The role of API in fintech is crucial as this intermediary software program allows communication among different systems and adds modern features that improve customer services.

Updated 3 April 2024

Global Delivery Head at Appventurez

The banking sector has undergone a massive transformation, integrating tech-intensive solutions to resolve complexities in operations. One of the key roles in this disruption is played by API in fintech, allowing diverse software systems to exchange data and communicate with each other.

These fintech APIs have helped several businesses to facilitate transparency in customer services, improving their operational efficiency and overall experience. A successful collaboration with a professional finance app development company can make this process of API integration seamless.

This blog will encompass all the essential information related to API in banking and finances. Besides their role, we will also discuss their prominent use cases and how financial API integration works.

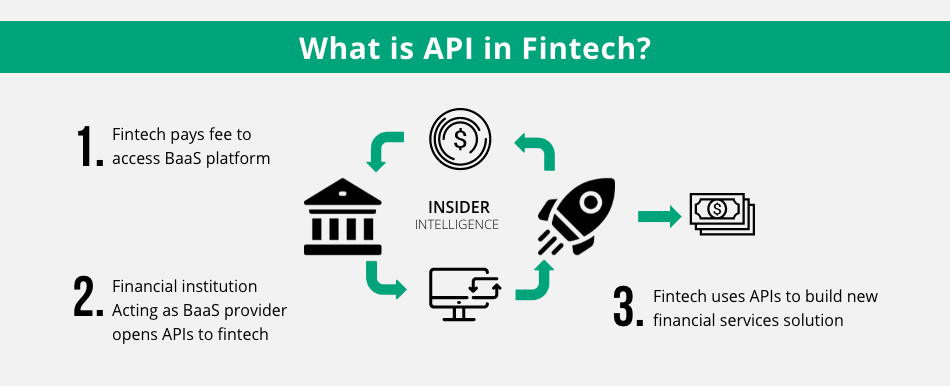

Fintech APIs can be defined as a set of protocols enabling seamless and secure communication between the bank’s server and the clients’ devices. They provide customers with a communication channel to interact with banking officials via their apps over internet connectivity.

Since this communication primarily involves data transfer and interactions regarding money, the APIs in banking need robust authentication and encryption.

Speaking of the backend, API in fintech links the developers to the payment networks, seamlessly showing billing information. This behind-the-scenes technological operation makes digital financing secure and convenient.

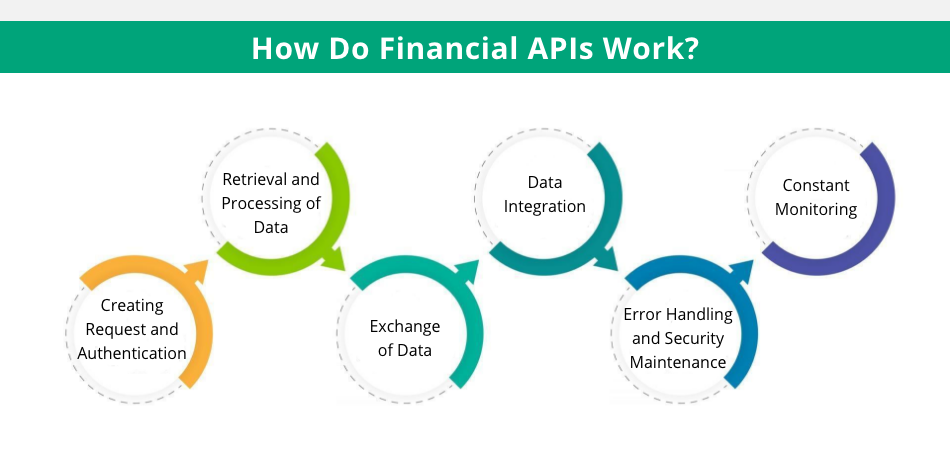

As already mentioned, API for fintech businesses works as a digital intermediary to expedite communication and data transfer between associated systems and applications. Here’s a detailed process of how financial API integration works:

When a user interacts with a fintech app to process a financial transaction, the system creates a request. These requests are authenticated with the user’s credentials or token verification to validate their identity.

These user requests are forwarded by fintech APIs to the server for processing. Under this stage, the system accesses databases, performs computations, or interacts with payment partners or banks for more details.

Once the server processes the requests and retrieves the required data, it reverts a response through the API in fintech. The response could comprise banking information, transaction confirmation, or other related details based on the user’s request.

The mobile banking application on the client side integrates this data into the app’s UI and shows it to the user. This data could also be used to perform some additional tasks if asked by the user.

The banking APIs further validate the requests to check errors or identify whether the request is incorrect. Besides, this bank API integration process requires the implementation of several security measures such as data encryption.

Last but not least, part of the API in fintech integration process involves continuous monitoring of API-based banking operations. This is a crucial stage as it ensures optimal performance and security of a banking application.

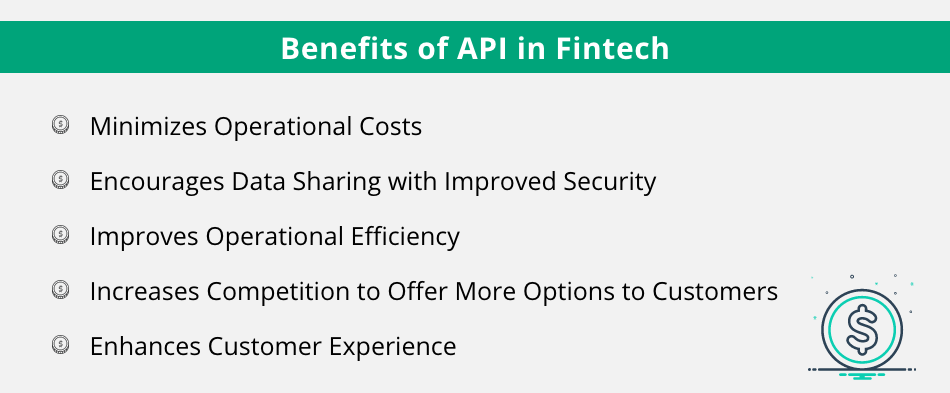

Leveraging the API banking technology comes with several advantages for both users and businesses. So, if you want to know why use financial APIs, below are some of the notable benefits of API in banking industry.

By using API in fintech, banks facilitate several financial services to users without investing in extensive infrastructure. For banking customers, these APIs help simplify their financial management and access wide-ranging services through their banking apps.

Consequently, implementing these APIs in financial services optimizes resource utilization and reduces operational costs.

Earlier, it used to be a challenge for banking institutions to share user information even with authorized third parties. However, this has significantly changed after introducing the application programming interface in banking.

By implementing a suitable API in fintech, the risks of potential threats, fraud, and errors have been considerably reduced. Now, users hold full access and control over their data, allowing them to share it with trusted third-party providers for better services.

Leveraging API in fintech allows greater opportunities for streamlining and automating financial operations. By using suitable APIs and integrating them with advanced technologies like AI in banking, businesses can significantly reduce manual processes, improving overall productivity.

This can further help in saving overhead expenses and making services faster, more convenient, and more comprehensible.

With the ever-evolving usage of API banking solutions, the competition in the financial sector has notably increased. Due to this high market competition, prices of financial services decrease, offering users to compare and choose between several banking options.

Furthermore, it also provides them with access to the facilities that were previously offered by their banks only. All thanks to the financial services aggregators using fintech APIs.

One of the best things about an API in fintech is that it helps create a more personalized and seamless user experience. Moreover, the way these APIs work allows banking institutions to serve their customers quickly and efficiently.

This can be easily understood by the fact that over 89% of US citizens prefer digital payments for financial transactions. Also, these API fintech apps make the integration between different financial systems seamless. Consequently, it makes accessing funds and managing finances across different channels convenient for users.

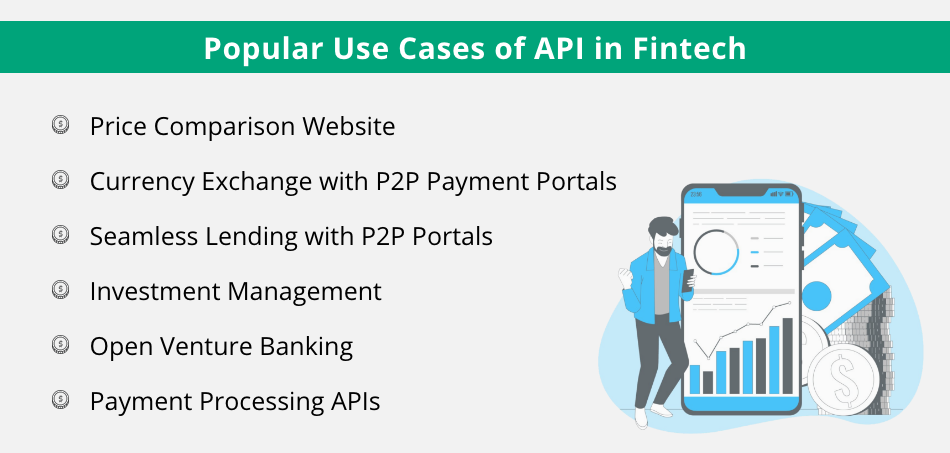

Exploring the different financial API use cases provides an idea about its applications in the banking sector. Below are some notable fintech API examples that significantly benefit financial institutions.

API in fintech can be used to compare prices of different financial products and services. It helps price comparison websites such as MoneySuperMarket to become direct online distributors of such products.

This not only helps businesses grow their commercial partnerships but also provides consumers with a platform to compare the prices of the commodities they want.

The blend of innovation and digital technologies in payment has transformed the landscape of financial services. The only challenge for the banking institutions has been the over-dependence on intermediaries that delay the process during currency exchange.

However, with the integration of APIs in banking apps, such as Wise, financial institutions can now eliminate intermediaries, making them independent providers.

Similar to currency exchange, lending portals like LendingClub are leveraging fintech APIs to connect lenders with borrowers bypassing intermediaries. These APIs allow users to search lending options, monitor loans, perform ordering, and configure the lending portfolios.

One of the prominent financial API use cases is investment management, which earlier used to be a challenge for financial advisors. This is because optimally managing investments and offering optimized services to customers require information about them. The challenge was to obtain this information.

However, after the implementation of API in fintech, getting a hold of client portfolios became easier, making investment management convenient.

By using different types of financial APIs, popular financial organizations such as ING have successfully launched various open and independent ventures. These ventures deal with different financial products and services that can be later integrated using API in fintech.

The role of payment processing APIs is notable, especially when it comes to online merchants and retailers for seamless transactions. One thing to note is that these APIs not only facilitate payments but also streamline the checkout process for users while performing online purchases.

With such prominent benefits and use cases of API in fintech, it won’t be wrong to say that its future is bright. However, integrating these APIs into your financial system is not an easy task, especially when you are not well-versed in this area.

That’s where you need a professional mobile app development company to help you with API integration in banking. Well, Appventurez is here for you to take up this job.

As an experienced and innovative fintech software development company, Appventurez knows the importance of APIs in a financial product. Our team holds expertise in different types of financial APIs that can make your fintech app faster, more secure, and more convenient. Our company has already developed some promising financial app solutions, namely:

Our experts ensure to craft a business-oriented fintech app for you, powered by robust API banking solutions. We also leverage the latest agile development methodologies to ensure the crafted solution is both productive and scalable.

Q. How does API work in banking?

API in banking allows users to access the financial services of a company and facilitates a digital connection between them and the bank.

Q. What is API in online banking?

API in digital banking is a set of tools that allows a fintech app solution to interact with users and perform the given tasks.

Q. How do financial APIs work?

The primary function of an API in fintech is to integrate the core banking platform of a financial institution with trusted third-party apps and networks. This helps them obtain user-permission data and use it to provide tailored banking services.

Elevate your journey and empower your choices with our insightful guidance.

Global Delivery Head at Appventurez

Ashish governs the process of software delivery operations. He ensures the end product attains the highest remarks in qualitative analysis and is streamlined to the clientele’s objectives. He has over a decade of experience as an iOS developer and teams mentorship.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.