From the app’s complexity to the features and functionalities, numerous factors can impact the cost of developing a fintech app that businesses must know beforehand. The ever-growing benefits of digital banking have boosted the growth of fintech applications, especially in the last few years. In fact, it is reported that 61% of consumers are most […]

Updated 31 January 2024

Manager – Technology at Appventurez

From the app’s complexity to the features and functionalities, numerous factors can impact the cost of developing a fintech app that businesses must know beforehand.

The ever-growing benefits of digital banking have boosted the growth of fintech applications, especially in the last few years. In fact, it is reported that 61% of consumers are most likely to switch to digital-only banking mediums.

The major reason for this transition in consumers’ preferences is the need for quick and convenient financial solutions. This made businesses in the banking and financial sector look for efficient alternatives and consequently, they started investing in fintech app development.

But do you wonder how much does it cost to build a fintech app? What are the influencing factors that impact the overall cost of development? Well, the type of application, its features, and the location of the development team profoundly impact the app development cost. And like these, there are many other aspects that must be considered before initiating the app-building process.

Lately, there has been a massive upsurge in the global fintech market. Based on the ongoing trends, experts indicate that this growth will steadily move in an upward direction in the coming years. In fact, it is reported that by 2030, the industry is projected to generate an overall revenue of $698.5 billion worldwide. Besides this, around 67% of senior banking officials believe that non-traditional financial services like fintech apps play an impactful role in payment transfers.

The stats show that the market will keep on increasing in terms of valuation, making it the right time to step into it. Also, with massive disruption in the payments industry after the digital transformation, the opportunities in this domain have increased more than ever. Let’s take an insight into the average cost of developing a fintech app.

Determining the exact cost to build a fintech app is not a simple task. It can vary from business to business and requirement to requirement. However, speaking of average cost, the range can vary anywhere from $50,000 to $300,000.

To evaluate the exact cost of developing a fintech app, you need to consider a number of factors impacting the overall expenses. A few of them are mentioned below:

Let’s discuss all these aspects impacting the cost of Fintech app development.

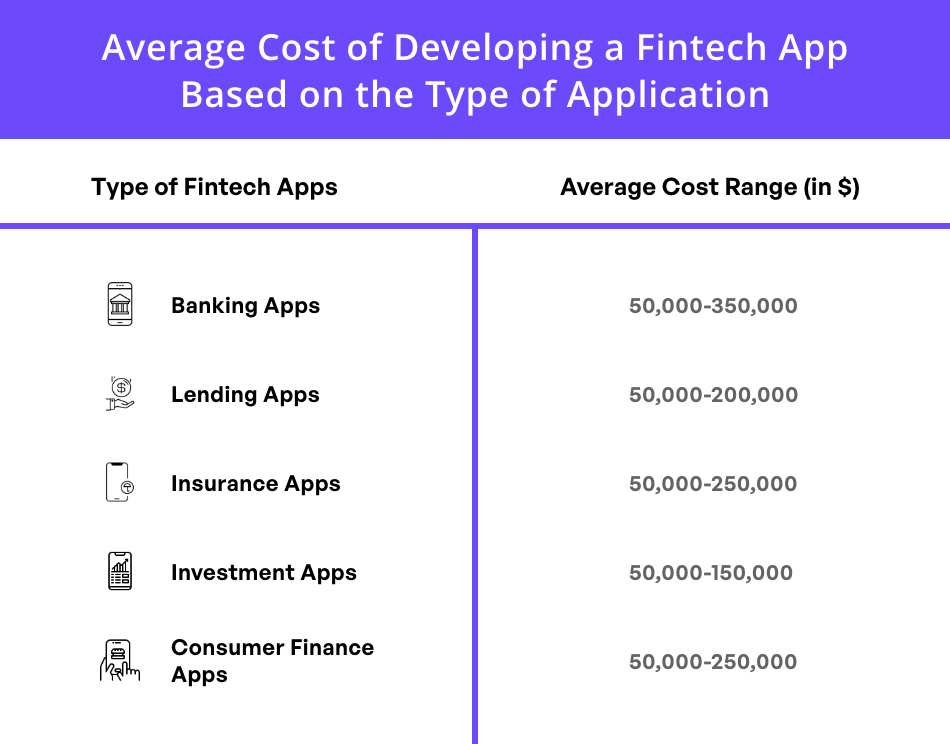

In the Fintech domain, there are mainly five types of applications businesses can invest in. These are:

Based on the complexity of the app, integrated features, and the purposes they serve, the average cost of these apps can be specific. Let’s discuss each one of these fintech apps in detail.

As the name suggests, a banking app mainly focuses on providing financial solutions to consumers through digital applications. A user can do all their primary tasks, from creating a bank account to applying for loans to a bank in the app. These apps eliminate the need of visiting bank branches and waiting in long queues for minimal tasks.

The fintech pricing for mobile banking apps could be broken down into admin panel and client-side costs.

It is often reported that over 60% of people will prefer digital banking mediums like mobile apps or internet banking in the next year. That’s one of the reasons why financial institutions and banks are looking to build a banking app.

Based on the complexity level of the application, a banking app may range anywhere between $50,000 and $350,000. Monobank and Revolut are some popular examples of banking apps.

These types of fintech applications connect users who want to lend money with the ones who are in need of it. Simply put, these platforms allow users to borrow some amount of money against their next payment.

With a lending application, it becomes easy to evaluate borrowers’ history, forecast their income projections, figure out the value of the collateral, and streamline the loan process management. A DeFi application is one of a kind of lending app that leverages the technical approach of blockchain.

On average, the cost of developing a lending app can lie somewhere between $50,000 and $200,000. Dave and ZestFinance can be put under the category of popular lending applications.

Insurance-based fintech apps are digital platforms helping businesses in the insurance sector to digitize their existing services. These apps primarily focus on solving the customers’ queries in the most convenient way possible and streamlining the overall insurance process for both parties.

Based on a specific niche, there can be a few types of insurance applications:

As the name suggests, these apps ease the process of settling claims and managing handlers’ needs digitally. Some popular apps include GEICO, Pocket Agent, etc.

These insurance apps provide a detailed description of all the diseases and health issues covered by an insurance company. The most popular health insurance apps include Aetna Health and Oscar.

With these apps, users can receive information about health and security measures in the respective countries they are traveling to. Besides this, they can also get alerts regarding weather information and flight changes. AIG Travel Assistant App and Goose are some popular travel insurance apps.

These applications enable users to collect essential information regarding car safety and the conditions in which they are eligible for insurance. Both GEICO and Cuvva are two prominent car insurance apps.

Since all these applications serve different purposes, the final fintech development app estimate can vary based on the functionalities added. Typically, the cost of developing an on-demand insurance app ranges between $50,000 and $250,000.

With investment applications, users can analyze the business market and invest in different financial assets. These investment management platforms help investors get valuable insights through data analytics in order to improve their investment decisions.

Financial companies that deal in services like mutual funds and online trading can develop such types of investment platforms for their target audience. The average cost of developing an investment app can lie somewhere between $50,000 and 150,000. However, in order to build a successful investment app like Acorns with additional functionalities, the expenses may go slightly higher.

One of the most common challenges faced by individuals today is managing their budgets and preventing overspending their money. To resolve this, businesses have started investing in developing consumer finance management apps.

These applications help users to plan their spending strategically so that they do not spend more than what they have planned. However, users might need to provide access to their income and expense data to these platforms for customized services. Consequently, they can manage their finances efficiently and conveniently.

Mint and Finch are two prominent examples in this category. Building a fintech app offering personal finance management services ranges from $50,000 to $250,000.

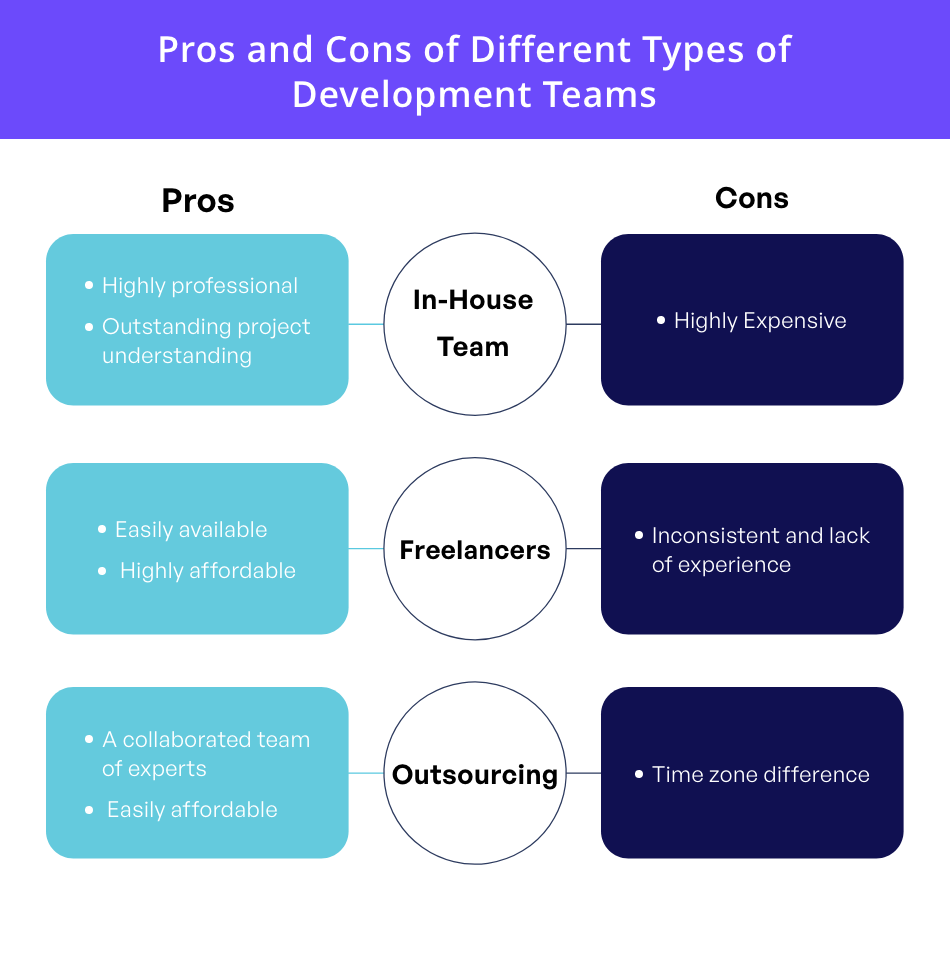

The second crucial factor that impacts the cost of mobile application development for fintech is the type of team developing it.

Depending on your budget, there is a wide range of options at your disposal to get fintech applications developed. However, besides app development costs, all these options have their own pros and cons, making it challenging to pick one. In such a case, it is recommended to opt for professional fintech app consulting first before stepping into the app-building process.

So, the first option available to you for robust fintech app development is to create your own in-house development team. Here, you can hire specific resources with expertise in their respective domains over which you have complete control.

Since all the team members will be within the same ecosystem, they will be equally familiar with the project requirements. Moreover, the sole ownership of the project will lie within you, since the source code belongs to your company.

However, recruiting a complete in-house team could be both time-consuming and expensive. Also, managing a full-time team means you have to pay them a fixed salary, cover their medical insurance, and much more. For startups and SMEs having a limited budget, this might be heavy on their pockets.

The second option is handing your fintech mobile app development project to freelance developers. They are easily available independent resources that a company could hire on a contract basis.

Freelancers generally charge businesses on an hourly basis. Besides their ease of availability, they are also highly affordable, making them a good option for startups and SMEs.

However, there are several disadvantages to hiring freelancers, too. For instance, most freelancers have more than one client, which might impact their performance in your project. Also, you have minimal control over them and you also can’t monitor their performance consistently. All these points make businesses think twice before choosing a freelance developer.

This is one of the most ideal choices for several businesses looking for the right fintech application development services. Outsourcing your app development project can help you avoid the risks with freelancers and provide you with an affordable solution to build a fintech app.

In this type of development, a third-party app development company is hired, mostly remotely, that manages the entire development process. However, they cater to your ideas and walk you through the procedure so that you have its complete understanding, too.

Furthermore, the team members in these offshore companies are experts in their own fields. Therefore, the results are outstanding and highly productive. The only problem is the time-zone difference between you and the outsourcing company which makes it challenging to communicate effectively.

Also, the offshore app development cost significantly depends on the location of the company. Therefore, make sure you choose one where the hourly charges of the developers are reasonable as per your budget.

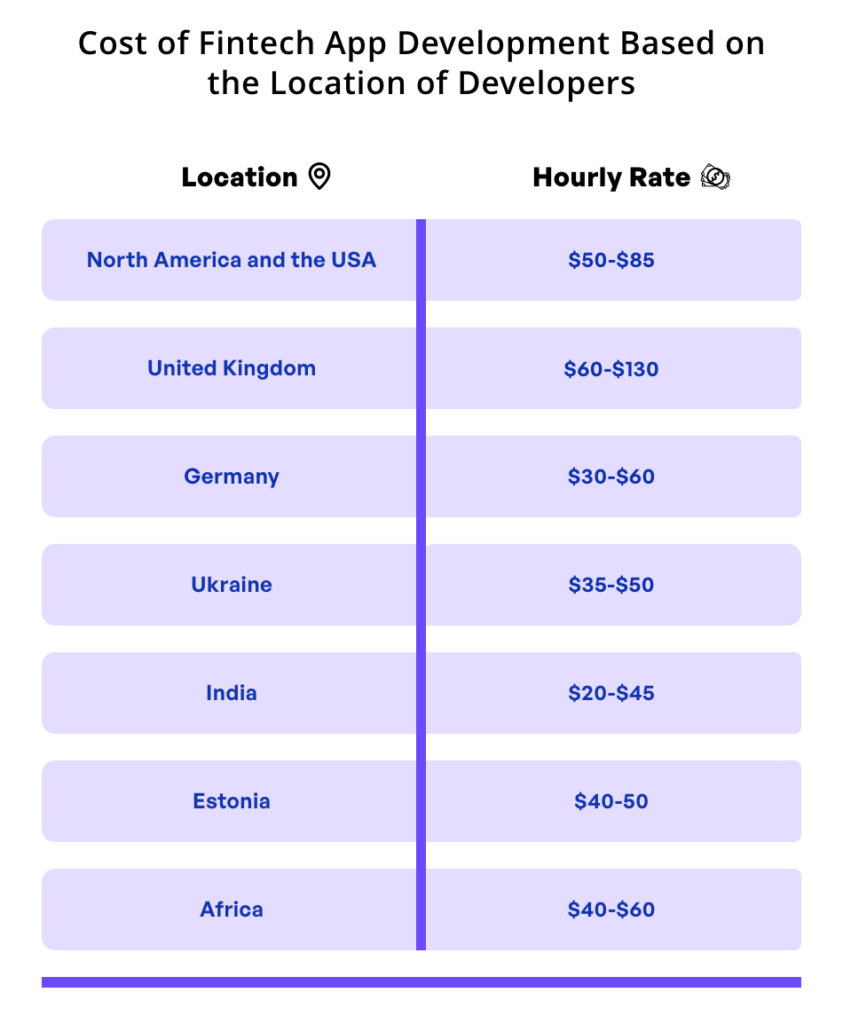

Generally, a fintech solution created in a developed nation can be more expensive than one built in a developing region. This is because the location of the development company significantly impacts the overall cost of building a fintech app.

For instance, the cost of app development in the United States or the United Kingdom is sky-high. However, when it comes to Ukraine, the app-building expenses will be comparatively lower.

The major reason behind these variations is that an average developer in the US charges way higher on an hourly basis than one based out of Ukraine. However, the exorbitant charges are due to the fact that the apps built by US-based companies will be of eminent quality, developed using the best app development methodologies.

Before you step right into investing in fintech app development, here are a few points you must consider beforehand:

There are certain activities of fintech companies that come right under the scope of some regulatory bodies. Refusal or failure in complying with these laws can even result in the withdrawal of your license. Therefore, in order to be legally compliant with such stipulations, fintech companies must keep the following points under consideration:

Many businesses often focus too much on the app development part that they have left with nothing for marketing purposes. This leaves them with a remarkable product that might not be used due to a lack of promotion.

That’s why it is extremely important to have a strategic marketing budget handy along with your app development plan. This will help you efficiently manage your operations keeping the overall budget in mind. This strategy will help you understand the fund’s allocation and keep a track of your expenses. Typically, the marketing budget should be two to three times the development estimate.

Every business has its own set of expectations from the application it invests in. There is no point in developing fintech applications if you do not have a clear understanding of why you want them in the first place.

Therefore, it’s crucial to have a clear app idea – what it does, how much people are willing to pay for it, and what makes it different from other fintech apps. For this, you need to:

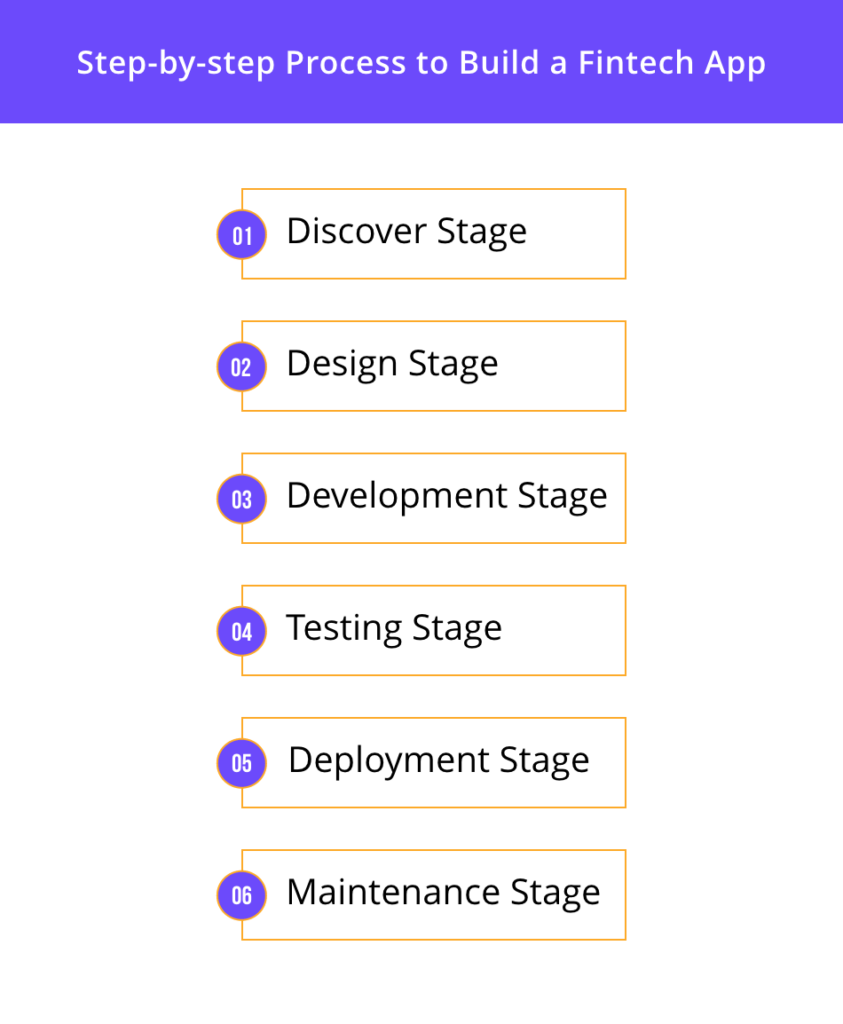

In order to build a highly intuitive fintech application, you need to follow a step-by-step approach.

This is the first step of your fintech app development process that deals with information gathering and understanding business requirements. Here you will analyze the market, conduct a competitive analysis, hire resources, create a development plan, and set your goals.

In the design phase, you create a blueprint, like a mock-up or wireframe of your fintech app. Simply put, this stage focuses on transforming a theoretical idea into a practical form that software developers can comprehend. The wireframes will provide a profound idea about the UI/UX design to be implemented in the next stage.

Since you have a design strategy in your hand, you are all set to develop it into a live application. The development stage deals with choosing the right tech stack for developing your app, integrating the functionalities, and leveraging tools to accelerate the app-building process.

Businesses can even go with MVP development first to test the primary features of their app with the target audience. It can help them understand the good and bad about their app so that changes can be made to the actual product. Also, the cost of MVP development is relatively low as well, making it best for startups.

In this stage, your app will be tested for bugs and flaws that might impact its performance. Once the QA and testing teams give the green flag in this stage, your app is all set for deployment.

This is almost the final stage in the app development process where your fintech app is made public. You have to decide the app marketplace where you want to launch your fintech application.

This is the post-development stage in which you need to constantly update your app for improvisation and performance enhancement. Besides this, you also need to start reading users’ reviews and feedback for your app and work on them to improve user experience and engagement.

The global financial market is progressing rapidly and it certainly has good prospects in terms of fintech applications. And looking at these ever-rising changes in the fintech domain, it’s undoubtedly the right time to step in.

However, things could be challenging without a reliable fintech partner, especially when you have no specific experience in this field. Therefore, the best option in such a case is to look for professional finance app development company that understand your business requirements and build an application that fulfills them.

Appventurez is one of the leading software development companies having expertise in building fintech solutions. Our developers are well-versed in all the state-of-the-art fintech technologies and follow the security-first approaches while building an app. The prime focus of the company is to develop a product that not only generates profits but connects consumers with businesses to a large extent.

Q. How much does it cost to build a fintech app integrated with advanced technologies?

The average cost of building a fintech app can range from $50,000 to $300,000 depending on the type of functionalities and features you want.

Q. What exactly is fintech software?

Fintech software is any program or application with which users can transact money or leverage finance-related services on their smartphones or computer systems.

Q. How long does it take to build a fintech app?

It generally depends on the complexity of an app. A basic fintech app may take around 3 to 6 months. However, the time to develop a full-fledged application can even go above a year.

Elevate your journey and empower your choices with our insightful guidance.

Manager – Technology at Appventurez

Suryansh Rawat is a Technology Manager at Appventurez who comes with a strong background in software development, technology leadership, and project management. With 5+ years of experience, he possesses expertise in seamless project execution and achieving outstanding results.

You’re just one step away from turning your idea into a global product.

Everything begins with a simple conversation.