What is DeFi? It is an emerging financial technology for organising cryptocurrency based transactions and financial services.

Updated 21 February 2024

CTO at Appventurez

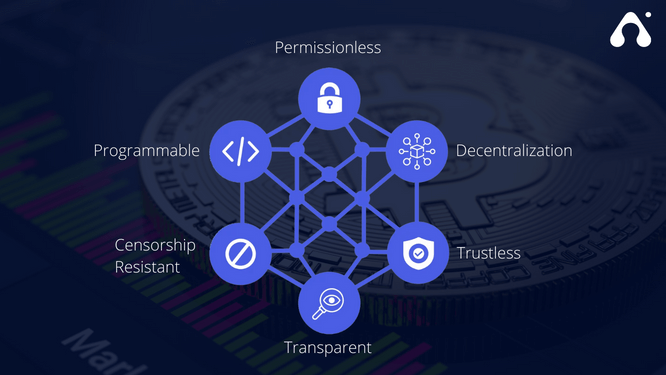

Decentralized finance is abbreviated as DeFi (pronounced dee-fy). It’s a young industry that allows users to avoid intermediaries and conduct financial transactions directly with others. As a result, it’s swiftly gaining acceptance as a viable substitute for conventional financial services. The majority of services provided by conventional banks and centralized financial institutions are now available through DeFi, and new goods and transactions are added daily.

A slew of crypto businesses have developed, each with its own set of ideas and methods, but all with the same goal in mind. The goal of making financial services available on a global scale.

What is Decentralized Finance ? is a new world being shaped by the acceptance of blockchain technology in finance and the expansion of decentralized financial services (DeFi). This environment is distinguished by worldwide accessibility to financial services, secure transactions, cheap transaction costs, and the most recent DeFi developments circulating in the market.

If you’re trying to understand what is DeFi and aims to grasp the essence of what DeFi represents, you’re in the right place. In this essay, we’ll be skimming the outer ring of DeFi, providing you with a starting point for your journey. So, hop aboard the shuttle as we navigate the intricacies of this revolutionary financial system! Additionally, as the DeFi landscape evolves, it’s worth noting the role of blockchain app development services in crafting applications that align with the principles and opportunities presented by decentralized finance.

Decentralized financial services, or DeFi, are those offered by blockchain technology trends as opposed to “centralized” financial services offered by banks or other conventional financial organizations that are built on blockchain.

The majority of activities offered by traditional banks using government-issued fiat currencies may be performed by participants using cryptocurrency, including lending, borrowing, earning interest, trading goods, purchasing insurance, and more. While answering the question what is DeFi, it is important to understand that these services are often quicker, more affordable, and simpler, and new benefits and services are always being introduced.

Participants in the decentralized finance ecosystem deal with each other directly via smart contracts, which eliminates the need for traditional financial institutions to act as guarantors for transactions. Blockchain technology for business is used to safeguard transactions. The majority of DeFi devices don’t seize your money, giving you complete control over your assets.

You may access your money or possessions with DeFi by utilizing a safe digital wallet. Smart contracts allow you to start transactions whenever you wish to deal, which requires that both you and the other party accept several specific terms. For instance, a smart contract may be set up to automatically transmit money to a certain account regularly as long as there are enough funds to support it. Money cannot be redirected and sent to a different account after a smart contract has been set up; it cannot be changed.

The majority of DeFi apps are created on the Ethereum blockchain, however, Cardano, Binance, and Solana are all rapidly producing comparable software. However, while understanding what is DeFi, we should understand that while in comparison to centralized financial systems, DeFi is still in its infancy, hence new apps are constantly being launched.

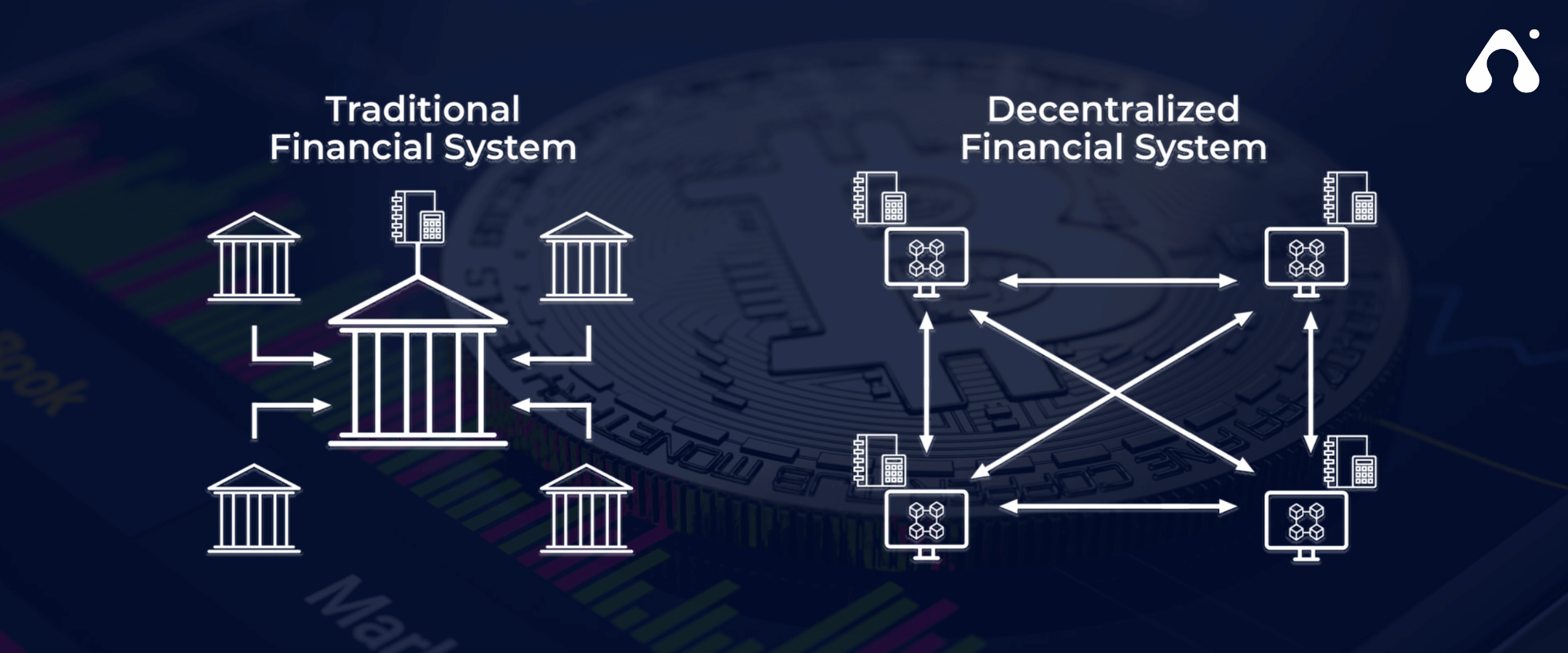

The default financial environment in which the world now runs is one of centralization, with payments, loans, and trading activities all going via intermediaries that are closely regulated locally. On the other hand, decentralized finance offers a wide range of benefits by allowing users to trade through financial apps over a blockchain network & how it works in DeFi, eliminating intermediaries like traditional banking organizations.

DeFi not only increases efficiency and reduces costs by doing away with middlemen, but it also greatly expands access to financial services. In the realm of centralized finance, not everyone is granted access to certain financial services or permitted to create a bank account.

Consequently, DeFi has the potential to financially emancipate billions of individuals worldwide who are now denied access to banking services. In today’s era AI is taking the banking sector to the next level.

Decentralized finance also offers the benefits of DeFi offering greater freedom, such as unrestricted trading hours as opposed to centralized finance.

There are some inherent decentralized differences to take into account for differentiating between Decentralized Finance (DeFi) and fintech with AI technology, even though Decentralized Finance (DeFi) use cases are merely an advanced version of the finance structure with the same core working, lying in receiving and giving money. one that elevates Blockchain development services to the status of one of the major Fintech trends for the years 2022 and beyond.

You might be thinking, “How is decentralized finance possible?” as we explain what DeFi is. With the use of so-called “smart contracts,” it is conceivable. Smart contracts are used in blockchain protocols like Ethereum to define the terms of transactions. Furthermore, if certain requirements are met, smart contracts carry out the transactions and store the assets.

The foundations of DeFi depend heavily on smart contracts. They are the foundation of decentralized or intermediary-free transactions. Furthermore, they provide smooth communication between various DeFi systems. Solidity, Ethereum’s programming language, is used by programmers today to create smart contracts (the first Turing-complete blockchain).

But several other blockchains have appeared since the debut of Ethereum, each with unique advantages of DeFi. These blockchains have improved upon Ethereum’s and the EVM’s (Ethereum Virtual Machine) expertise by changing things like transaction speeds and gas fee structures.

If you’re searching for an explanation of NFT, see our blog – What is NFT? A detailed guide on it.

DeFi apps can take on as many different forms as there are financial products, services, and organizations. Although there are no restrictions, the opportunity to produce many more different sorts of apps is unbounded since DeFi copies improve upon, or innovate our present financial services. In addition, one must consider the many DeFi applications that exist and the elements that make up the importance of decentralized finance to adequately answer the question, “What is DeFi?” As a result, the principal types of DeFi dapps and components are illustrated in the following sections.

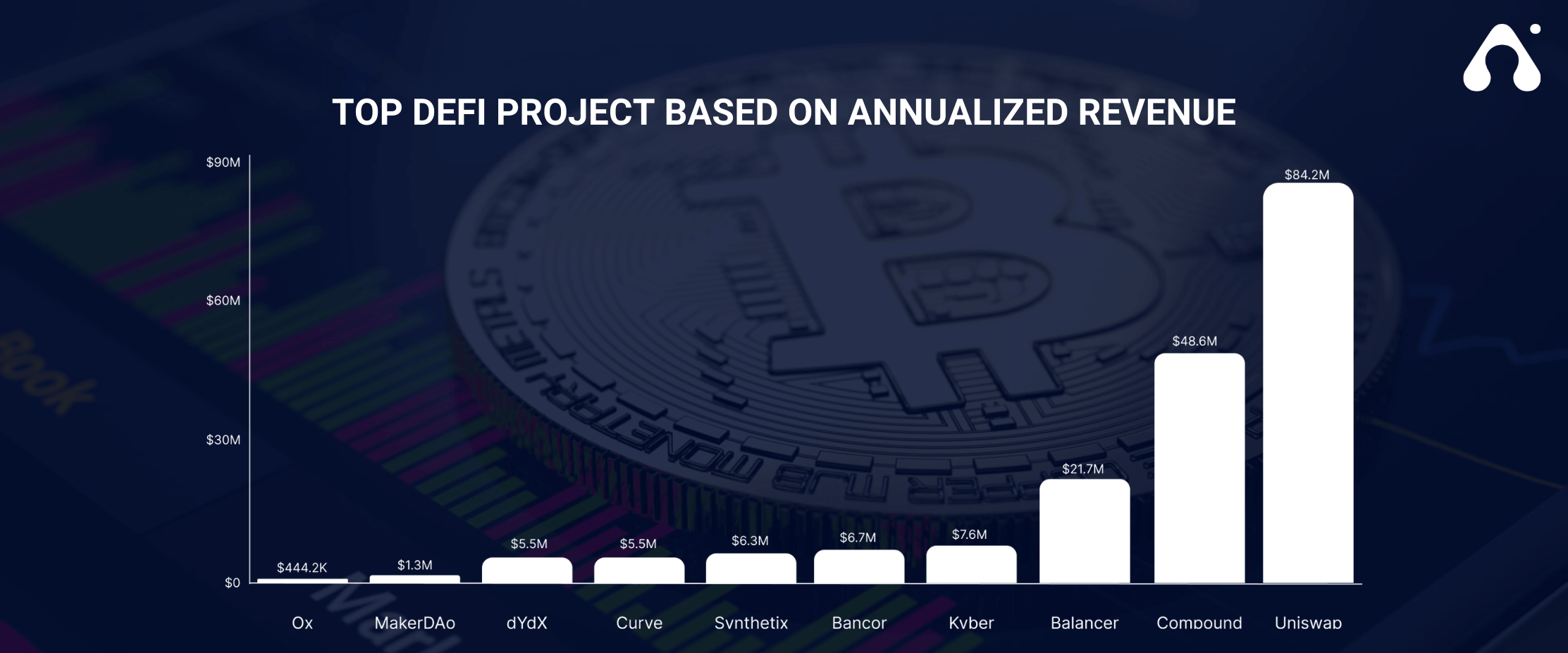

Without the necessity for conventional KYC, consumers may trade their crypto assets on decentralized exchanges, or DEXs. As a result, they permit pseudonymous or anonymous trading. Trading on DEXs is also permissionless. Additionally, the popularity of DEXs like Uniswap and PancakeSwap in DeFi demonstrates how important a role they play in sustaining the crypto economy.

Stablecoins are digital currencies that are linked to a specific price. The majority are tied to the US currency (USD). Therefore, a stablecoin that is tied to and supported by the USD will always be worth $1. Although there are other kinds of stablecoins besides those using fiat collateral, including:

Are less centralized than fiat-backed stablecoins and are typically over-collateralized to absorb swings.

These employ commodities as collateral, such as gold, real estate, oil, and other precious metals.

Stablecoins like this employ an algorithm to restrict supply and the seigniorage share technique.

Stablecoins are very beneficial in DeFi environments. Dominant cryptocurrencies or crypto assets, such as the Bitcoin wallet app or Ethereum, can be extremely volatile and are not suitable for all applications.

On a separate blockchain, wrapped coins are coins that are represented by another coin. Typically, this promotes interoperability and speeds up transactions. One of the most useful concepts in DeFi, even if the execution is more complicated than the concept. Additionally, when coins are wrapped, their value is maintained even when being exchanged on a different blockchain. On Ethereum, for instance, wrapped BTC may be traded as BTC. Additionally, the depicted currency may completely support the wrapped currency.

The same rules that govern traditional credit apply to Dapps that allow lending and borrowing. The sole distinction is the absence of a middleman. For instance, cryptocurrencies such as Bitcoin or Ethereum can be used as collateral to borrow stablecoins.

If you’ve ever questioned if gambling dapps fall within the definition of “DeFi applications” or not, the answer is yes. Such gambling dapps place a strong emphasis on anonymity, decentralization, and distrustfulness in DeFi. Additionally, it is feasible to present gaming outcomes transparently with gambling dapps while maintaining user privacy.

All unbanked people in the world can have their lives transformed by the growing use of open finance platforms and procedures.

The costs that international employees must pay on the remittance market, where they transmit billions of dollars across borders to their families, are exorbitant. These expenses might be reduced by more than 50% thanks to trends in decentralized finance services. This boosts worker productivity while simultaneously promoting economic growth with the trending technology.

Loans are the other difficult area that may be handled by focusing on DeFi’s benefits. Due to a lack of credit or a problematic banking history, it is now difficult for the unbanked to borrow money. By connecting borrowers and lenders, the risks of decentralized finance platforms do away with the need for credit checks.

These two instances just begin to scratch the surface of how blockchain is influencing the finance industry. Blockchain is only getting ready to develop novel use cases of DeFi in every Fintech real-world application by eliminating errors and intermediaries and bringing transparency and a lack of centralized control into the picture.

Every financial instrument with a high rate of return has a risk. It follows that a list of DeFi’s difficulties will also exist.

Utilizing cryptocurrency technologies safely and effectively requires specific expertise and associated risk. The user now has to handle their key with care, keep it private, and adhere to the multi-factor authentication method.

A lot too many security-related mishaps have also occurred, necessitating the introduction of strict security and privacy algorithms by reliable blockchain development firms. While the duty has been handed off to the solution’s developers, DeFi users must also be informed of any modifications to the service conditions of various wallets, exchanges, and other cryptocurrency initiatives.

Finally, before making any investment decisions, investors might consider historical data and benchmarks in the case of conventional currencies. However, DeFi users do not enjoy the same access. They find it challenging to evaluate the related risk because there aren’t any previous data points. As a result, they are forced to do in-depth independent research.

If you want to check out the PE ratio of the most popular DeFi applications, Token Terminal does a great job at providing accessible data.

The industry has existed since the dawn of humanity, and cryptocurrency is only its most recent digital product. Every financial service we currently utilize under the fiat system is likely to be replicated in the DeFi and open finance environment shortly.

The initial generation of Defi applications heavily relies on the use of collateral as a safety mechanism, which means you must first hold cryptocurrency before you can use it as collateral to borrow additional cryptocurrency.

Due to the most recent modifications of DeFi applications, we are already witnessing enormous innovation in the insurance sector. Many of the DeFi loans available today are overcollateralized (the loans are rendered fundamentally secure by the significant asset cushion held in the reserve).

Cryptocurrency wallets are also likely to take on the role of the hub for all activity involving digital assets in the future. You might think of it as a dashboard that not only displays the assets you hold but also the percentage of those assets that are restricted to certain open finance protocols, such as pools, loans, and insurance contracts.

We observers find it more than intriguing that the future of DeFi and money is in the hands of anyone who can code.

Are you equipped to handle this coming change? If you believe that your app or ideas are prepared to incorporate the modifications, contact Appventurez, a reputable and trustworthy business that specializes in Blockchain app development Company USA is a business that will support you in continuing your decentralized journey by offering the best blockchain app development services.

Q. What is DeFi investing in?

DeFi, or decentralized finance, is a novel idea in banking and finance that relies on peer-to-peer transactions made possible by blockchain technology. DeFi uses blockchain to provide "trust-less" banking, eschewing conventional financial intermediaries like banks or brokers.

Q. How do DeFi companies make money?

The pool gives a portion of the obtained fees to the user as incentives and repurposes the invested cryptocurrency to offer liquidity for DeFi protocols. Ether (ETH) and other ERC-20 tokens are accepted for investments and rewards on DeFi yield farms.

Q. What is DeFi and metaverse?

The virtual worlds of Metaverse, DeFi (Decentralized Finance), and NFT (non-fungible tokens) all have practical applications in the real world. The connection between the virtual environment and actual problems and interactions is made easier through accessibility.

Elevate your journey and empower your choices with our insightful guidance.

CTO at Appventurez

CTO and Co-Founder at Appventurez, Sitaram Sharma has 10+ years of experience in providing world-class digital solutions. As a CTO, he brought his expertise ranging from product enhancements to advanced technological integrations, while focusing on the consistent growth of the team.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.