In the domain of short-term financing solutions, Buy Now Pay Later emerges as the most convenient option, allowing consumers to make purchases, usually with no interest.

Updated 2 February 2024

Head of Marketing at Appventurez

Buy Now Pay Later has emerged as an alternative payment method that provides the benefit of paying back in instalments and according to the convenience of the consumer. Even though this form of payment option has been available for years, the growing popularity of buy now pay later can be credited to the pandemic which provided a huge boost to online shopping.

BNPL is a payment option where the consumer can make a purchase and pay for it over time, usually with no interest. The plan can be opted for as one of the options during the checkout process as it requires an upfront payment followed by three bi-weekly payments. Considering the emerging popularity of Buy Now Pay Later, businesses in the financial industry often opt for fintech app development services to develop seamless BNPL solutions.

Under buy now pay later, payments can be automatically deducted from the consumer’s bank account when the bill is due. Consumers have the option of paying through bank cheques, but as per the Consumer Financial Protection Bureau (CFPB), most BNPL lenders don’t give any other option than autopay.

There is no doubt, that buy now pay later market has emerged as an efficient option as it has seen unprecedented growth in the past few years. Read more below to know how BNPL works and what makes it the consumer’s most preferred payment option.

Buy now pay later solutions provide an easy way for the consumer to pay for the purchase later. Usually, BNPL programs have different terms and conditions, but most of the programs offer short-term loans, with fixed payments and zero percent interest. The consumer can easily use a BNPL app for the purchase or may access the buy now, pay later option through credit cards.

Under BNPL, the consumer can purchase from a participating retailer and can opt for buy now pay later during the checkout. If approved, they can make a down payment, such as 25% of the total purchase, and pay the remaining amount in a series of interest-free installments.

In some cases, the payment can also be done through a bank transfer or cheque. Although, as per the Consumer Financial Protection Bureau (CFPB), most lenders only provide the option of autopay.

Notably, the evolution of buy now pay later markets can be traced back to the pre-COVID period as the best-known brands of the service have been on the market for around five to seven years. Companies such as Klarna and Afterpay were among the first to offer BNPL. As the demand of the buy now pay later industry increases, companies have been continuously working on refining their offerings and expanding their reach.

Buy Now, Pay Later is a payment option that has seen a rise more recently than earlier. As per the reports, from the year 2019 to 2021, the number of BNPL loans originated in the United States by five lenders that it surveyed grew from 16.8 million to 180 million.

Notably, the rise in the BNPL trends, which was once most popular only among beauty and apparel purchases, has branched out into other areas such as pet care, travel, gas, and groceries.

It was also reported that the users of BNPL services were far more likely to have payday loans, bank overdrafts, pawn loans, and other high-interest financial products. It further indicates that the buyers are more financially unstable than the non-users of BNPL financing.

As the cloud of inflation persists, the option of buy now pay later has emerged as the tool for those who try to fit higher prices on a limited budget. It is also becoming another significant option for managing the budget as consumers are drawn to BNPL to avoid paying interest on an item that they might ordinarily use their credit card for. In this case, the consumer is saving money while also simultaneously enjoying the purchase for which they can conveniently pay in installments.

Reportedly, total BNPL loans issued by the largest US providers have tripled in a single year, from $ 8.3 billion in 2020 to 24.2 billion in 2021. BNPL can benefit consumers without credit or replace the high rate credit cards or payday loans.

In the past few years, various domains saw enormous and unprecedented growth as they opted for a much-convenient more digital method. The move was welcomed both by the businesses and the consumers.

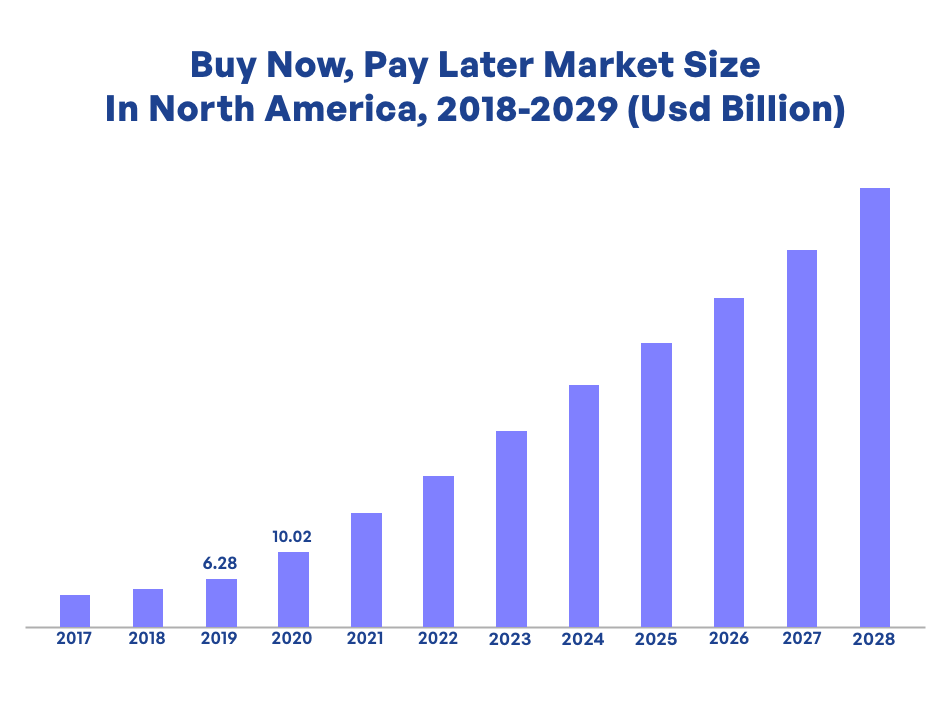

Impact of Buy Now Pay Later has been tremendous on how consumers. The global market size of buy now pay later was valued at $15.91 billion in 2021 and is projected to grow to USD 90.51 billion by the year 2029. The growth in the buy now pay later market size also indicates an increase in the BNPL trends where new players are expected to expand as per the demand.

The increasing number of e-commerce platforms and the rising service adoption across the millennials in developed countries have propelled the market growth and has increased buy now pay later trends. Reportedly, the number of consumers of BNPL has increased by 300% in the United States since 2018, with 45 million users in 2021. Their spending has been valued at around USD 20.8 billion.

The market size of buy Now pay Later can also be credited to the trend followed by e-commerce companies that are adopting BNPL services to facilitate their customers across the globe. Another factor resulting in the rise of BNPL trends is that the leading players in the market have been investing in developing advanced BNPL applications and services.

Buy Now Pay Later has become one of the prominent payment options for online shoppers in various ways. BNPL services run only a soft credit check that does not further impact the credit rating of the customer. The instant approval provided by BNPL to the users is one of the prime reasons for its sudden growth in the market. Check below some of the other benefits that BNPL offers to its user:

Unlike credit cards, the Buy Now Pay Later plan has an easy repayment structure that facilitates its user to repay the amount on a weekly or monthly basis. Most BNPL loans are designed to be paid off in four installments and once the loan is paid, it disappears. There is no revolving credit line like with major credit cards.

With the leverage of flexible payment methods, customers can successfully complete the checkout even if they are waiting for the month’s paycheck. It is BNPL’s more inclusive payment method that increases the chance of conversion rates of the customers.

If there are chances to make the repayment of the product over time, there are chances that the consumer will opt to purchase items of higher value. As per the reports, merchants implementing the Buy Now Pay Later technology increased their average checkout value by 60 percent and also saw a 20% increase in conversion.

The businesses offering BNPL services are likely to attract new customers who prefer this payment method. Notably, the rate of American shoppers who used BNPL increased by 80% between 2020 and 2021 alone.

Even though BNPL does not seem like a complicated plan, the impact of BNPL can still be seen on the consumer. It can also affect their credibility for future payment capability.

Most of the buy now pay later companies only require a soft credit check for approval, which doesn’t affect the consumers’ credit score. However, other companies may conduct a hard pull of the credit file, knocking off the consumer’s score temporarily.

Some buy now pay later loans are also reported to one or more of the three major credit bureaus. It could show up on the credit reports and can also have an impact on the consumer’s credit score.

After agreeing to the BNPL loan, it becomes important to ensure that the monthly installments are paid on time. In case, the installments are not paid, it could negatively impact the credit history, report, and score. As per the reports, those who use BNPL loans frequently often have delinquencies on their other credit lines and adverse impact on credit scores.

Buy Now Pay Later has introduced a new perspective in the market which has altered the way consumers are opting to pay. It has become a prominent form of financing over the years, particularly with BNPL specialists such as Klarna and Affirm gaining popularity.

Buy Now Pay Later emerged as more than a convenient payment method and it essentially decreased the financial burden on the borrowers by offering no-cost EMI. It has helped consumers in breaking large expenses into smaller, interest-free EMIs, rather than having to dive deep into their pockets.

Buy Now, Pay Later has not only eased the purchases of consumers of daily essentials but has also bought aspirational products within their reach. Most importantly, BNPL has become an agile solution that appeals to today’s youth who are known for their habit of instant purchases. In the future, BNPL is expected to continue to rise in popularity as a payment method benefitting all players.

BNPL payment options are responsible for increasing the purchasing power of the consumer. However, before choosing the plan, one should familiarize themselves with the challenges of the BNPL market and what are risks of using bnpl apps.

First of all, the consumer needs to understand the repayment terms to which they are agreeing while choosing the BNPL option. Since BNPL financing is not as closely regulated as credit cards are, it is suggested to go through the terms and conditions of BNPL lenders thoroughly and then proceed with the plan.

Understanding how the payment system will work will help the consumer in managing the installments and will ensure that they can afford the payments and can make them on time. Missing a payment for the BNPL program can result in late fees and the late payment history could also be reported to the credit bureaus.

Before diving into the BNPL option, the consumer should consider store return policies and how buy now, pay later can affect one’s ability to return the purchased product. For instance, a merchant may provide the consumer with an option of returning the item, but they might not be able to cancel the BNPL arrangement until it is not proven that the return has been accepted and processed.

In consumer finance, Buy Now Pay Later has created one of the fastest-growing segments. The business model of BNPL has emerged out of a very interest-rate environment. It enabled the firms to raise funds at a relatively low cost and in return offer point-of-sale to customers on shopping websites.

Under the BNPL model, the consumer pay for their purchases in installments, usually interest-free. In return, BNPL firms charge online retailers a fee for each transaction.

The model proved extremely popular with young buyers as e-commerce soared in the past few years. However, as people returned to their normal day-to-day pattern, they started cutting their spending costs, and the firms started squeezing their margins. Top BNPL firms faced massive layoffs, including Klarna which laid off 10% of its workforce.

For smaller players in the BNPL market, many of them start-ups, accessing funding to lend to shoppers has become more difficult to retain. Even though, the sector saw increased demand in the past few years, the constant scrutiny of the regulators can result in one of the major drawbacks for the BNPL business model.

Buy Now Pay Later companies make revenue from mainly two methods. The first is from the sellers and the other one is from customers with interest fees and late fees charged from delayed payments:

For vendors, Buy Now Pay Later is an alternative payment method and thus they have to bear a transaction fee like any other medium at a particular rate. To earn revenue, BNPL firms charge online retailers a fee for each transaction, and in return, BNPL service attracts customers to opt for the retailers for future purchases.

Most lenders prefer soft-check of the customers to avoid lending money to those with a negative financial record in order to fulfill the repaying obligation. However, the method is not followed by all the lenders of BNPL.

BNPL earns from its customers in a form of interest rates. It varies from company to company, but some providers opt to charge an interest of 10-30% on the loan amount, depending widely on the customer’s credit and duration of repayment. On the other hand, there are organizations in the US that do not charge any interest rate as long as the consumer pays the installments on time.

The lenders of Buy Now Pay Later make a major chunk of their money from the late fees charged on delayed payments. Depending on the organization, it can go as high as 30%. Late fees in BNPL occur when a charge is imposed on a customer for not making the payment on time.

The growth of technology is responsible for rapidly changing the financial landscape, providing various options for digital payments. Buy now pay later, as mentioned, allows the consumers to pay for things over time without interest charges. These loans also do not add to the consumer’s credit card debts. However, they do add to the personal loan debt. Some of the Pros and Cons of buy Now Pay Later option are listed below.

The buy now pay later future seems bright given the fact that the purchasing power of the consumer has increased. BNPL provides an easier way for instant purchases even if the budget doesn’t allow it. The option of paying later in installments not only ensures convenience, but the monthly or weekly arrangement of the paying back also gives plenty of time to save the required amount.

Buy now pay later services will mostly be benefited because of its customer who is just a click away from a variety of options available for purchase. However, lenders will have to take notice of the fact that not everyone will be capable of paying back and must be careful before offering the service.

BNPL, from the consumer’s point of view, might seem convenient but if one is considering using the plan, it must be made sure that terms and conditions are understood and that the consumer will be able to make the payments on time. It must also be considered that the payments are affordable and the penalties that will be faced by the consumer in case they are unable to pay.

E-commerce companies experienced rapid growth in the past two years. As online shopping grew, the growth of buy now, pay later also increased as the alternative payment method became popular among consumers. Though some of the BNPL providers started offering the services in 2012, the past few years saw unprecedented growth in the financing market.

The evolution of BNPL should also be credited to the fact that the service appeal to all shoppers across all demographics. Particularly the young shoppers who haven’t had the opportunity to build their credit scores have had the opportunity to feel financially empowered while easily avoiding interest and fees.

Notably, despite the recent market volatility of Buy Now Pay Later, the transaction volume and integration across shopping platforms are expected to grow in the future.

Digital Payment methods such as BNPL have seen a significant rise. These services are the entities that provide the luxury of transactions via the digital or an online mode, without any involvement of the physical exchange of money.

Considering this, the development of an alternative payment method not only welcomes more consumer-friendly businesses but also helps in understanding consumer behavior.

Notably, Appventurez has been playing a major role in transforming finance through secure fintech app development services. The company in its mission to make a digital payment that is safe and secure has also served more than 10 app development services with a promise to make digital payment more accessible.

The team at Appventurez not only provides efficient services but also understands the market where the service is much suited and has a scope for expansion. This also further helps with the vision of where the businesses see themselves in the next few years.

Q. What is the meaning of the buy now, pay later business?

BNPL (buy now pay later) is a type of short-term financing that allows the customer to pay in installments over a defined period. The payments are often made with no interest or fees.

Q. What are the risks of BNPL for consumers?

While buy now, pay later does not usually charge interest or fees, there is an increased risk of using BNPL apps as it is encouraging more lenders to opt for the minimum interest rate. Considering this, the consumer must go through the terms and conditions carefully. They should also take hold of the fact that late payments might come with heavy fines.

Q. How businesses can be benefitted from buy now, pay later?

Businesses offering BNPL plans can increase brand awareness, and raise revenue and customer loyalty. The increased conversion rates are also one of the immediate benefits that come with BNPL as the consumers who leverage BNPL are more likely to complete a purchase than those who do not.

Q. What is the future of buy now, pay later in India?

As one of the largest growing economies, there is no doubt that India will see a much brighter future in short-term financing. With an increased purchasing power, the consumer is looking forward to alternative plans such as BNPL where paying back for the purchase is convenient and can be done in installments without any interest.

Elevate your journey and empower your choices with our insightful guidance.

Head of Marketing at Appventurez

Twinkle Kalkandha is a seasoned digital marketing professional with 8+ years of experience. As a Head of Marketing, she oversees the website content, creates strategies for social media campaigns, and works towards generating leads through organic channels.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.