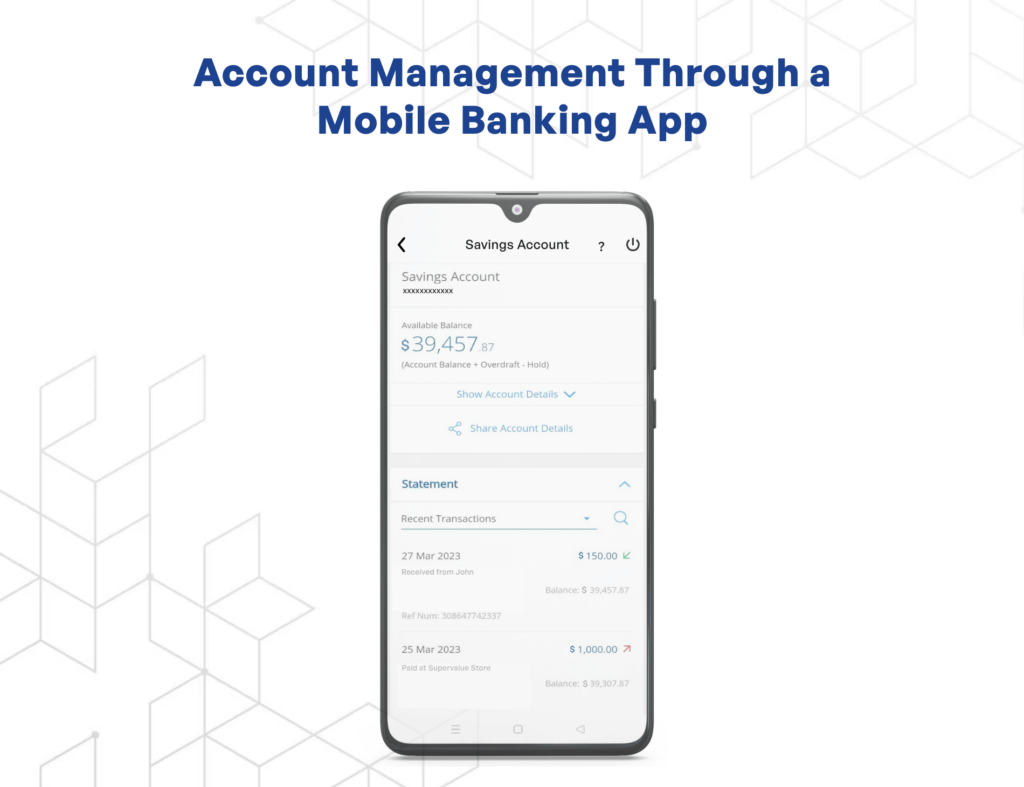

Managing bank accounts is the basic feature that every mobile banking app must have. Here are some of the operations that your users can perform using the account management feature:

It is important that the information regarding the bank balance is the same and updated in the banking app portal, irrespective of the device in which it is accessed.

A mobile banking app must have a separate section where you can manage all your cards. Besides managing, it can also provide users with an option to apply for new cards, close the existing ones, link them to their bank accounts, etc.

This feature allows users to track their expenses by reviewing the history of their recent transactions made by them.

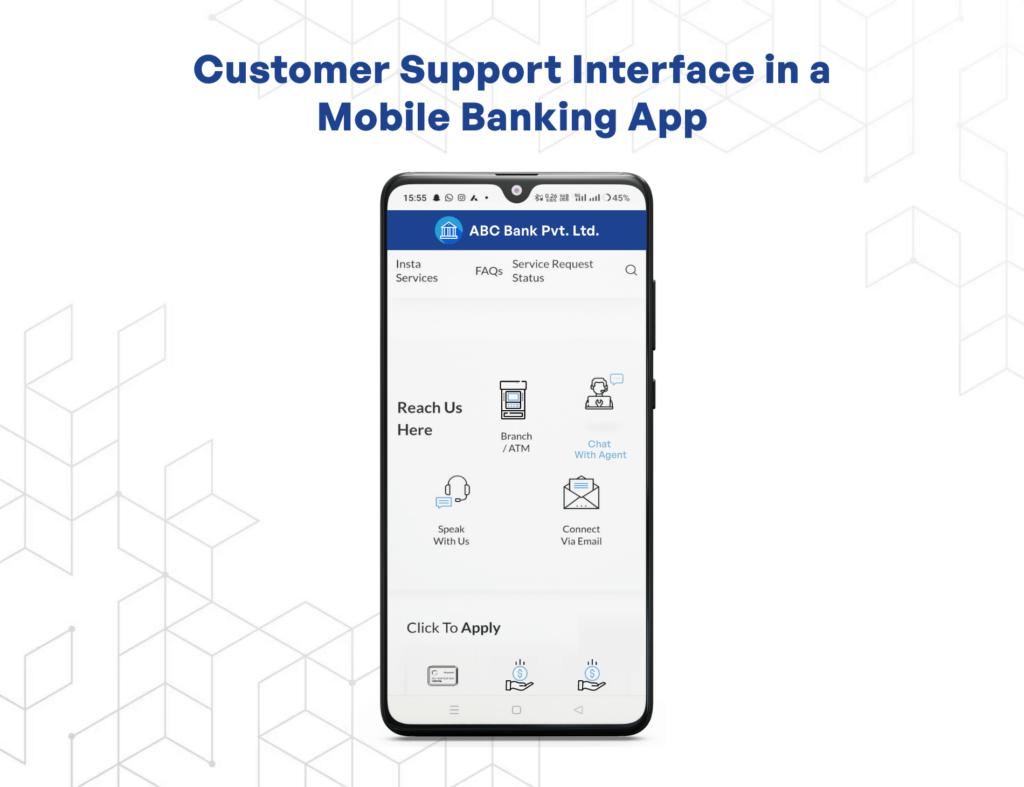

Besides making your banking app highly interactive and easily navigable, adding a customer support feature can make things better. Your customers might not have any problems with the app, but they can be inquisitive regarding the banking services they want to avail.

For such cases, it is a must to have a 24/7 digital support system prepared for them. The users can be provided with multiple options to connect with the support team, like email, live chat, or on-call. Apart from this, you can also integrate chatbots to increase efficiency and improve the level of customer service.

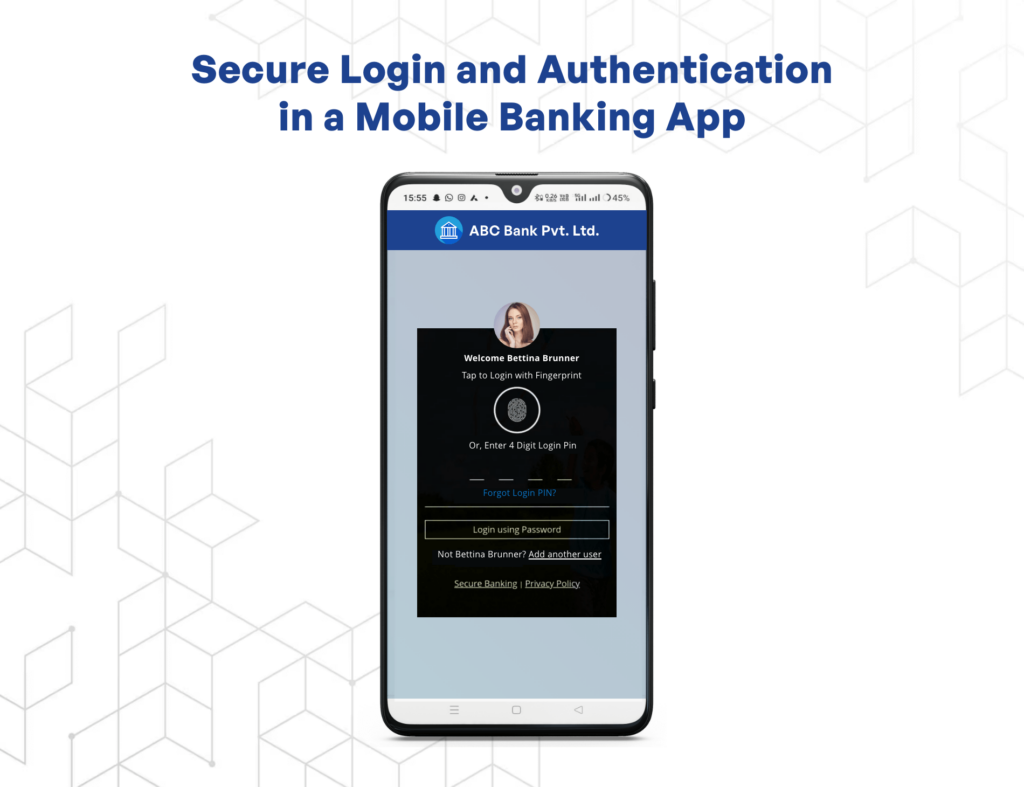

Accessing the mobile banking app should be super easy yet highly secure for your users. You must provide them with multiple methods to authenticate the login process. Some of the most prevalent ways include numeric secret pins and fingerprint authentication.

In between these two, signing into a bank account using your fingerprint has become the preferred method due to its high convenience and security. Since every fingerprint is unique, only a specific one can help access the app, make a transaction, change the password, or perform other critical actions.

One of the best ways for banks and other financial institutions to connect with their customers is through push notifications. Enterprises in the banking industry can use push notifications in different ways that impact their business to a large extent:

This kind of push notification notifies users regarding transactions, such as withdrawals, credits, etc.

As the name suggests, these notifications deal with sharing offers, discounts, investment plans, etc.

These types of notifications are mainly related to in-app operations and alert users to perform specific actions, such as changing passwords, attaching documents, etc.

This is an advanced feature that most banks, credit companies, and other enterprises in the financial domain have already implemented. It allows users to purchase a product or service by scanning a unique QR code of the merchant. The funds are directly transferred to the bank account associated with that code.

If you are clear about the prominent features to be added to your application, it’s time to go through all the crucial stages to create a mobile banking app. Here is the step-by-step procedure to create your own business app for mobile banking operations.

Many people wonder why it is important to initiate building an MVP when one can go straight with developing a mobile banking application. Well, the reason is a mobile banking system consists of several complex mechanisms that require the integration of several advanced technologies and features. In such a case, directly building a banking app from scratch could be both challenging and risky.

Developing an MVP in the first place can possibly be the best way to test your idea and determine its performance with your target audience. The cost incurred in MVP development is usually low and affordable. With it, you can figure out the good and bad about your banking app, and incorporate the advanced features later that fulfill the remaining demands of users.

In fact, to start with, you can create a prototype of your app. The cost of developing a mobile banking app prototype is a lot cheaper than developing an actual full-fledged app. In addition, you get an immense level of flexibility while tweaking features during prototyping. All you need is the right mobile app prototyping tools that make your work easy and speed up the development process.

The UI/UX design of any application plays a crucial role in making an app engaging and responsive. The best way to make it highly interactive is by using minimalistic elements – avoiding complex designs and making the features easily navigable. Besides this, it is crucial that you do not overload your banking with heavy graphical elements that make it slow to load.

Including relevant data visualization components is another aspect that improves the UI design of your app and generates value for your users. Lastly, the more personalized experience you offer to your customers, the greater are chances that they will like the app.

Every mobile application has some specific features and purposes to fulfill. In such a scenario, following the one-size-fits-all approach regarding technologies to choose for development doesn’t always work.

When it comes to choosing the right tech stack to create a banking app, you must consider your project requirements first. You need to pick a specific set of frontend and backend frameworks, an efficient database management system, robust APIs, and programming languages supporting the features you want in your application.

As discussed earlier, data security is the most crucial aspect, especially when it comes to mobile application development for banking. Therefore, it becomes a matter of prime importance to ensure that your banking application is completely safe for your users. Some most common tech models that you can integrate with mobile banking technology to create a safe transactional environment for your users are:

There are two widely used data encryption algorithms used in the banking and financial industry – 256-bit and SSL encryption. They are primarily used to encrypt specific data in the application and only the user with a specific encryption key can decrypt it.

Repacking an application means any intruder or cyber-criminal gets an app’s copy, unfolds it, inserts malicious code, and then repacks it. In order to prevent this, your development team must be self-aware while writing the code and integrate repackaging code detection systems into the app.

This is a common yet effective method used by developers to protect the app from unauthorized access and malicious activities. In this process, the source code is turned into a form that is highly challenging to understand or modify during decompilation but still preserves the required functionality.

Apart from these, there are some other techniques with which you can protect user data on a more superficial level. Here are they:

Finding The Right Development Team

One of the most challenging tasks while developing a mobile banking application is to find the right development team with expertise in creating fintech apps. The hired developers must clearly understand your mobile banking application requirements and what are your expectations with the project. Only a profound analysis of your needs can help in bringing your app idea to life.

Also, ensure that the development company signs an NDA for app development so that the ownership stays with you and data confidentiality is taken care of. You can check out the top fintech app development companies on verified company review portals, such as Clutch or Goodfirms for an informed decision.

All mobile banking technologies and solutions are different in terms of scope, purpose, and complexity. All these factors impact the cost of development and it becomes quite difficult to get an exact figure. Some of the critical aspects affecting the banking app development cost are:

The total time taken in app development can significantly impact the cost to build a banking app. Generally speaking, it takes around six to ten months only for creating the MVP of a mobile banking application. The more time it takes to develop an app, the greater will be the cost of development.

This goes for all types of mobile apps for banks – be it a digital wallet, an application just for card management, or a complete banking application. The more features you will incorporate into your mobile banking app, the longer it will take to build it. Consequently, the greater will be the cost of development.

The kind of frameworks, tools, or technologies you utilize to build a banking app also impact the mobile banking application development expenses. For instance, some tools are open-source, while others are only available as paid versions. Moreover, you will also need specific experts and additional resources to use those technologies to make the best out of them.

The location of the development company has a massive impact on the overall banking app development cost. For instance, the hourly rates of a software developer located in a developing nation are significantly lower than the ones residing in developed and technologically advanced countries.

In addition, the experience and type of development resources also influence the app-building expenses. Hiring professional fintech app development services will cost you slightly more but provide you with exceptional results. Meanwhile, outsourcing your app development project is another option, especially when you have a tight budget.

The mobile banking app market is skyrocketing on a global scale and businesses in the financial domain are leveraging the benefits of banking applications extensively. It’s certainly the right time to delve into the ongoing trends and plan for your own mobile banking system. All you need is a plan – a well-prepared strategy and a professional fintech app development partner by your side to make it happen.

Appventurez has got a great deal of experience in the field of fintech app development. The company consists of proficient developers, designers, and testers well-versed in developing banking apps and digital wallet solutions. They not only build a banking app as per your demands but also pay attention to the overall project for a scope of improvement at every stage of development.

Q. What are the primary challenges associated with mobile banking?

The major challenges in mobile banking include server-end issues, downtime errors in the application, security breaches, non-compliance with the main regulations, and intrusion of data-extracting malware.

Q. How does mobile banking work?

For mobile banking, users need a mobile device, say a smartphone or tablet, and download a specific mobile application in it. On creating a profile, linking bank accounts, and verifying the details, users can easily leverage most of the banking services on their devices.

Q. What characteristics make a banking app good?

In order to provide your customers with the best banking experience, it is crucial to build a banking app having top-notch security, appealing UI design, 24/7 customer support, and a comprehensive set of important features.

Elevate your journey and empower your choices with our insightful guidance.

VP – Pre Sales at Appventurez

Anand specializes in sales and business development as its VP - Sales and Presales. He supervises the pre-sales process by upscaling on establishing client relationships. He skillfully deploys instruments such as cloud computing, automation, data centers, information storage, and analytics to evaluate clients’ business activities.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.