In the insurance industry, an increasing number of organizations adopt robotic process automation. RPA is used by market-leading insurers to automate data input, repetitive operations, and even computational workloads.

Updated 4 October 2023

VP – Pre Sales at Appventurez

In the insurance industry, an increasing number of organizations adopt robotic process automation. RPA is used by market-leading insurers to automate data input, repetitive operations, and even computational workloads.

Robotic Process Automation in insurance has shown considerable potential in a variety of industries, including insurance. However, the arrival of RPA in the insurance sector is the solution to repetitive administrative activities undertaken by human labor.

The insurance sector is burdened by an abundance of complex and sophisticated activities, which affects client satisfaction and wastes a significant amount of time. RPA can help humans complete repetitive jobs more effectively, correctly, and relentlessly.

With the Robotic Process Automation in insurance sector, you can digitize insurance and use the time to advance your company up the value chain, concentrating on providing a better customer experience and creating services. However, you must first understand how to utilize a well-planned RPA for insurance to apply in your regular company operations. This article informs you about several automation areas, including:

Robotic process automation entails establishing a set of instructions for a robot to follow in response to triggers and replies. The most prevalent RPA applications in the insurance sector include configuring software robots to execute repetitive operations such as launching and controlling various other programs.

RPA requires less code since bots work automatically in apps on the user interface side of the presentation layer. As a result, RPA is an excellent alternative for insurance businesses that use outdated systems. Bots are compatible with the majority of existing systems, making this method of automation easier and less expensive to install than other ways of automation.

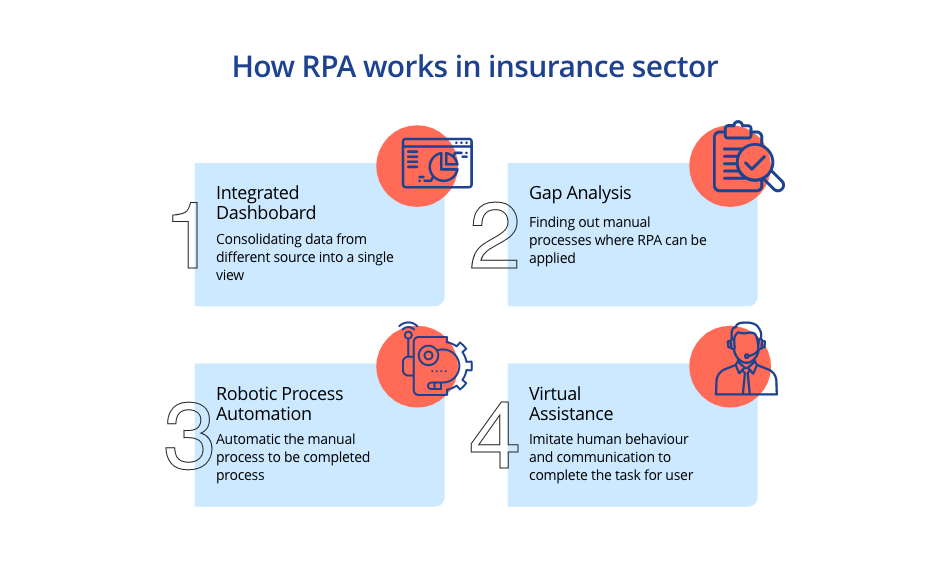

An insurance RPA business should emphasize process management first to get the most out of automation. The workflow management software makes it easier to automate a wide range of processes across platforms. Insurance businesses will use this platform and RPA to automate most data input and verification operations, as well as several phases of claim processing and risk analysis.

RPA enables the integration of old insurance systems, enhancing both operational effectiveness and customer satisfaction. Particularly, RPA platforms will integrate with systems at a lower level via application programming interfaces (APIs) and process activities all the way down to the mouse and keyboard levels.

When constructing their processes using RPA for end-to-end automation, organizations might employ API development. RPA technologies are ideal for a scattered workforce because they can:

Insurance companies use RPA to make services more customer-friendly and enhance back-office operations and modernize the workplace. Employees shouldn’t perform repetitive data input functions all day, after all, and channel their energy toward innovation and growth.

The following are some major benefits of RPA in insurance operations:

Employees acquire data from various papers and enter it into other systems when processing conventional claims. Customers now receive a quicker response when they register a claim, thanks to RPA bots they facilitate substantial volumes of claims data with just one click.

With RPA, insurers will accelerate a variety of data-rich activities, from the onboarding of new clients to the termination of policies. RPA can automatically transport data across different systems while navigating between them, reducing human labor and improving consumer satisfaction.

RPA in insurance is a terrific approach to improving productivity and reducing costs overall by streamlining corporate procedures. Additionally, businesses can reallocate staff to tasks with greater priority and promote expansion.

RPA bots utilize sophisticated document processing to automate a variety of manual data entry processes, freeing up staff members to work on high-value operations. This further results in greater organizational morale.

Using robots, legacy systems that could be replaced in a few years can be given a longer lifespan before being modified to operate with new systems. That will be set up considerably more quickly than conventional IT initiatives.

RPA use cases in insurance are widely used by insurance businesses to eliminate the need for human data input and free up staff members to perform specialized tasks.

According to a survey from Business Wire, 70% of executives believe RPA lowers manual mistakes and boosts employee engagement, and 60% believe it allows workers to concentrate on more strategic facets of their jobs.

The whole claims process, from the First Notice of Loss (FNOL) to adjustment and payment, will be streamlined with RPA bots. Insurance companies can free up their claims inspectors to deal with important problems and exceptions by automating their high-volume claims filing procedures. Standard claims are resolved quickly while staff members concentrate on problems that are crucial to the company.

Optical Character Recognition (OCR) and Robotic Process Automation (RPA) integration enable insurers to automatically decipher text from registration forms and route the data into the relevant workstreams. As a result, data quality and accuracy are improved, and insurance backlogs are decreased.

RPA is being used by insurers to offer novel goods and services such as customer portals, policy management applications, and quotes based on demand in an application. For instance, rates will be determined by a customer’s historical driving habits. Or, instead of requiring an adjuster visit, photographs of car damage will be automatically assessed for quick auto insurance claims.

Workers in the digital sector can assist those who assist clients. For instance, agents can handle service queries in real-time using attended bots or chatbot development in the application. RPA bots will improve staff cooperation, swiftly aggregate customer and product information, and boost policyholder retention.

Robotics in insurance can automate transactional and administrative processes. Insurance companies are also using RPA to increase operational effectiveness and decrease administrative hassles.

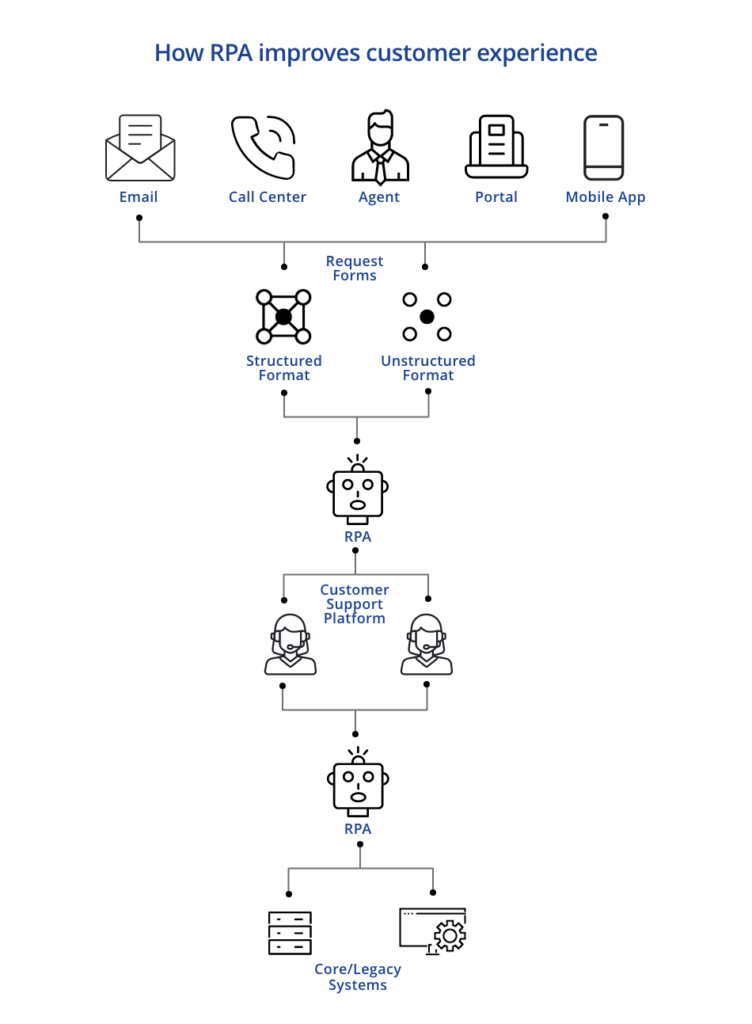

According to McKinsey research, RPA saves the time needed to process data by 34% in the insurance industry. To have a clear idea about the significance of RPA, have a look at the following flowchart, enabling the customer experience of the insurance companies.

Prior to a few years ago, insurance companies used RPA for straightforward tasks like processing claims and filling out forms.

However, RPA is already transforming the whole insurance process, including data extraction, error tracking, flagging, automatic claim routing, and precise process/business analytics, which allows insurance firms to save 30–50% of their time and effort.

As we know RPA is only the first step in the insurance industry to effectively operate, cognitive skills such as artificial intelligence and machine learning are also required. Your insurance company will become an intelligent, self-processing system by using cognitive software technologies by using natural processing language.

You might be shocked to know that automation in insurance can improve customers’ impressions of responsiveness and even release up to 30% of capacity at an enterprise level. In addition to this, here are some reasons to use RPA in the insurance sector:

RPA insurance services enable businesses to expand without affecting workflow. When you automate your insurance processes, you can anticipate:

With the rise of finance automation with ML finance technology specialists also think that businesses investing in RPA insurance will probably see a 100% return on their money right away.

It is widely known that insurance companies manage a lot of data, either manually or through data integration. In any case, Robotic Process Automation in insurance is the complete answer to the business’s digital transformation with technologies. Automation in the insurance industry will help organizations save a tonne of money by improving compliance and increasing revenues.

In the insurance industry, mistakes are quite expensive. Companies using RPA insurance services that allow an operational strategy to be impacted by human mistakes are more likely to have customer attrition and brand reputation issues.

With a clear and automated system, RPA automation software will assist you in managing the growing needs of policyholders and consumers. You will provide your consumers as a result with fewer or no faults.

Robotic Process Automation in insurance is the ideal option if you want to advance with sales. It enhances data processing skills and offers insights that aid in helping sales representatives connect with the appropriate customers and finally increase sales.

Without overlooking any nuances, intelligent automation in the insurance industry aids firms with pre-qualification, policy administration, regulatory compliance, claims to process, etc.

The success of automation projects depends on a carefully thought-out approach that is exactly in line with corporate goals. The two most important considerations for smooth process integration are budget and deadline.

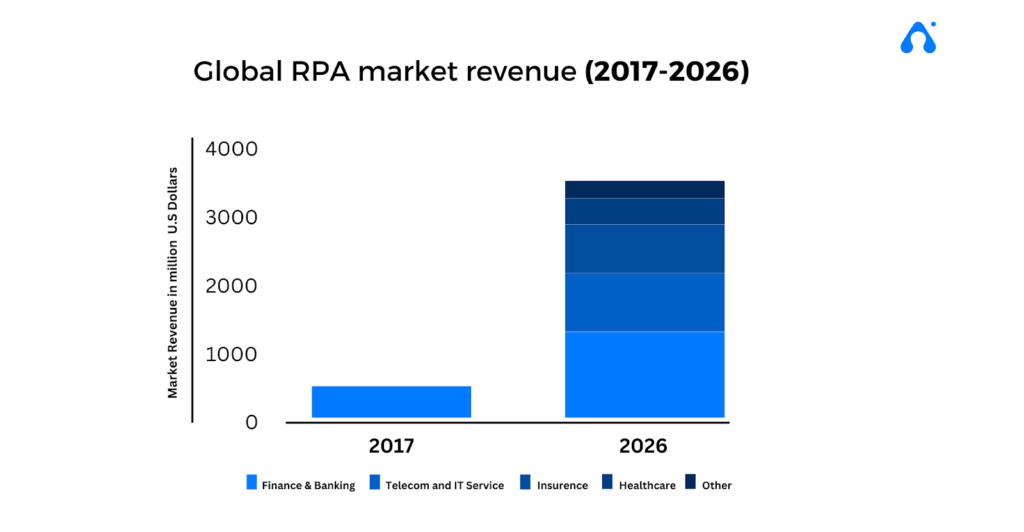

Market leaders in insurance will improve their workflow by automating time-consuming operations like data input, record maintenance, transaction facilitation, etc. This is possibly one of the most crucial reasons to use Robotic Process Automation in insurance. Further, it has been predicted that using RPA facts and figures for insurance would boost the insurance sector to $261.6 billion by 2026.

The global RPA market is expected to generate approximately $1202.1 million in sales by 2026 only for RPA.

Customers’ expectations are changing more quickly than ever as a result of increased competition in the insurance industry. For the insurance sector’s back-office process efficiency, insurers repurpose their resources for higher-level integrity, and more strategic work by automating routine, and rules-based transactions with RPA.

Insurance companies use robotic process automation with chatbot development services in the insurance sector to increase revenues, enhance compliance, maintain long-term corporate development, and provide exceptional customer service while lowering costs and lowering client dropout rates.

Worry not, we at Appventurez AI ML development company got the solution with RPA experts to solve your business problem. We have a team of financial experts who are known to reinvent the way people pay, buy and invest in today’s modern era. Consult your ideas and requirements to know the exact ratios for integrating this technology into your business infrastructure.

Q. How technology is changing the insurance industry?

Technology is helping carriers manage risk and use complex consumer data more effectively as insurance moves toward a “predict and prevent” model where data is shared more often between parties and insurers play an active role in claims prevention.

Q. What is robotic process automation in insurance?

RPA, or robotic process automation, is a term used in the insurance industry to describe the employment of rules-based, low-code software “bots” to handle human workers’ repetitive activities, such as gathering customer data, extracting data from claims, running background checks, and so on.

Q. How AI can help insurance companies?

Artificial intelligence (AI) assists insurers in risk assessment, fraud detection, and application process error reduction. As a result, insurers are in a better position to suggest consumers enroll in plans that suit their requirements. AI’s enhanced claim processing and customer service benefit customers.

Elevate your journey and empower your choices with our insightful guidance.

VP – Pre Sales at Appventurez

Anand specializes in sales and business development as its VP - Sales and Presales. He supervises the pre-sales process by upscaling on establishing client relationships. He skillfully deploys instruments such as cloud computing, automation, data centers, information storage, and analytics to evaluate clients’ business activities.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.